Oh, Bitcoin, you fickle beast. One minute you’re soaring to the moon like a rocket fueled by pure FOMO, and the next, you’re plummeting faster than my hopes after realizing I left the oven on. 🌕🔥

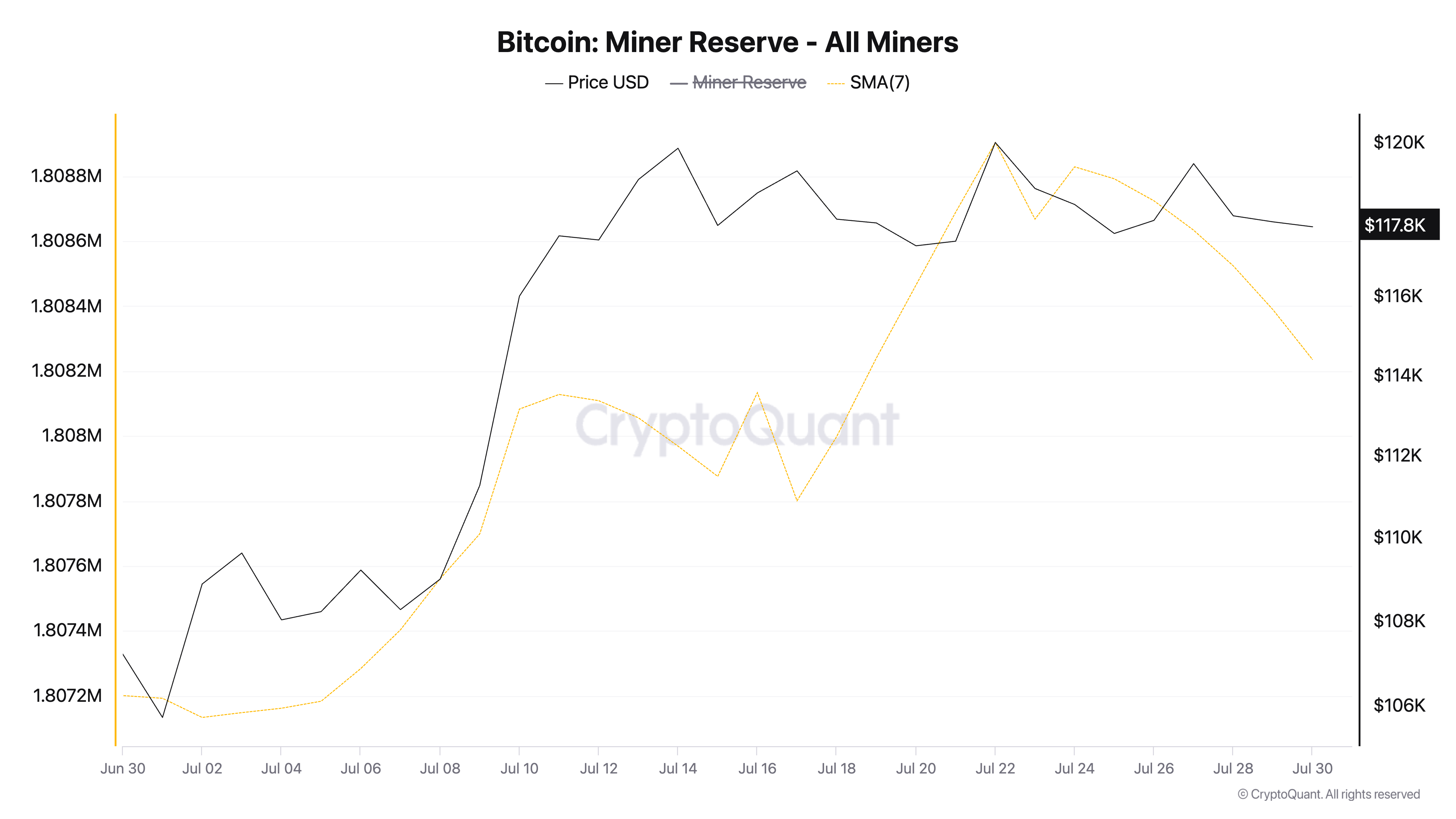

Back in July, miners were hoarding BTC like it was the last roll of toilet paper at the start of a pandemic. Between July 2 and July 22, their reserves climbed steadily, hitting a peak of 1.808 million coins. “We’re holding!” they shouted, their diamond hands glistening with optimism. But then, as if someone whispered, “Hey, what if we just… sold?”, they started offloading their holdings faster than a Black Friday shopper ditching a broken TV. 📉💸

Miners: From Hodlers to Sellers, a Tale as Old as Time ⏳

According to CryptoQuant—because who doesn’t love a good chart?—the Miner Reserve metric (7-day SMA, for the nerds) rose by 0.05% during this period. But then, like a reality TV star’s fame, it all came crashing down. Since July 22, the reserve has been trending downward, signaling that miners are now selling like it’s their job. (Oh wait, it is.) 🏃♂️💨

For more crypto drama and market tea: Subscribe to Editor Harsh Notariya’s Daily Crypto Newsletter here. Because who doesn’t love a good newsletter? 📧✨

The Miner Reserve metric, for those not in the know, tracks how much BTC miners are hoarding in their wallets. When it goes up, they’re bullish. When it goes down, they’re either panicking or cashing out for a new yacht. 🛥️💰

After BTC hit its July 14 peak of $122,054 (yes, you read that right), it entered a consolidation phase, which is just a fancy way of saying it’s been stuck in a sideways shuffle. Miners, sensing the party might be over, started selling like it’s 2017 all over again. This shift could spell trouble for BTC in August, unless someone invents a new meme to pump the price. 🚀🤡

Institutions to the Rescue? 🦸♂️💼

Abdul Rafay Gadit, the CFO of Zignaly, chimed in with his two satoshis, saying the July uptick in miner reserves was “likely a short-term pause rather than the start of aggressive accumulation.” Translation: Miners were just catching their breath before dumping more. 🗣️💤

“The uptick suggests they’re holding onto their BTC, probably waiting for a sign from the crypto gods or a better price. It’s not accumulation; it’s more like a strategic nap. If Bitcoin stabilizes, they might start buying again, but for now, they’re just preserving capital—aka not losing their shirts.” 👕💸

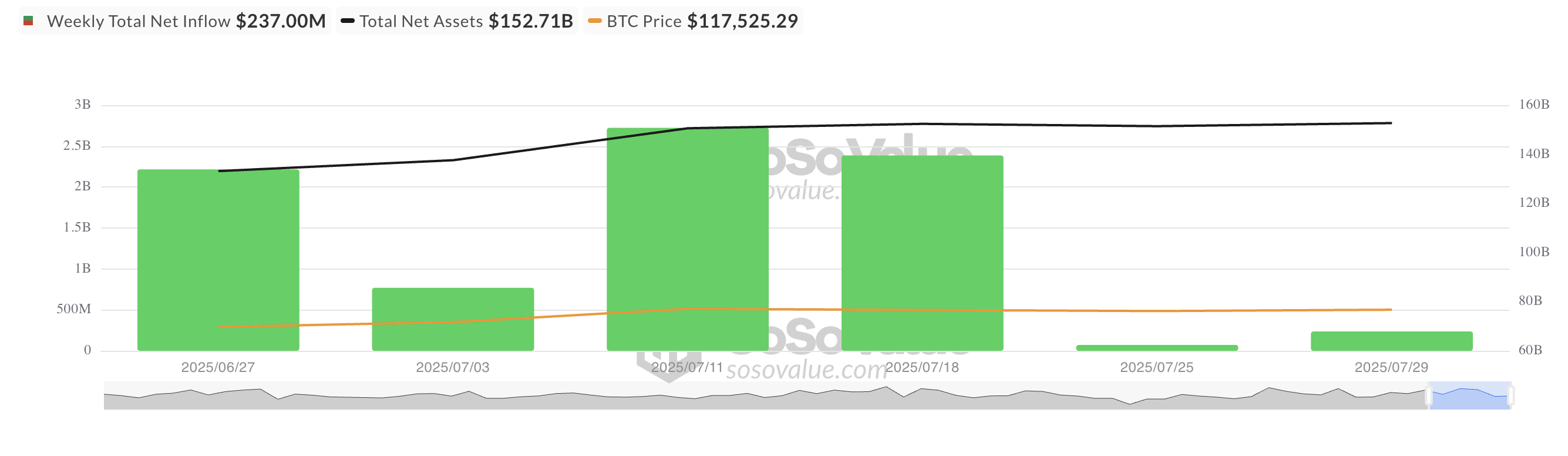

When asked about the influence of miners vs. institutions, Gadit dropped this gem: “Institutional demand is the real backbone of Bitcoin’s price. ETFs from BlackRock, Fidelity, and Ark are creating a structural bid that’s propping up the price more than miners ever could.” So, miners, take a seat. The big boys are in town. 🏛️💪

“While miners are easing short-term supply pressure, institutions are the ones calling the shots. Miners used to set the pace, but now they’re just along for the ride.” 🚗🤷♂️

With institutional demand growing—BTC ETFs have seen $237 million in net inflows this week—miner selling pressure might be offset, keeping BTC stable in August. Unless, of course, someone tweets something stupid. (Looking at you, Elon.) 🐦🤦♂️

This confirms Gadit’s view that institutions, not miners, are the real MVPs of the crypto world. 🏆💼

Will Bitcoin Break Free or Stay Stuck? 🕸️🤔

At press time, BTC is trading at $117,826, stuck between $116,952 and $120,811. If institutions keep buying and the market mood improves, it could break past $120,811 and aim for its all-time high. But if bears take over, it might drop to $114,354. So, basically, it’s a coin toss. (Pun intended.) 🪙🤷♀️

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- Silver Rate Forecast

- Brent Oil Forecast

- ZK Price: A Comedy of Errors 📉💰

- ZEC Surges 17%-Is $750 Just Around the Corner? 🚀💰

2025-07-31 05:53