What to know:

- Crypto traders, brace yourselves! A descent below $4,200 could unleash a veritable tsunami of long liquidations, sending market volatility into a delightful frenzy.

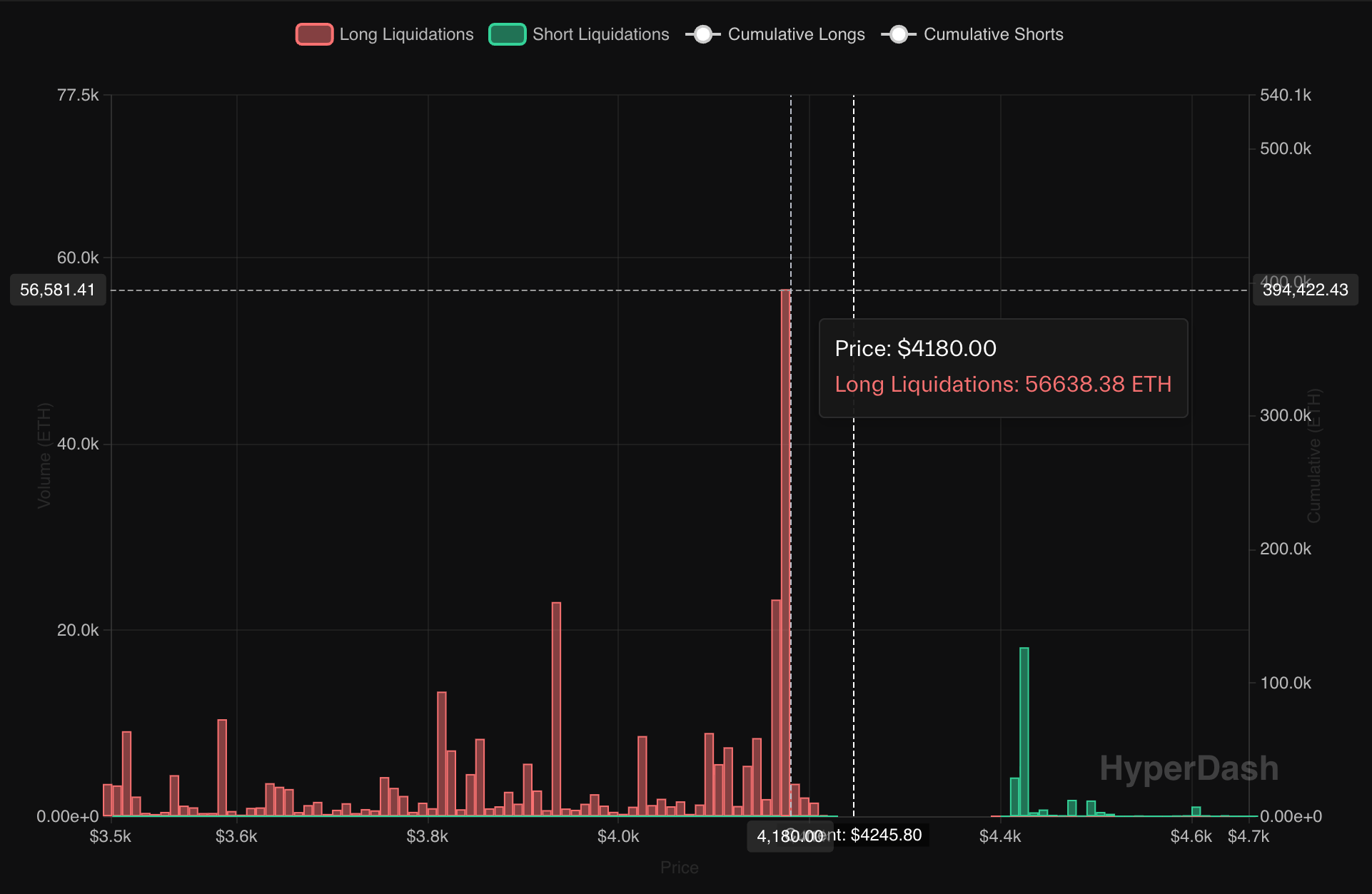

- According to the ever-reliable Hyperdash, a staggering 56,638 ETH in long positions-worth a princely $236 million-are teetering on the brink of liquidation should ether dare to dip to $4,170.

In the grand theatre of cryptocurrency, one must remain ever vigilant for the ominous specter of an ether (ETH) price drop below $4,200. Such a calamity could unleash millions in long liquidations, transforming the market into a veritable circus of volatility.

As of this very moment, over 56,638 ETH in bullish long positions-valued at a staggering $236 million-are at risk of being unceremoniously liquidated on the decentralized perpetual exchange Hyperliquid, should ether decide to plummet to $4,170, as per the sage data from Hyperdash.

The data also reveals potential liquidation hotspots at $2,150-$2,160 and $3,940. At the time of writing, ether was trading at $4,260, down nearly 5% on the day, according to the ever-astute CoinDesk.

Andrew Kang, the illustrious founder of Mechanism Capital, took to X to proclaim that large long liquidations could very well send ether prices spiraling down to the depths of $3,600.

“[I] would estimate we’re about to hit $5b in ETH liquidations across exchanges, taking us down to $3.2k – $3.6k,” Kang declared, as if he were reading the tea leaves of the crypto market.

Liquidations, or the rather unceremonious closure of leveraged bets, occur when a trader’s position fails to meet the margin requirements set by the exchange. It’s a bit like being told you can’t enter the club because you’re not wearing the right shoes-only, in this case, it’s your money that gets the boot.

This margin shortfall typically arises when the market decides to play a cruel joke on the trader, causing their account equity to plummet below the minimum maintenance margin. The exchange, ever the vigilant guardian, then swoops in to close the position, ensuring that borrowed funds are recovered-because who needs a good time when you can have a margin call?

These long liquidations create a delightful surge in selling pressure, pushing prices even lower and triggering a cascading effect that can lead to further liquidations. It’s a negative feedback loop that amplifies market volatility, much like a particularly raucous dinner party where one too many guests have had a bit too much to drink.

Read More

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- USD HUF PREDICTION

- Silver Rate Forecast

- Brent Oil Forecast

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

- KuCoin’s Bold Foray Into Thailand: Crypto Drama Meets Tropical Charm! 🐘💸

- Shiba Inu’s Wild Race to Bitcoin’s Castle: Will It Leap or Trip? 🐕💥

- Deutsche Telekom: Now Validating Crypto, Still Not Fixing My Wi-Fi 🤷♂️

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

2025-08-18 10:54