Well, now, what do we have here? Several market analyses, as they call ’em, are showing a cautious optimism, with traders as busy as bees, accumulating positions and watching those resistance and support zones like hawks. It’s a bit like watching a poker game where everyone’s bluffing, and nobody wants to fold first. 🃏

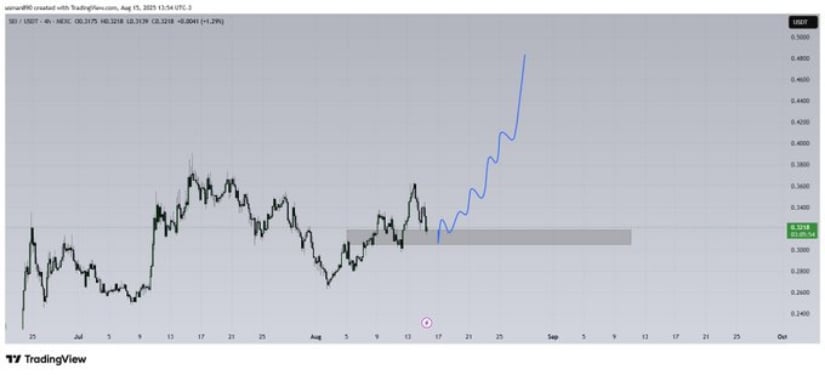

Weekly Chart Shows Consolidation and Accumulation Phase

The weekly chart, you see, paints a picture of SEI trading in a narrow band, somewhere around $0.30 to $0.32. This sideways dance, as they say, reflects an accumulation phase-neither the bulls nor the bears are taking charge, which suggests a standoff between supply and demand. It’s like two stubborn mules facing off in the middle of Main Street, neither willing to budge. 🐴

According to one wise analyst, @cryptoknight890, this kind of consolidation often precedes a strong move, either up or down, once enough buying pressure builds up. It’s like a coiled spring, just waiting to be released. 💪

Now, traders are advised to keep their eyes peeled for a decisive breakout above the resistance zone. If that happens, it could spark a significant rally, much like a firecracker at a Fourth of July celebration. Conversely, if the support fails to hold, it might force a retest of lower levels before any real recovery can take place. Rising volume at these critical points would be a good sign, indicating renewed buying strength and more market interest. The current accumulation phase makes SEI look like a shiny new penny, attractive to traders looking for a bit of upside while keeping a close eye on the downside. 📈

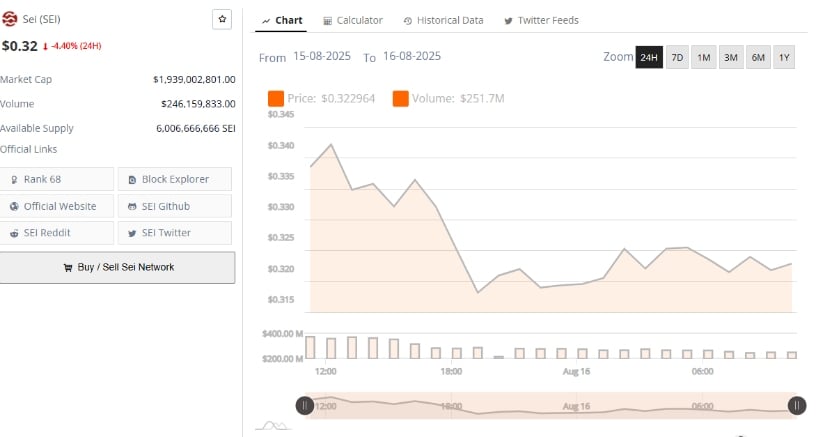

Intraday Price Action Reveals Market Sentiment

Looking at the intraday data from recent sessions, SEI has experienced a slight pullback of about 4.4%, dropping from $0.34 to $0.32. This short-term dip is likely due to some general corrective movements in the crypto market or a bit of profit-taking after testing those resistance levels. It’s like when you’re playing catch, and you toss the ball a little too high; it comes back down eventually. 🤹♂️

Despite this little tumble, trading volume has remained steady, suggesting that sellers haven’t taken over the game just yet, and investor confidence is still holding strong. The market cap is hovering around $1.9 billion, a sign of solid interest. Support at around $0.30 has been pretty resilient, and if prices stabilize there with consistent volume, it might mean buyers are gearing up for another push upwards. However, if selling pressure picks up, traders should tread carefully, as a deeper dip towards weaker support zones could be on the horizon. 🚨

Daily Technical Indicators Show Positive Momentum

The daily chart gives us a fairly balanced but promising technical picture. The MACD indicator is hovering near neutral but shows signs of potential bullish momentum as prices consolidate. The Chaikin Money Flow (CMF) is also near zero, reflecting a balance between money flowing in and out, consistent with the ongoing sideways price action. It’s like a seesaw in the playground, teetering back and forth but not quite tipping over. 🎠

Recent price behavior shows higher lows, hinting at a developing upward bias. Key levels to watch include resistance near $0.34 and support around $0.30. A sustained move above the $0.34 resistance could ignite fresh rally attempts, while a failure to hold above $0.30 could lead to more pronounced corrections. The positive momentum in SEI aligns with encouraging trends in other cryptocurrencies like Uniswap, suggesting that strength in the broader altcoin market could bolster further price gains. 🚀

In summary, SEI finds itself at a pivotal moment, consolidating in a critical range while bullish momentum slowly builds. A breakout confirmed by increased volume would signal higher price targets, while a failure to hold key support levels risks a retracement. For traders aiming to navigate the next move successfully, keeping a close eye on price action and volume around these levels will be crucial. So, buckle up, folks, it might be a bumpy ride! 🛫

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Gold Rate Forecast

- Brent Oil Forecast

- Wallet Wars! TRON, $100 Million, and the Blockchain Blacklist Brouhaha 🤡

- SUI ETF? Oh, the Drama! 🤑

- SOL Plunge: Doom or Boom? 🤑

- Is Jack Ma’s Alibaba Secretly Betting Big on Ethereum? Find Out! 🚀

- Bitcoin’s Epic Wait: Will It Finally Wake Up From Its Nap and Skyrocket? 🤔🚀

- Bitcoin’s Wild Ride: Is It a Bull or Just a Bump? 🐂💰

2025-08-16 23:14