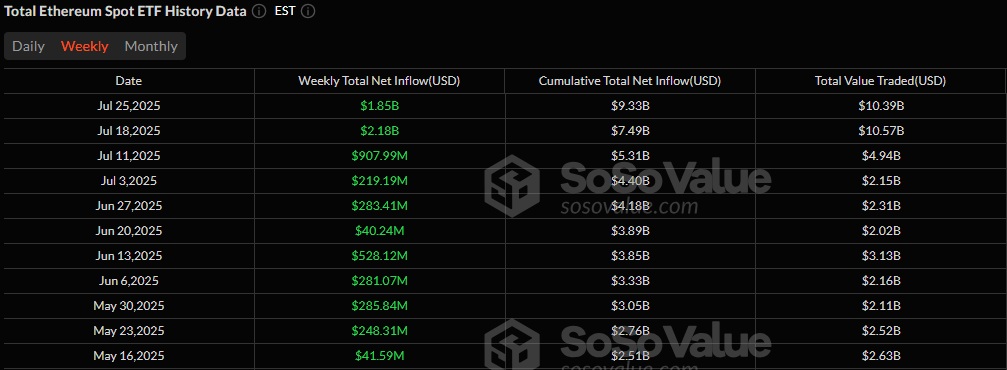

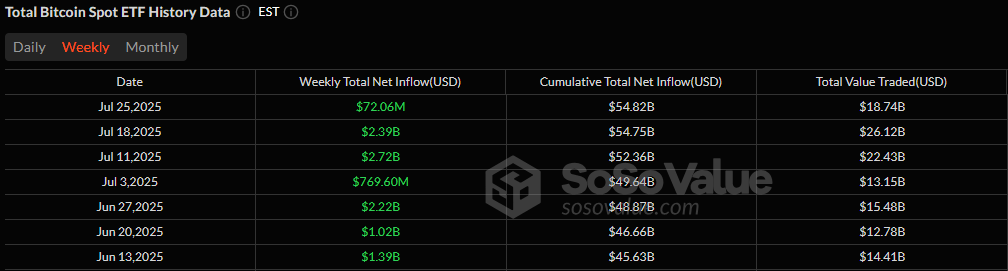

In the grim dance of market forces, Ether’s ETFs have unleashed a torrent of $1.85 billion in inflows, a savage streak now 11 weeks strong, while Bitcoin‘s ETFs crawl forward with a mere $73 million, dragged down by the week’s early despairs and fleeting glories.

The Eternal Struggle: Ether’s Relentless March Amid Bitcoin’s Faltering Steps

Ether ETFs are not merely trading; they are rewriting the annals of avarice. For the week ending July 25, they devoured another monumental $1.85 billion, their 11th unbroken week of gluttony, second only to some mythic inflow in their brief history. Meanwhile, bitcoin ETFs eked out a paltry $73 million, their gains smothered by initial outflows, a reminder that even digital gold can taste defeat. 😂

Ether ETFs: A Cascade of Covetousness and Unyielding Triumph

Ether ETFs raged on, inflowing every day without respite, stretching a historic 16-day feast. The peak came on Tuesday, July 22, with a voracious gulp of $533.87 million. Six ETFs joined this bacchanal:

Blackrock’s ETHA: +$1.29 billion – oh, how they feast! 😏

Fidelity’s FETH: +$382.89 million – loyalty rewarded, or just blind luck?

Grayscale’s Ether Mini Trust: +$171.75 million – a mini trust with maxi ambitions, eh? 😂

Bitwise’s ETHW: +$34.63 million – small bites for the bitwise beast.

Vaneck’s ETHV: +$3.95 million – barely a nibble, but every drop counts. 😜

Franklin’s EZET: +$2.84 million – easy come, easy go, I suppose.

Yet, in this orgy of excess, Grayscale’s ETHE (-$42.03 million) and 21Shares’ CETH (-$374.05k) offered a fleeting nod to sanity, minor rebellions in an otherwise unhinged week. 😱

Bitcoin ETFs: A Wretched Comedy of Errors and Partial Redemption

Bitcoin ETFs endured three days of exile at the week’s start, outflows mocking their hubris, before two days of meager inflows salvaged a net gain. The highlight? A Thursday surge of $226.61 million, though it pales against past excesses. Ah, the irony of digital scarcity yielding such fickle abundance. 😂

The weekly ledger reads like a tragic farce:

Blackrock’s IBIT: +$267.88 million – still the king, but wearing a crown of thorns.

Vaneck’s HODL: +$62.04 million – holding on for dear life, or just delusional? 😏

Grayscale’s Bitcoin Mini Trust: +$27.18 million – mini indeed, in this era of giants.

Bitwise’s BITB: +$4.67 million – a bitwise whisper in the wind.

Franklin’s EZBC: +$3.45 million – easy, but hardly breezy.

But outflows cut deep: Fidelity’s FBTC fled with -$123.23 million, Ark 21shares’ ARKB deserted at -$90.20 million, and Grayscale’s GBTC escaped with -$79.74 million. A exodus fit for a fallen idol. 😜

In this carnival of capital, bitcoin ETFs clutch their dominance in total Assets under Management, yet they may be surrendering the soul of the game to ether’s siren call, as institutions chase novelty like moths to a flame. ETH ETFs now command 4.3% of ether’s market cap, a testament to the accelerating madness of institutional desire. Combined inflows hit $1.92 billion, a bold defiance of volatility’s whips, where risk is but a mask for unbridled greed. 😂😱

Read More

- Gold Rate Forecast

- USD HUF PREDICTION

- When Will the Long Traders Finally Give Up? 🤔

- Crypto Chaos: Will the White House’s New Report Save the Day? 🤔💰

- Traders Rush Back to XRP: The Silent Storm Brewing in the Crypto World! 😱🚀

- Bitcoin’s Price Madness: A Comedy of Bulls and Bears 🎭💰

- Bitcoin’s $90K Standoff: Is It Playing Hard to Get or Just Confused? 🤔💸

- Crypto Whirlwind: How DeepBook’s Wild Ride Might Just Make You Smile 😏💸

- How Ethereum Became the Unexpected Hero of AI Finance 🚀💰

- Doge Doomed?! 😱🐳

2025-07-28 23:58