One cannot help but notice: When two billionaires toss their coins into the public market, the clink tends to echo in the halls of Wall Street. Circle and Bullish danced into the public spotlight and emerged, pockets swelling, each clutching a billion-dollar bouquet. Gemini, it seems, wishes to join the ball-albeit a tad bloodied.

A Drama Unfolds: Gemini’s IPO-A Financial Tragedy in Several Acts

In an act perhaps most fitting for a Greek tragedy (or a Silicon Valley sequel), cryptocurrency exchange Gemini has dared to file its paperwork with the U.S. Securities and Exchange Commission, confidently aiming to go public. Alas, there lurks a problem so conspicuous that only a true financier could overlook it: the firm is hemorrhaging cash faster than a beleaguered poet drinks absinthe. 💸

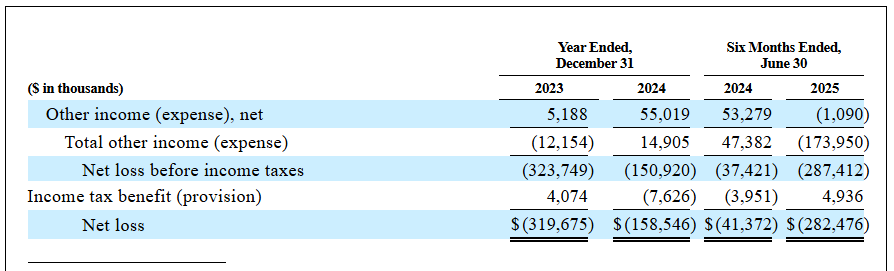

Founded by the most celebrated twins east of Eden-Camron and Tyler Winklevoss, heirs to the throne of Facebook drama-Gemini first emerged in 2014. Imagine, now, a crypto castle with $18 billion in assets, 1.5 million souls under its roof, and a staff large enough for a minor opera chorus. Magnificent, until one glances at the numbers. A casual perusal of the financial script reveals losses: $160 million lost to the gods of finance in 2024, and by mid-2025, nearly $282 million more tossed into the abyss. One suspects their accountants deserve medals for bravery. 🏅

Yet, undeterred by financial carnage, the Winklevoss ensemble is placing bets on a regulatory climate warmed by the affections of a crypto-friendly Trump administration. (Whether this heat will illuminate or incinerate, history will decide.) The dreams are vivid: to capture the fanfare seen by stablecoin illuminati Circle and bullish upstart Bullish-both of whom now lounge atop billion-dollar piles, sipping something expensive, one imagines. 🍸

“We discovered Bitcoin in the Summer of 2012,” declare the cherubic twins in epistolary form, loving immortalization via IPO filing. “In 2014, we conscripted a crew of technologically enchanted minds, all sworn to ‘security first’-a motto one expects to see needlepointed on the office wall next to a golden ledger.”

Now, the grand performance approaches: Gemini will ascribe to the Nasdaq under the ticker “GEMI,” with Goldman Sachs and Citigroup as both orchestra and conductor. The proceeds-being poetic, if not entirely solvent-will be used to pay off “third-party indebtedness.” Translation: someone else’s patience will, at last, be rewarded. 🎭

Undaunted, the brothers write, “As we stand here today, ready to introduce Gemini to the public markets, we are as excited as we were when we first started Gemini in 2014.” One cannot help but applaud such optimism. After all, who needs prophets when you have twins willing to gamble with style? 🚀

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- Silver Rate Forecast

- Brent Oil Forecast

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Crypto Chaos: Hackers Make a Killing While CEOs Insist “Nothing’s Changed” 😒

- Unleashing the XRP Kraken: Will It Really Reach $15? 🤔🚀

2025-08-19 01:02