Ah, Litecoin! The plucky underdog of the cryptocurrency world, boasting swifter transaction times, a veritable cornucopia of circulating supply, and a mining algorithm that is, dare I say, refreshingly different. But, dear reader, could this cheeky little token be on the precipice of a breakout so massive it would make even the most stoic Bitcoin enthusiast raise an eyebrow? Let us plunge into the charts with all the enthusiasm of a cat in a room full of laser pointers.

Number of Transactions on Litecoin

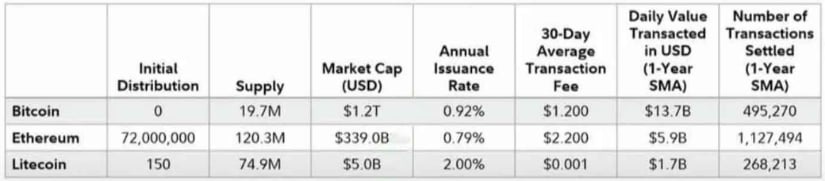

These rather enlightening metrics from 2024 reveal a rather amusing divergence between Litecoin’s potential and its current market cap. One mustn’t forget that Litecoin is practically the elder statesman of the altcoin family, having been birthed shortly after Bitcoin. The number of transactions on the Litecoin network is a mere half of those on Bitcoin’s illustrious platform. Now, while a higher transaction count does not necessarily equate to a more valuable asset-after all, Bitcoin still reigns supreme in the USD transaction volume and as a store of value-it does suggest that the Litecoin blockchain is, at the very least, not gathering dust.

Litecoin Miner Sell-off & Network Growth

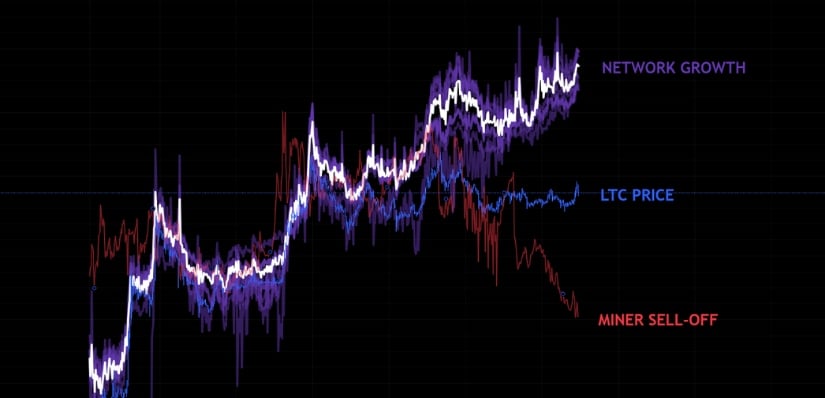

Our dear Litecoin network has been experiencing a rather significant uptick in activity. Historically, such phenomena have often heralded price rallies akin to a well-timed entrance at a soirée. Meanwhile, Litecoin miners have been rather industrious, selling off their mined tokens, which could, in theory, alleviate some of the selling pressure. Yet, the price has been as stagnant as a pond in mid-summer for the past couple of years. Might it be time for Litecoin to finally follow the lead of its burgeoning network growth? Let us examine the technical structure with the scrutiny of a hawk eyeing its next meal.

Litecoin Technical Price Structure

Since its meteoric rise in 2017, Litecoin has been ensconced in a triangle formation that could rival the most elaborate of origami creations. This seven-year consolidation pattern may very well serve as a continuation pattern, suggesting that the likely direction of any breakout would be upwards-unless, of course, the universe has other plans.

Moon Phases on Litecoin

In a delightful twist of fate, some traders have taken to consulting the moon cycles for their short-term price predictions. Statistically speaking, markets tend to frolic upwards between a full moon (the white one, for those keeping score) and the subsequent new moon (the blue one, naturally). Currently, Litecoin is testing the resistance of its triangle formation, and lo and behold, we find ourselves in a bullish moon phase. Could this celestial alignment be the harbinger of an imminent breakout? Only time will tell, but I wouldn’t bet my last shilling on it.

2017 Comparison

Another rather intriguing observation: in 2017, XRP was the first altcoin to gallop into the limelight. In this current bull market, history appears to be repeating itself, with XRP once again leading the charge with a staggering 400% gain. Might Litecoin be poised to follow in its illustrious footsteps? One can only hope, for the sake of our collective sanity.

Conclusion

With robust network activity, a long-term bullish technical structure, and even the moon phase aligning in a most fortuitous manner, Litecoin may very well be on the brink of a significant move. The seven-year triangle pattern suggests that should LTC break out convincingly, we could be looking at a technical target of around $700-a level not graced since the dizzying heights of the 2017 bull run. While nothing in the whimsical world of crypto is ever guaranteed, the delightful combination of historical patterns, network growth, and technical setup makes Litecoin a chart worth watching with bated breath.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Silver Rate Forecast

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

- Brent Oil Forecast

- Bitcoin Beats Amazon! 🍕 The Day Crypto Took Over the World

- 🚀 Ants Gone Wild: $1.24B Korean Crypto Frenzy During Chuseok! 🤑

- Solana’s Meltdown: $111M Longs Liquidate Like It’s Going Out of Style! 💸🔥

2025-08-14 04:43