TL;DR (a.k.a. Why you should probably buy ETH and then hide the keys):

- Ethereum‘s supply on exchanges has plummeted faster than my diet attempts—down to its lowest in nearly a decade. Apparently, everyone’s hiding their coins like they’re the last slice of pizza.

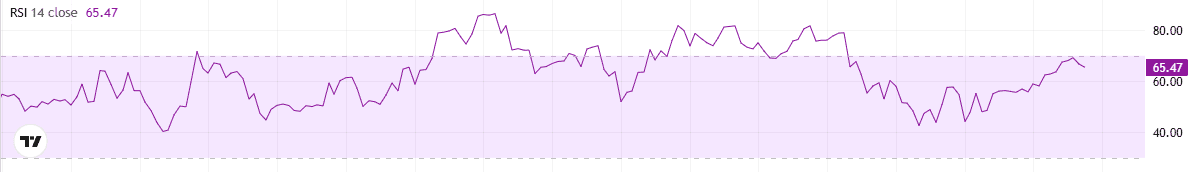

- Spot ETF inflows are acting like the cocktail umbrella at a hurricane—pointless but cheerful. Analysts say ETH might keep climbing, but the RSI (that’s crypto’s version of a fever thermometer) is telling us it’s overdone, so brace for a nap.

Or Is It Just the Beginning of a New Bubble?

Ethereum has been riding a wave so high it’s making the Grand Canyon jealous. With a solid 60% jump in a month, it’s practically screaming, “Look at me!”

Just a few hours ago, ETH hit roughly $3,940—the highest since last December, which is basically a geological epoch in crypto years. Now it’s chilling around $3,800, probably waiting for Tesla to give it a thumbs-up or a thumbs-down.

Meanwhile, X (Twitter’s reincarnation) user Ali Martinez spilled the beans: over one million ETH vanished from exchanges faster than you can say “rug pull,” totaling nearly $3.9 billion in crypto cash. That’s more zeroes than my bank account—by a lot.

“More than 1 million Ethereum $ETH have been withdrawn from exchanges in just a month!” 🕵️♂️

— Ali (@ali_charts) July 28, 2025

CryptoQuant’s data confirms it: exchanges are holding about 19 million ETH—lowest in ten years. Investors are turning into their own bank tellers, which is fancy talk for “I don’t trust anyone, not even the guy who sells me coffee.”

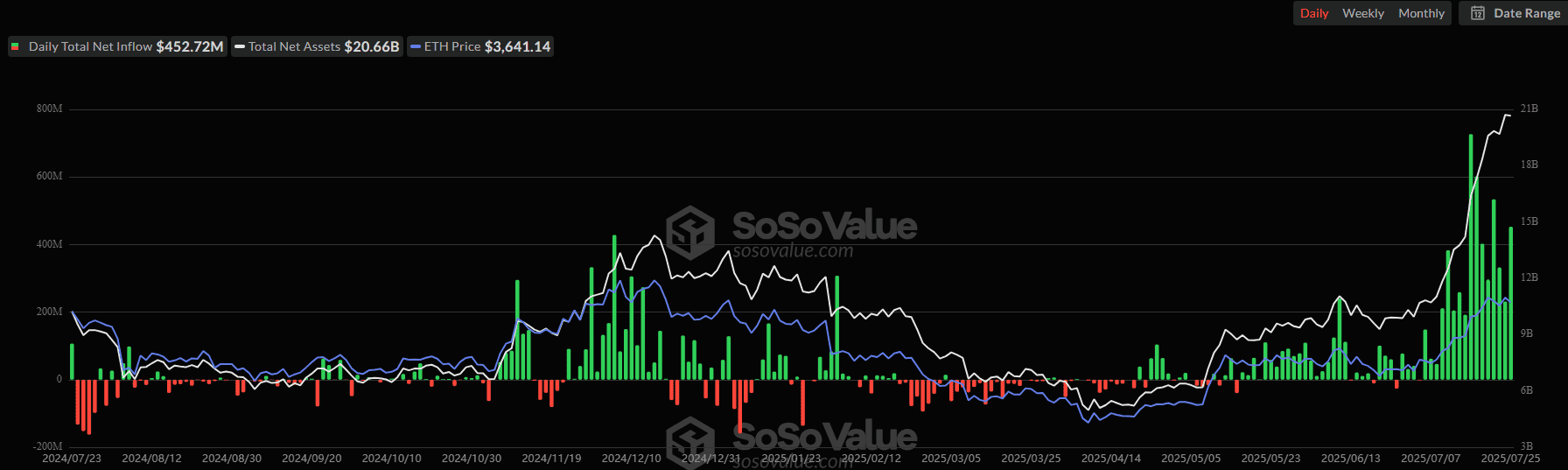

And the money flowing into spot ETH ETFs? It’s like a giant feeding frenzy—positive daily net flows for weeks, signaling serious investor interest. Or maybe just FOMO with a side of greed.

But don’t pop the champagne yet. The RSI (that’s the crypto mood ring) is nudging 70, indicating it’s overheated and ripe for a correction—kind of like that deliciously overcooked steak you secretly loved. Readings over 70 suggest a short break or a dip, while below 30 signals the buying bin is open for business.

Chasing Dreams or Pumping Fears?

If you ask the crypto oracle—who is either a wizard, a lunatic, or just really good at drawing lines—ETH might soar to $4,800. That’s right, almost a new moon shot. “Just doesn’t give a chance to buy lower,” whispers the crypto community, which is a fancy way of saying, “It’s going higher—probably while you’re still trying to find your wallet.”

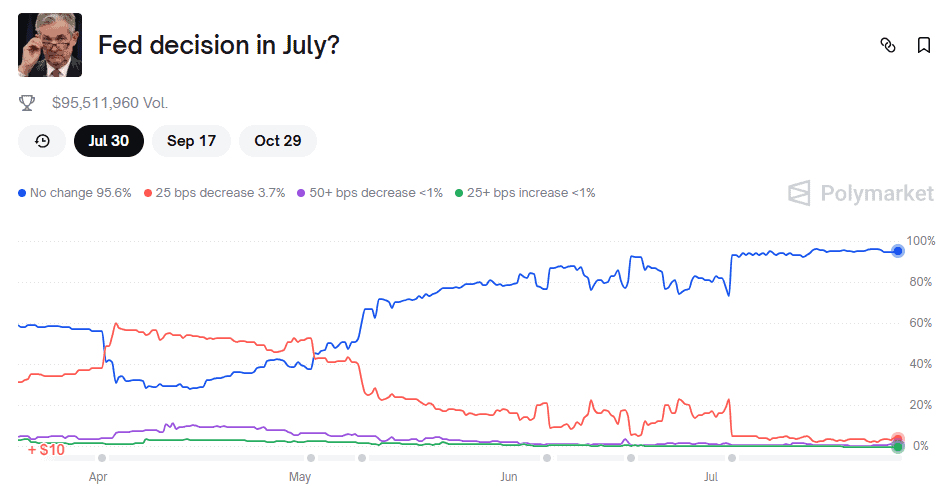

Crypto Rover, the guy who loves timing the market more than his morning coffee, points out ETH tends to go nuts after Federal Reserve meetings. Next up? The Fed’s big powwow from July 29-30, where they decide whether to make borrowing more expensive or just twiddle their thumbs—either way, ETH could get caught in the crossfire or bask in the glory.

The betting odds? 95.5% chance they keep rates steady at 4.25%-4.50%. So, the rollercoaster might be about to pause, but in crypto, never say never. Will that calm or chaos? Time will tell, or maybe a tarot card reading.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- How Ethereum Became the Unexpected Hero of AI Finance 🚀💰

- Bitcoin’s Price Madness: A Comedy of Bulls and Bears 🎭💰

- PLUME: 60% Down?! 😱

- USD THB PREDICTION

- When Will the Long Traders Finally Give Up? 🤔

- USD GEL PREDICTION

- Crypto Whirlwind: How DeepBook’s Wild Ride Might Just Make You Smile 😏💸

- Ethereum’s Fee Fiasco: When Blockchains Play Hard to Get! 🤡

2025-07-28 17:56