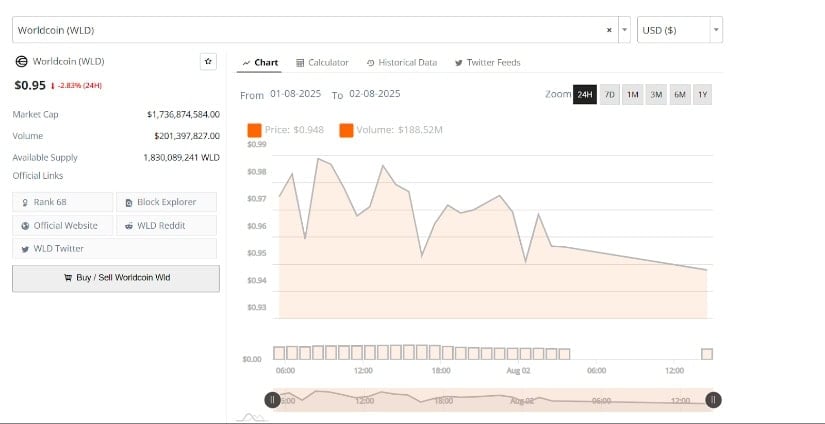

In the dusty streets of the crypto market, Worldcoin WLD stumbled, stubbornly stuck below that elusive $0.99 mark—like a mule refusing to cross the river. Traders cast sideways glances, eyes wide with a mix of hope and despair, as the token’s feeble attempt to climb above $1.20 was met with a stone wall—and *then* some.

That little $0.99 resistance? Like a stubborn beef steer, it kept pushing WLD back, leaving a trail of lower highs and lower lows, as if the coin was playing hide and seek with the bulls. The 4-hour chart told stories—of a market hesitating, caught in a dance of doubt, as volume wavered like a lamp flickering on a storm-wracked porch.

The traders? They’re watching the neckline like hawks, hoping the token will hold steady at $0.94, maybe bounce and give them something to cheer about. Or, more likely, they’re bracing for a tumble into deeper shadows, should the price dip past that line, into the abyss of lower prices.

With WLD bobbing around $0.95—like a cork in choppy waters—resistance at $0.90 looms like a gatekeeper, while the potential targets between $1.22 and $1.64 hang in the air, tantalizing yet distant. As volatility whips around and volume dwindles, uncertainty hangs thick—like fog over a sleepy valley, hiding what’s next.

Worldcoin Price Fails to Break Above $0.99 and Risks a Deeper Pullback

Worldcoin (WLD) is caught in a sort of tease — reaching near $0.99 then retreating, as if it’s got commitment issues. Now sitting at $0.95, down almost 3% in a day, it’s like watching a boxer punch the air—lots of effort, but no real punch. Buyers hesitate, sellers push, and the price remains confined within a tight leash, awaiting some sign of life.

The chart shows a pattern—sharp pullbacks after brief rallies, a dance of lower highs and lows, warning of bearish winds blowing through the market. Volume? Moderate at best, like a crowd murmuring at a small-town fair, not enough to turn the tide.

All eyes are on the $0.93 to $0.94 zone—like waiting on a signal from a tired old man—hoping it holds or gives way to something worse. The WLD retest of the $0.96 mark? That’s the crossroads, where a bounce might lift it skyward—or flop in the dirt.

The resistance levels above are towering like mountains — $1.221, $1.430, and $1.645 — each a potential peak, or just a mirage for traders daring enough to dream. Unless WLD can muster a rally here, it may just slide lower, seeking refuge in the valleys of lesser values.

Resistance Near $0.90 Adds to Pressure

Another analyst, CW, points out that the $0.90 zone has become a virtual fortress of selling, with the bears lining up to block any bullish advance. After the $1.40 battle zone was lost, the pattern of lower highs whispers a story of seller strength—not a good bedtime read for hopeful traders.

That range between $0.90 and $1.40? It’s like a crowded street—resistance clusters blocking the way, buying interest drying up, while support tries to hold the line between $0.83 and $0.76, like loyal guards risking it all.

If those guards fall—if volume doesn’t stir and support crumbles—the slide may turn into a landslide, dragging WLD deeper into the shadows. Until it recovers above $0.90 convincingly, the outlook remains a cloudy forecast with a chance of rain.

Short-Term Price Action Shows Weak Recovery Attempts

The latest dance? WLD oscillated wildly between $0.93 and $0.99 — like a kid on a sugar rush, bouncing with no real direction. Every attempt at climbing was met with a stern push downhill; supply overwhelmed demand, and the coin was dragged back to the lower end, around $0.94.

Intraday traders? They saw volume spikes mostly during the falls, confirming the bearish mood. If WLD can’t close above $0.99 soon, it’s likely to slip further, into the waiting arms of support levels at $0.90 and beyond.

Big if here: slip below $0.93, and the bears might have a field day, aiming for lower targets. The hopefuls need a solid close above $0.99—like a confident nod—to turn the tide and maybe, just maybe, spark some excitement in this sleepy market.

Read More

- Gold Rate Forecast

- USD HUF PREDICTION

- Bitcoin’s $90K Standoff: Is It Playing Hard to Get or Just Confused? 🤔💸

- USD GEL PREDICTION

- Doge Doomed?! 😱🐳

- Crypto Whirlwind: How DeepBook’s Wild Ride Might Just Make You Smile 😏💸

- Steinbeck’s Take on Upexi’s Solana Gold Rush 🏭💰

- PLUME: 60% Down?! 😱

- Traders Rush Back to XRP: The Silent Storm Brewing in the Crypto World! 😱🚀

- When Will the Long Traders Finally Give Up? 🤔

2025-08-03 02:40