Well, hold onto your wallets, because according to Fundstrat’s very important research, Ether is getting ready to blow your mind (and possibly your bank account). They’re calling for price targets that could rocket from $10,000 all the way up to $15,000 by the end of 2025. That’s right, a 50% increase in a mere few years. You might want to start budgeting your next vacation to the moon. 🚀💸

In the last 30 days alone, Ether has surged by 60%-yeah, you read that right-hitting a near four-year high of $4,770 in early trading. Other reports are saying it’s chilling just a little lower at $4,694, which is still a 78% spike over an eight-week period. You’d think Ether was working out at the gym with those gains. 💪🏽

So, what’s driving this crypto rocket? Well, fund managers are noticing. And when they notice, it’s usually a sign that something big is happening, even if it’s just their stock portfolio shaking in their boots.

Fundstrat’s Crystal Ball: Targets and Rationale

According to Tom Lee (who we’re assuming is the wizard behind Fundstrat’s crypto predictions) and Sean Farrell (the head of digital asset research-yep, that’s a thing now), the rise of institutions and shiny new rules are all part of this wild ride. They’re pointing to stablecoin work and tokenized projects-aka stuff that’s mostly built on Ethereum-and let’s not forget the GENIUS Act (yes, that’s really what it’s called) and the SEC’s Project Crypto. Apparently, Wall Street is about to get all cozy with blockchain. 🏦🤖

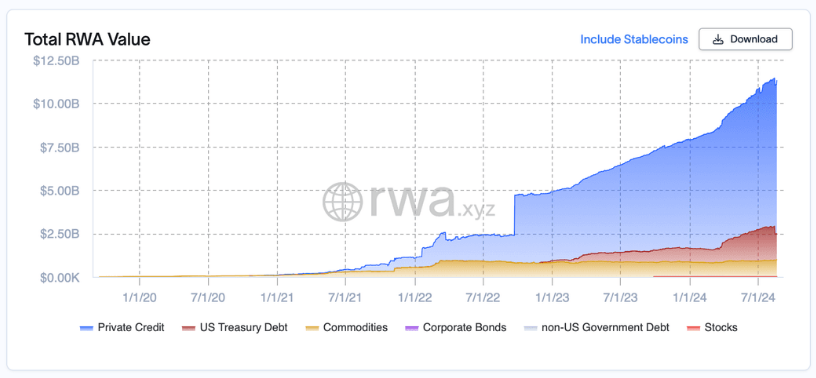

Here’s the kicker: Ethereum controls a jaw-dropping 55% of the $25 billion real-world asset tokenization market. Yes, you heard that right. It’s basically holding the blockchain world’s purse strings. Fundstrat’s like, “See? Told you this thing’s going to the moon.” 🌕

Institutional Demand: Where Are the Big Buyers Hiding?

Here’s some more fun gossip: Corporations are gobbling up Ether like it’s a Black Friday sale. BitMine Immersion Technologies (you know, the tech geniuses) have reportedly added 1.2 million ETH since early July. That’s about $5.5 billion worth of Ether on their books. Can you imagine the Christmas bonus with that kind of stash? 🤑

According to Fundstrat (and a few other crystal ball gazers), this accumulation trend, along with ETF flows, could give ETH a structural bid if these big buyers keep going. Apparently, there’s a real “strategic” reason behind these purchases. Translation: These buyers aren’t just picking up some spare change-they’re in it for the long haul. 📈

Market Momentum and Price Claims: ETH vs. Bitcoin

In case you’ve been living under a rock, Fundstrat also pointed out that Ether is actually outperforming Bitcoin this year. ETH’s up 28% year-to-date, while Bitcoin is just lagging behind at 18%. Wait, it gets juicier-recent reports say ETH is up 41%, and Bitcoin is at 30%. Ethereum is basically pulling ahead like that one kid who finishes the 5K in 15 minutes while everyone else is still stretching. 🏃♂️💨

Fundstrat’s analysts are putting their money where their mouth is, predicting that ETH will be the macro trade of the next 10 to 15 years-if institutional and regulatory trends keep pushing demand. Sounds like Ethereum’s got a long runway. ✈️

But here’s the reality check: For those $10,000 to $15,000 price targets to happen, we need sustained big-money inflows. So, keep your eyes on ETF flows, corporate treasury moves, and any government shenanigans around stablecoins. And let’s be real, big buys can move markets fast-like “oh no, the market’s in a tailspin” fast-so let’s hope the party keeps going. 💃🏽

In conclusion, Fundstrat’s bullish case for Ether is looking pretty strong. It’s got the numbers, the institutional backing, and the gains to back it up. Now, it’s just a matter of watching if those big boys keep throwing their money in. So, cross your fingers, check your crypto wallets, and get ready for what might just be a 2025 surprise. 🎉💰

Read More

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Silver Rate Forecast

- Ukraine’s Bitcoin Myth: The 46,000 BTC Mirage! 🚀🤡

- SEC’s Jenga Tower: Crenshaw Calls Out Crypto Chaos! 🎲💥

- BTC AUD PREDICTION. BTC cryptocurrency

- TRX PREDICTION. TRX cryptocurrency

- The XRP Rollercoaster: Will $2.08 Save or Sink the Altcoin? 🚀💥

- TRX: The Bullish Saga of $0.30 – Will the Whales Save Us? 🐋💰

- Ride the Crypto Wave or Wipe Out – $250K Up for Grabs! 🌊💸

2025-08-14 22:32