On August 1, 2025-a date now destined to haunt crypto bros forever-the mighty Philippine SEC crash-landed with an advisory targeting some of the crypto world’s glitziest lounge acts: OKX, Bybit, KuCoin, and Kraken all found themselves accused of playing footsie with Filipino users, despite not having the all-important “CASP” (Crypto Asset Service Provider) paperwork. Apparently, the rules changed on July 5, but nobody told these exchanges, or perhaps they just decided to ~manifest~ their own regulatory future. 📉

If this all feels a bit deja-vu, it’s because last year the regulators delivered a knockout blow to Binance-booted straight off the islands with users given a dramatic 90-day ticking clock to kiss their digital stashes goodbye. Honestly, it played out like a slapstick action movie. 🍿

Rules: Now 100% More Annoying For Crypto Exchanges

The real life plot twist started in May 2025, when the SEC dropped new rules (Memo Nos. 4 and 5) that made every crypto CEO shriek into their oat milk lattes. You now need to be an actual Philippine company, produce endless financial reports every month, and, of course, scrape together a “mere” 100 million pesos (so… $1.8 million, give or take) in spare pocket change just to join the party. Not to mention, you get to rent real-life offices, proving you exist outside Discord. 😅

There’s even a rule that says customer money must stay away from the company’s rainy-day fund. Why? Because when crypto exchanges do belly flops (and they almost always do), users don’t want to lose everything-just, you know, 90% maybe.

Break the rules? You’ll get hit with fines from 50K to 10 million pesos faster than you can say “HODL,” with extra daily billings if you’re feeling rebellious. Who knew the SEC liked subscription models too?

The Hall of Shame: Top 10 Exchanges Caught Red-Handed

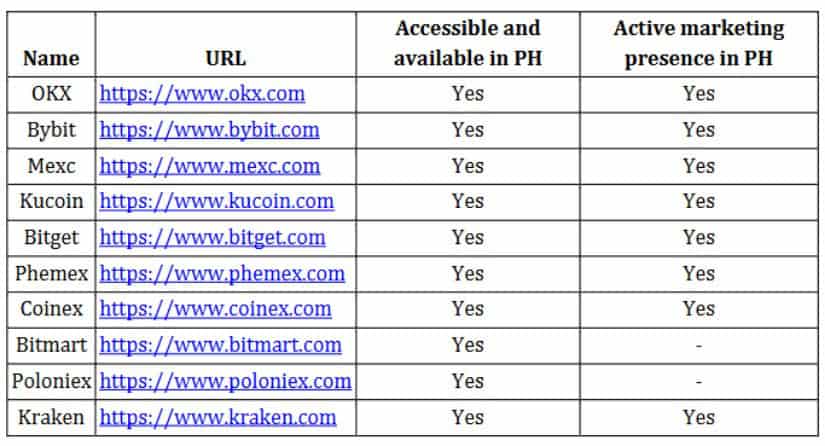

You can practically hear the dramatic music swell as the SEC called out ten exchanges still running wild in the Philippines without a license:

- OKX and Bybit: basically the prom kings of crypto

- KuCoin and Kraken: popular with those who enjoy a little international intrigue

- MEXC, Bitget, Phemex, CoinEx, BitMart, and Poloniex: honorable mentions for trying REALLY hard

These exchanges haven’t exactly been shy, aggressively sliding into Filipino DMs via social media and yes, actual advertising. Faux pas, or just chutzpah? Hard to say.

The SEC pointedly clarified-this “naughty list” is nowhere near finished. Like Santa, they’re always watching.

Replay: Binance Smackdown, Now with Extra Enforcement

Remember the Binance blockbuster ban? Expect reruns: the SEC vows to tag-team with Google, Apple, and Meta to block all those shiny crypto ads targeted at Filipinos. Is this the end of crypto TikToks and #getrichquick hashtags as we know it?

And for the truly incorrigible, there’s “geo-blocking”-a fancy way of saying you’ll need a VPN and a whole lot of patience just to log in. The SEC’s also readying its legal toolkit, with criminal complaints and cease-and-desist letters practically flying out the printer. 👮♂️🔨

Asia’s Regulatory Winter is Coming

The Philippines isn’t alone in ramping up the fun sponge approach to crypto. Thailand is sharpening its own regulatory shuriken, vowing to block OKX, Bybit and more unlicensed exchanges by June 28, 2025.

Indonesia joined the anti-crypto party by slapping foreign platforms with high taxes and strict bans-all while cheering on domestic exchanges like proud soccer moms. Vietnam’s racing to roll out totally-not-boring crypto regulations by May 2025, mostly to keep away the money launderers and pesky scammers.

Takeaway? Governments in Southeast Asia now prefer paperwork over yacht parties, and cross-border crypto freedom is looking as endangered as my New Year’s gym membership.

Will the Real Filipino Crypto Users Please Stand Up?

Filipinos love crypto-possibly even more than karaoke. The country is 20th in global crypto wealth with an expected 12.79 million users by 2026, which could generate a cool 1.1 billion pesos in revenue. Talk about mooning. 🚀

Bigger market, more sharks: the SEC is worried about everything from accounts getting frozen to full-on rug pulls, fraud, identity theft, and the type of money laundering that only happens in really bad Hollywood movies. If you use legit, licensed exchanges: “legal protections.” If not-well, let’s just say, don’t quit your day job. 😬

- Total “bye-bye” to your crypto if the exchange faceplants

- Potential starring role in a fraud investigation

- Your personal data wandering the web aimlessly

- Becoming unwitting accomplice to international criminal syndicates (not as Netflix-worthy as you’d hope)

Legit exchanges must do customer verification and MOAR paperwork. Shadowy platforms? Not so much. The result: the hackers are circling like sharks that smell airdropped blood.

Industry: Tumbleweed and Nervous Sweating

The accused exchanges haven’t said a word-not even a snarky tweet. They’re probably too busy Googling “How to get a CASP license” or “Jobs for ex-crypto PR staff.” Some might risk all for a Philippine license (hello, regulatory romance!); the shy ones may pull a Houdini and disappear altogether. 🤷♀️

Meanwhile, watch local, rule-following exchanges swoop in for all that delicious, newly available market share. Who knew regulations could taste so sweet?

So far, the SEC hasn’t started freezing accounts or assets, but if Binance’s ghost still lingers, that could be just around the corner.

What’s Next: No More Playing Hide and Seek

The party’s over for non-compliant crypto cowboys. With the ambiguity gone and rules set in stone (or at least written in Comic Sans), the Philippines is now that student who actually did the reading. There’s room for innovation, but only if you bring your papers and promise not to blow up the economy.

Regional regulators are definitely watching this telenovela unfold, so don’t be surprised if the SEC’s moves echo across Asia soon. Until then, expect lots of lawyers, lots of memes, and, of course, plenty of people pretending they always knew this was coming. 🫠

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Silver Rate Forecast

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

- Unmasking the Whale: Ethereum’s Shocking, Witty Crypto Power Move Revealed 😎

- Brent Oil Forecast

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Bitcoin Investors Are Making Bank and Changing Their Minds. What’s Going on? 🤔

- Ukraine’s Bitcoin Myth: The 46,000 BTC Mirage! 🚀🤡

2025-08-06 00:27