Ethena soared over 140% in July, a feat worthy of a ticker-tape parade, but alas, the party might be cut short as whales prepare to cash out ahead of a massive token unlock. 🎉🚀

- Ethena’s July surge, fueled by protocol growth, stablecoin expansion, and a major buyback announcement, was a spectacle to behold.

- However, a $103.6 million token unlock looms on Aug. 5, casting a shadow over the festivities with the specter of whale sell-offs.

- ENA is precariously perched near a key support level, teetering on the edge of a bearish wedge pattern. 📉

Per crypto.news, Ethena (ENA) was trading at $0.61 at press time, a modest 11% gain over the past 24 hours. This latest leap extends its 30-day rally to a staggering 142%. Trading volume has swelled by 33%, propelling ENA to the top of the day’s performers and securing its place as the 41st most valuable cryptocurrency. 🌟

What Sparked Ethena’s July Rally?

Ethena’s July rally wasn’t a fluke but a symphony of bullish developments. Market access expanded, protocol growth surged, regulatory hurdles were cleared, and whales, those majestic creatures of the crypto sea, began to accumulate ENA en masse. 🐳💰

DeFiLlama reports that Ethena’s Total Value Locked (TVL) grew by 73% in just 30 days, catapulting it to the sixth-largest DeFi platform globally. This puts it in the same league as Aave, Lido, and EigenLayer—names that once seemed untouchable. 🏆

Ethena’s synthetic stablecoin, USDe, saw a 75% increase in supply, reaching $9.3 billion and overtaking FDUSD to become the third-largest stablecoin. Only Tether (USDT) and USD Coin (USDC) stand above it. 🚀

The whales didn’t just sit idly by. Several whale wallets gobbled up substantial amounts of ENA throughout July, contributing to the frenzy. 🐋🌊

On July 11, Ethena secured a listing on Upbit, South Korea’s premier crypto exchange, enhancing its visibility and liquidity in the Asian markets. Less than two weeks later, StablecoinX announced a $360 million fundraising round, with $260 million earmarked for ENA buybacks. This influx of capital sparked a demand shock, further fueling the price surge. 💥

Regulatory progress added another feather to Ethena’s cap. On July 24, Ethena and Anchorage Digital achieved a compliance breakthrough, making their synthetic dollar, USDtb, one of the first stablecoins to meet the stringent requirements of the U.S. GENIUS Act. 📜✨

The Token Unlock Looms

Despite the July fireworks, Ethena faces a formidable challenge as a large token unlock approaches. According to Tokenomist, 171.88 million ENA tokens, valued at approximately $104.56 million, will unlock on Aug. 5. This represents a mere 2.7% of the current circulating supply of 6.35 billion tokens, but the impact could be significant. 🗝️

Token unlocks often bring additional selling pressure, especially when the market is riding high. While not every unlocked token will hit the market, the increased supply could dampen momentum, particularly if traders decide to cash in on recent gains. 💸

Whales Diving for Cover

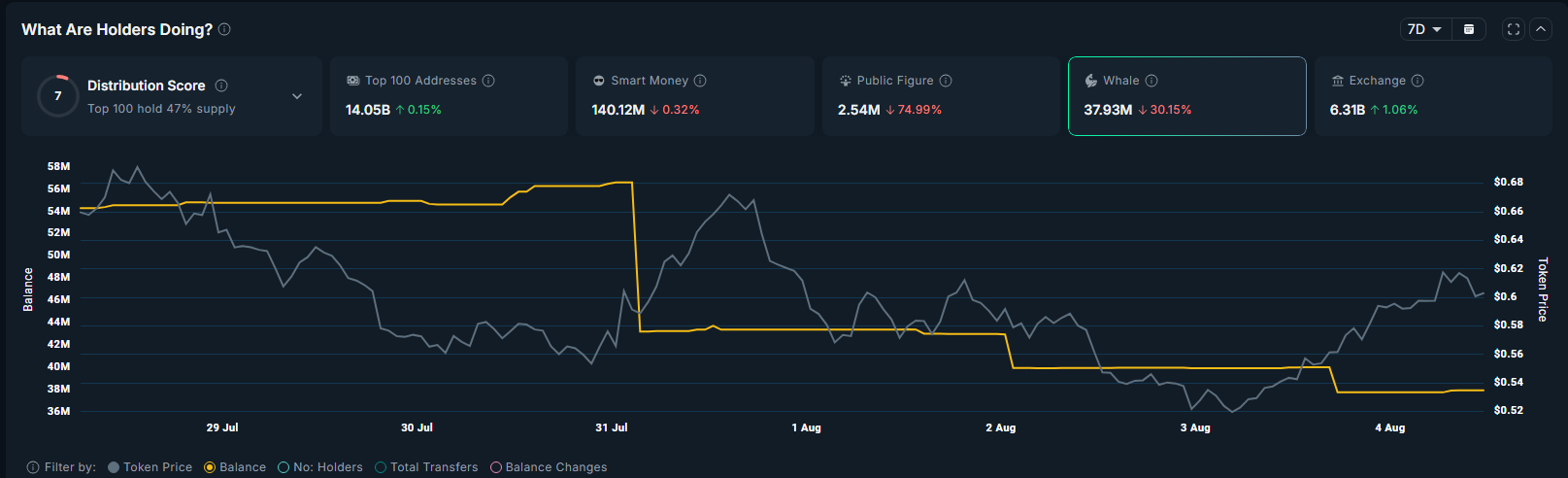

Compounding the concerns, recent on-chain data suggests that large holders are showing signs of fatigue. Whale wallets have trimmed their ENA holdings by 30%, now holding 37.93 million tokens, according to Nansen. Public figure wallets, often seen as barometers of sentiment, have slashed their holdings by 75%, down to just 2.54 million ENA. 📉💔

Even seasoned trader Arthur Hayes, who amassed ENA in July, has sold off around $4.62 million worth of the token. He cited macroeconomic risks, including tepid U.S. jobs data and sluggish global credit growth, as reasons for his exit. 📈📉

These reductions may indicate that influential investors are locking in profits ahead of the unlock event, bracing for potential short-term price pressure. When whales and public figures start to bail, it often signals a market pullback, especially with an impending increase in token supply. 🚪💸

ENA Price Analysis

On the daily chart, ENA hit its year-to-date low of $0.23 on June 23. After a brief consolidation, it embarked on a robust upward rally. However, the price has recently formed an ascending broadening wedge, a pattern notorious for its bearish implications. 📉🚫

ENA is currently trading near the wedge’s lower trendline support at approximately $0.52. A decisive break below this level could confirm the bearish setup and trigger a broader pullback. 🚨

Momentum indicators are flashing warning signs. The MACD signal line has crossed below the MACD line, signaling a bearish crossover and waning upward momentum. The RSI has dipped to 62, still in overbought territory but trending downward, indicating a cooling of buying interest. 📉📊

If ENA fails to hold above the $0.47 psychological support level, it may be vulnerable to further declines. A bounce at this level could temporarily disrupt the bearish narrative. However, a breakdown could pave the way for a deeper correction toward $0.24, potentially retesting July’s lows. A sustained move below that could push prices toward $0.07, aligning with the wedge pattern’s measured target. 🌊📉

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- USD THB PREDICTION

- When Will the Long Traders Finally Give Up? 🤔

- Bitcoin’s $90K Standoff: Is It Playing Hard to Get or Just Confused? 🤔💸

- USD GEL PREDICTION

- PLUME: 60% Down?! 😱

- Bitcoin Beats Amazon! 🍕 The Day Crypto Took Over the World

- ZEC Surges 17%-Is $750 Just Around the Corner? 🚀💰

2025-08-04 11:25