In the early light of day, Bessent, a man of many words and fewer certainties, stood before the reporters like a farmer before a barren field. He spoke of the Strategic Bitcoin Reserve (SBR) with a tone that suggested he was discussing the weather-unpredictable and often disappointing. “We’ve got our $15 to $20 billion worth of Bitcoin,” he declared, “and that’s all she wrote, folks!” The Bitcoin, he explained, was mostly harvested from the spoils of law enforcement, a sort of digital bounty from the wild west of the internet. No more buying, he said, as if he were closing the door on a raucous party.

But as the sun dipped low, casting long shadows over the day’s events, Bessent seemed to have a change of heart. In a post on X, he proclaimed with newfound enthusiasm that the Treasury was “committed to exploring budget-neutral pathways to acquire more Bitcoin to expand the reserve.” It was as if he had discovered a hidden stash of apples in a tree that had seemed bare. “Seized assets will remain the foundation,” he emphasized, as if trying to convince himself that this was a solid plan. The government, it seemed, was now open to the idea of finding clever ways to add to its digital hoard, like a raccoon rummaging through a trash can for shiny objects.

The SBR, born in the spring under the watchful eye of President Trump, was a brainchild of Bessent’s own making-a noble initiative to bolster the U.S. financial resilience and diversify its strategic assets. Yet, like a ship without a captain, it recently lost a key architect, Bo Hines, who had sailed away from the White House’s Council of Advisors on Digital Assets. One could almost hear the collective sigh of the Bitcoin community, mourning the loss of yet another visionary.

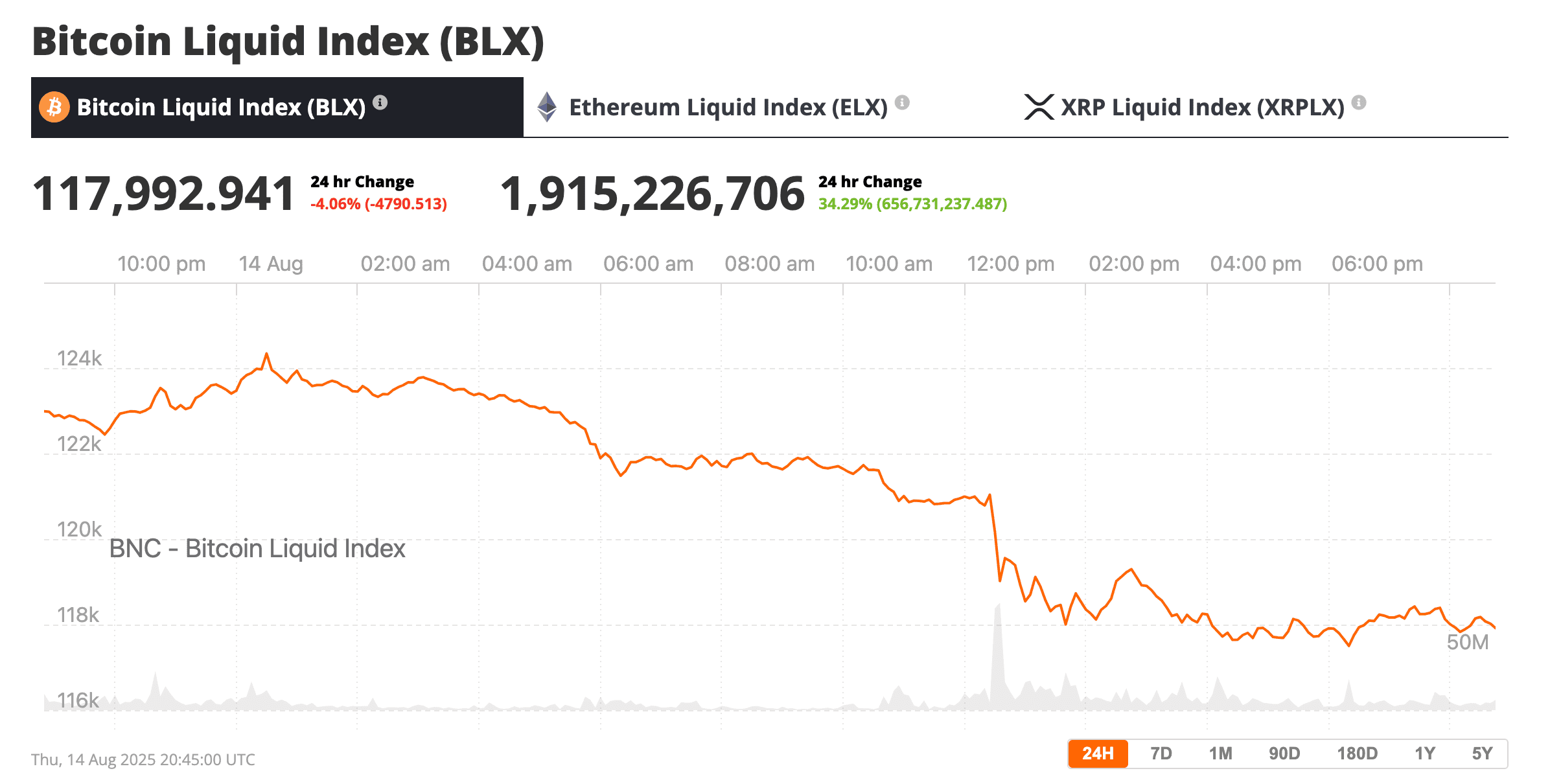

Meanwhile, Bitcoin prices danced a sad jig, plummeting despite Bessent’s late-day revelation. After reaching a dizzying high of $124,000, the cryptocurrency took a nosedive, landing at about $118,000 by Thursday’s close. It was a drop that could make even the most stoic investor weep, exacerbated by the stronger-than-expected U.S. Producer Price Index data, which dashed hopes for a September interest rate cut by the Federal Reserve. The market, it seemed, was more concerned with the economic storm clouds than the government’s newfound interest in Bitcoin.

Bitcoin slid to just under $118,000, source: Bitcoin Liquid Index

As traders mulled over Bessent’s updated comments, their muted reactions suggested they were more focused on the macroeconomic conditions than the prospect of government Bitcoin accumulation. Yet, his late-day statement left a glimmer of hope that the U.S. might one day emerge as a player in the grand game of cryptocurrency, should those elusive budget-neutral mechanisms prove to be more than just a fanciful dream.

Read More

- Silver Rate Forecast

- EUR UAH PREDICTION

- Gold Rate Forecast

- USD RUB PREDICTION

- USD TRY PREDICTION

- TRX PREDICTION. TRX cryptocurrency

- BTC’s Ballet: A Symphony in Satoshis 🎻💰

- The Cryptic Summer of 2026: Drama and Bitcoin!

- Brent Oil Forecast

- GBP JPY PREDICTION

2025-08-15 01:11