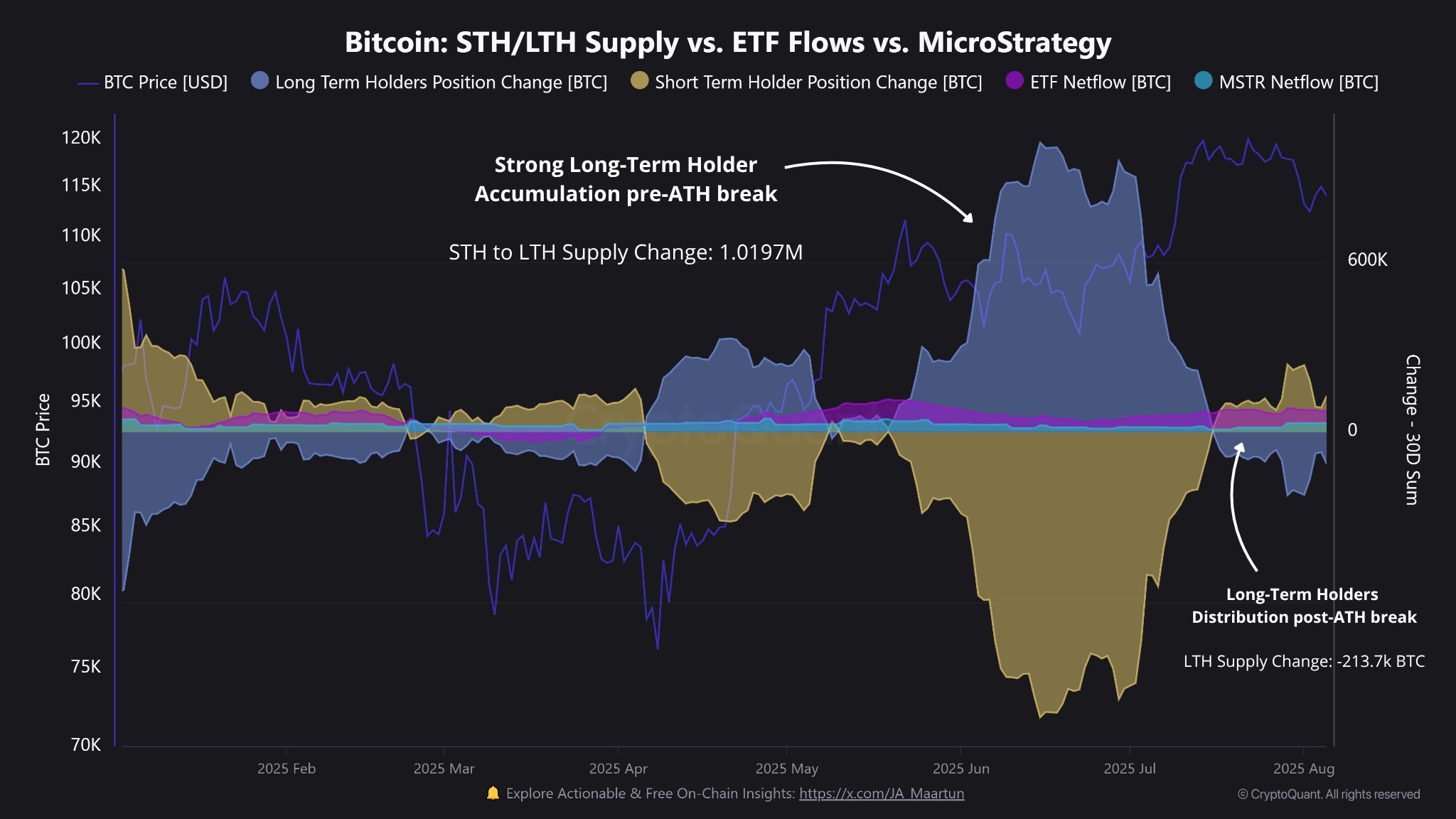

Ah, the grand spectacle of the Bitcoin bazaar! 🌪️ Behold, as the CryptoQuant sage, Maartunn, unravels the tapestry of greed and folly in a 10-part epic on X. “Bitcoin, the golden calf, has shattered its chains, yet the wise old whales are fleeing the frenzy,” he proclaims, his words dripping with the irony of a man who’s seen too many cycles. The long-term holders, those stoic guardians of the crypt, are selling into the madness, leaving the market to choke on its own gluttony. The first act of this tragedy? A stress test, where the very fabric of greed is stretched to its limits.

Is the Bitcoin Bull Run a Mere Mirage?

In the heart of this drama lies a jaw-dropping revelation: 80,000 BTC, slumbering in a Satoshi-era wallet, has awoken from its 14-year slumber, only to be sacrificed at the altar of profit. Galaxy Digital, the modern-day Midas, facilitated this ancient exodus. But Maartunn, ever the keen observer, notes that it’s not just the whales-it’s the entire ecosystem of holders driving this chaotic dance. Retail, those eternal optimists, have arrived fashionably late, their enthusiasm as predictable as a circus clown’s entrance. 🌈💸

Ah, retail! Always the last to the feast, yet so eager to devour the crumbs. Maartunn quips, “They step in after the ATH, as if the peak were a mere prelude to greater heights.” A familiar tale, indeed, as Bitcoin’s July surge to $123,000 lured the masses, only to leave them spinning in a $113,000-$115,000 vortex. Fresh capital, from the likes of Strategy (MicroStrategy’s new guise) and Metaplanet, tried to buoy the ship, but even their billions couldn’t stem the tide. Strategy’s 21,021 BTC and Metaplanet’s 463 BTC were but drops in the ocean of sell pressure.

And what of the short-term holders? Those fickle souls, Maartunn notes, “started to puke and sell at a loss,” their panic a symphony of realized losses. Waves of 52,230 BTC, 42,493 BTC, and a staggering 70,028 BTC crashed against the shores of the market, each episode more dramatic than the last. “A pressure valve,” Maartunn muses, “one that needs time to exhaust.” 🕰️💥

Even the ETFs, those institutional darlings, are bleeding. CoinShares reports the first net weekly outflow in 15 weeks, with Bitcoin funds leading the exodus at -$404 million. Daily tallies paint a grim picture: US spot Bitcoin ETFs hemorrhaged $196 million on Tuesday alone. The bid, once steadfast, now wobbles like a drunkard on a tightrope. 🪜💸

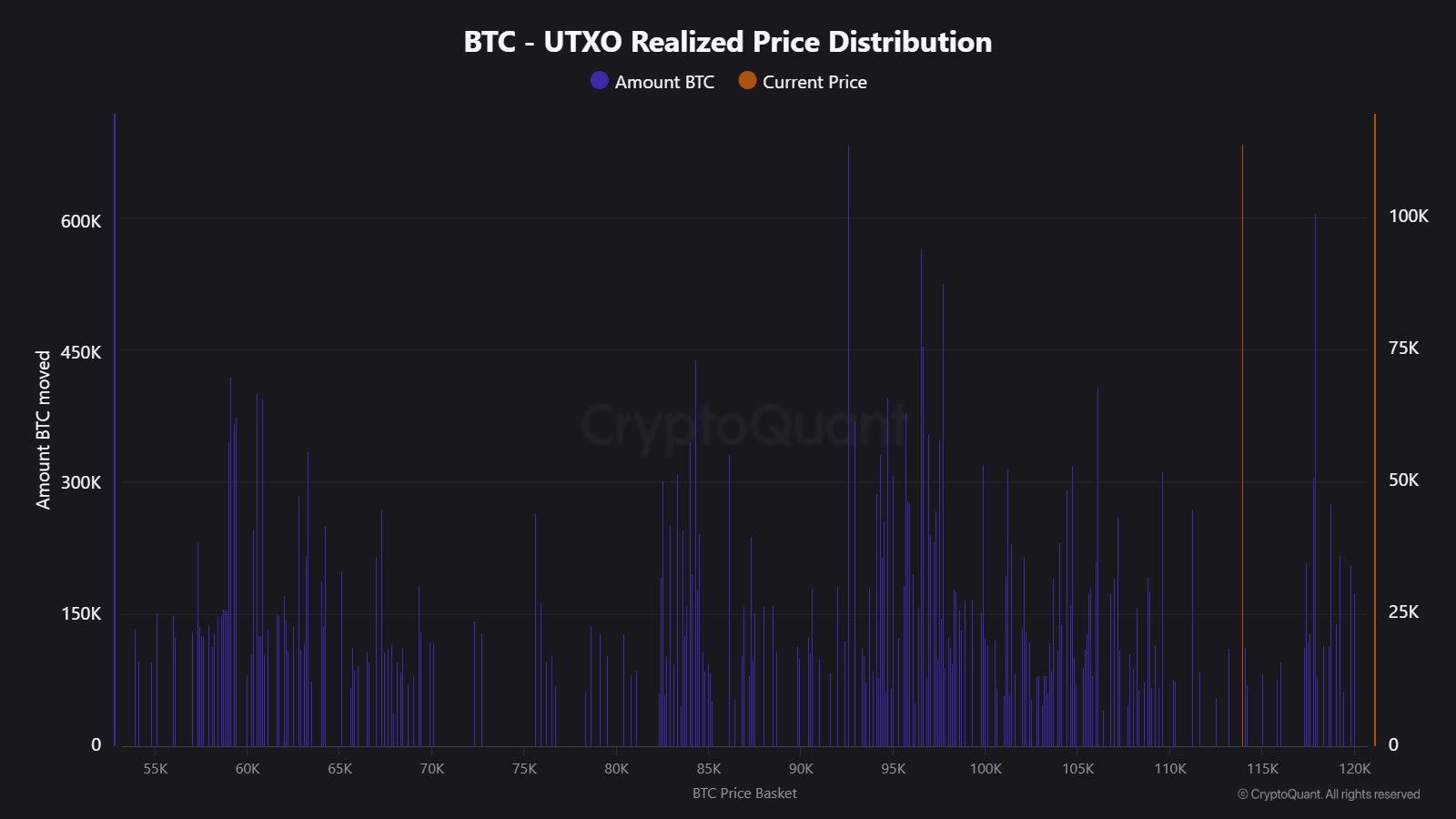

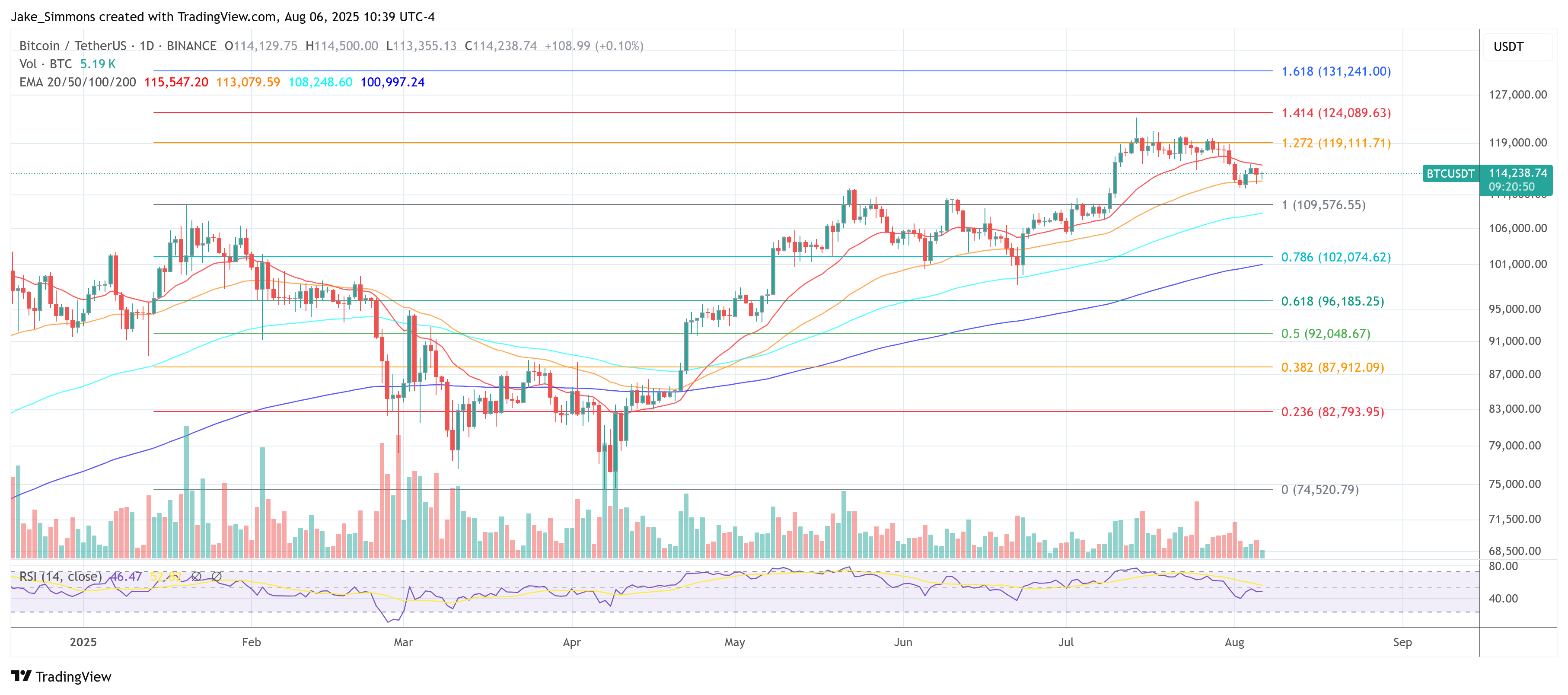

Technically, Maartunn’s gaze fixes on the former breakout zone, where Bitcoin clings to support around $112,000. “A confluence of chart structure and on-chain price-distribution,” he explains, his voice tinged with the gravitas of a prophet. Yet, context is key. The July ATH of $123,000 looms large, a reminder of institutional ambition. Maartunn’s caution is clear: “If we break below $112,000, it’s not just a pullback-it’s a shift in the very soul of the market.”

In the near term, the fate of the $108,000-$112,000 “shelf” hangs in the balance. Will the supply from profit-taking whales, loss-realizing retail, and ETF redemptions overwhelm the demand? If the shelf holds, Maartunn sees a mere pullback, a cleansing of excesses. But if it crumbles, the cycle will bear the scars of a broken ATH-a true shift in behavior, not just a narrative twist. 🎭🔄

As the curtain falls, BTC trades at $114,238, a number as fleeting as the hopes of latecomers. Will the circus continue, or will the clowns be left holding the bag? Only time will tell. 🕰️🎪

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Silver Rate Forecast

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- Brent Oil Forecast

- Unleashing the XRP Kraken: Will It Really Reach $15? 🤔🚀

- One Weird Trick: Billionaires Flock to Crypto-Ready Trump Tower in Dubai! 🏦🏙️

2025-08-07 02:12