Amidst the swirling mists of the crypto market, the token known as BNB has emerged like a phoenix from the ashes of a falling wedge pattern, hinting at a celestial ascent. The stars, or rather, the chart signals from analysts, now whisper of a potential breakout above $820. As I pen these words, BNB floats gracefully at $809.50, with the bulls’ horns gleaming under the favorable light of momentum indicators.

Bullish Wedge Structure Reinforces Short-Term Recovery

The 1-hour BNB/USDT chart, a masterpiece shared by the sage @ChristiaanDefi, reveals a classic falling wedge formation, a pattern often heralded as a harbinger of bullish reversal. BNB, after its noble retreat from the lofty heights of $862.58, paid homage to the descending wedge’s boundaries, bowing but never breaking.

Time and again, the price kissed the lower trendline near the $796.92 support level, a tender embrace that suggested the exhaustion of the bears’ relentless assault.

A stirring reaction near the base of the wedge has kindled a new flame, propelling BNB toward the upper resistance line. Should BNB pierce the descending trendline with the grace of a knight charging into battle, it might embark on a measured journey toward the previous high.

The path ahead is strewn with resistance levels at $820, $835, and $850, each a stepping stone on the road to glory. This upward odyssey aligns with the wedge’s breakout potential, a common tale of triumph when consolidation patterns yield to the prevailing macro trend.

24-Hour Price Action Shows Recovery From Dip

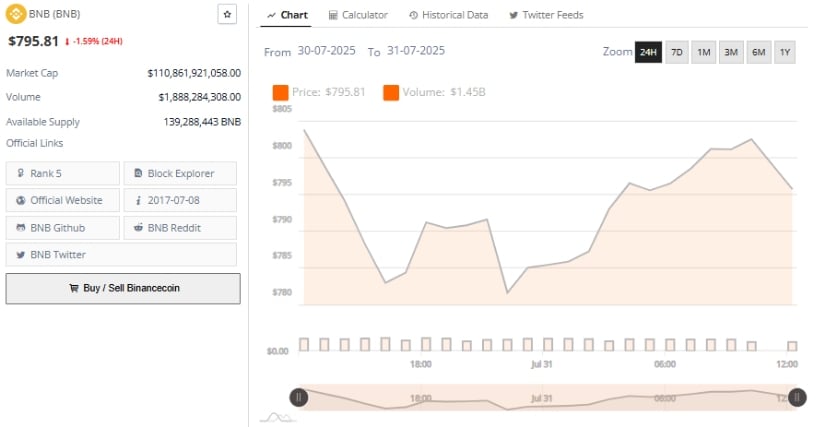

The 24-hour price chart for BNB from July 30 to July 31 is a saga of a sharp decline followed by a steady, almost poetic, rebound. BNB plummeted from the heavens at approximately $805 to an intraday low of $780, only to rise again, phoenix-like, later in the session. The initial descent, perhaps influenced by the capricious winds of broader market movements or the inevitable profit-taking near recent highs, found its end near the $780 level, a zone where the faithful buyers gathered to quell the storm.

Following the dip, the price ascended in a series of graceful waves, each higher than the last, a testament to the market’s unwavering confidence in the support structure. Trading volume during the session swelled to $1.45 billion, a sign of robust market participation. Though BNB closed at $795.81, down 1.59%, the rebound from the intraday low spoke of a market striving to find balance around key zones.

At the Time of Writing, Indicators Support a Cautious Uptrend

As the ink dries, BNB trades at $809.50, a 2.02% ascent on the day. The daily TradingView chart narrates the asset’s valiant effort to reclaim its bullish momentum after a brief correction. The rally from late June, which lifted BNB from the depths below $600 to the heights above $800, saw buyers emerge near $790, a zone that has served as a temporary sanctuary during the recent pullback.

Technical indicators echo the chorus of bulls. The MACD line (36.10) stands proudly above the signal line (33.82), while the histogram reads 2.28, a testament to the unyielding buying pressure. The RSI, at 67.36, approaches the overbought zone, a cautionary note amidst the jubilation. While the RSI trend supports the bulls, prudence dictates vigilance, for any move above 70 may signal a market on the brink of overheating. Holding the $790–$800 zone remains crucial for sustaining the bullish charge and reaching the coveted $850 mark.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- One Weird Trick: Billionaires Flock to Crypto-Ready Trump Tower in Dubai! 🏦🏙️

- Brent Oil Forecast

- How Ethereum Became the Unexpected Hero of AI Finance 🚀💰

- Frog Frenzy: You Won’t Believe What PEPE Just Did! 🚀

- Silver Rate Forecast

- You Won’t Believe How $3B in Real Estate Is Now Just Tokens. Mind-Blowing, Right?

- Will BNB’s $600 Wall Finally Crumble? Spoiler: The Hodlers Are Plotting 😉

2025-07-31 21:20