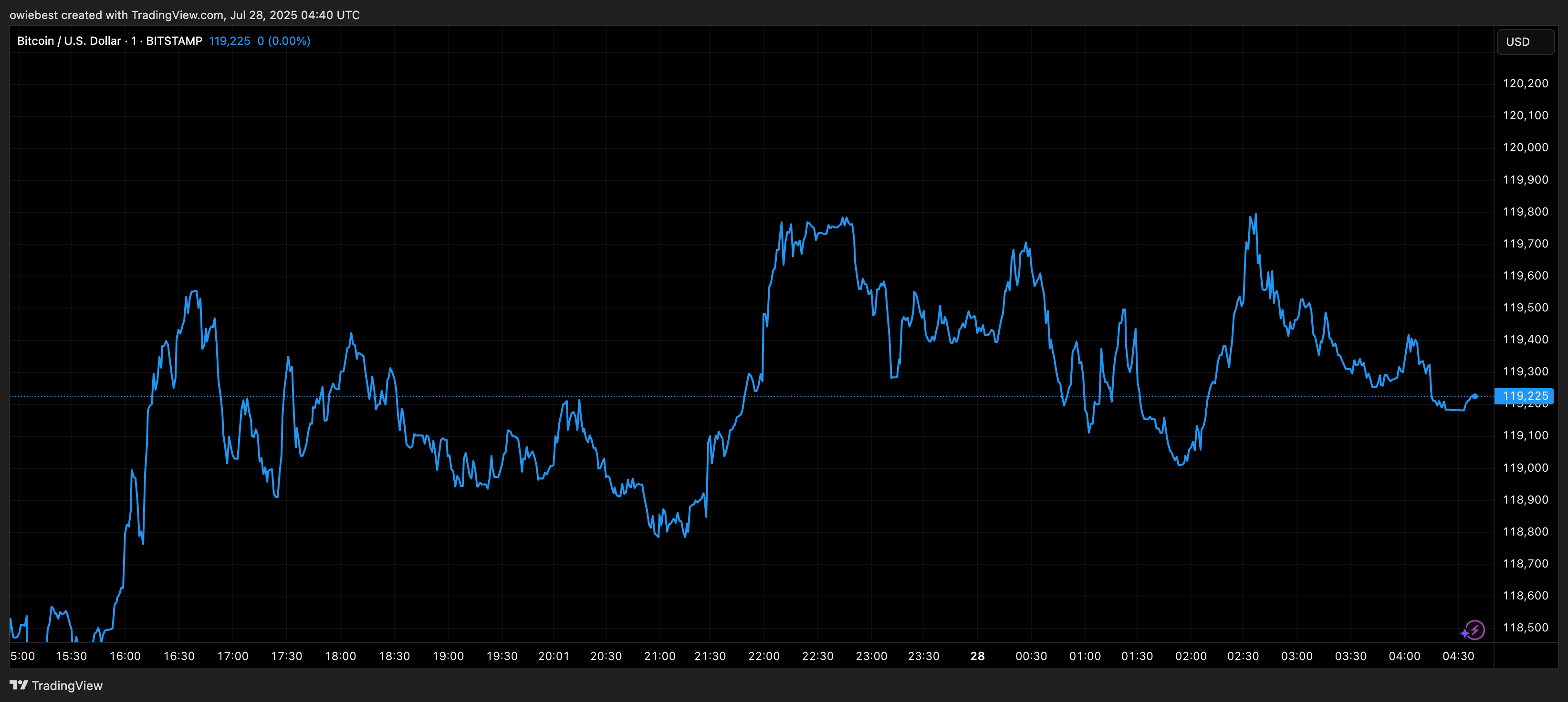

It is a truth universally acknowledged, that a cryptocurrency in possession of a good fortune must be in want of a dramatic rebound. Thus, our dear Bitcoin—having endured a week of scandalous volatility—has lately deigned to rise once more from the depths of £115,000, as if to remind the world of its enduring charm and penchant for theatrics. The whispers of a short squeeze, as foretold by the esteemed analyst Luca upon the digital agora of X, suggest this drama may yet have further acts.

A Dance of Market Makers and Mischievous Traps

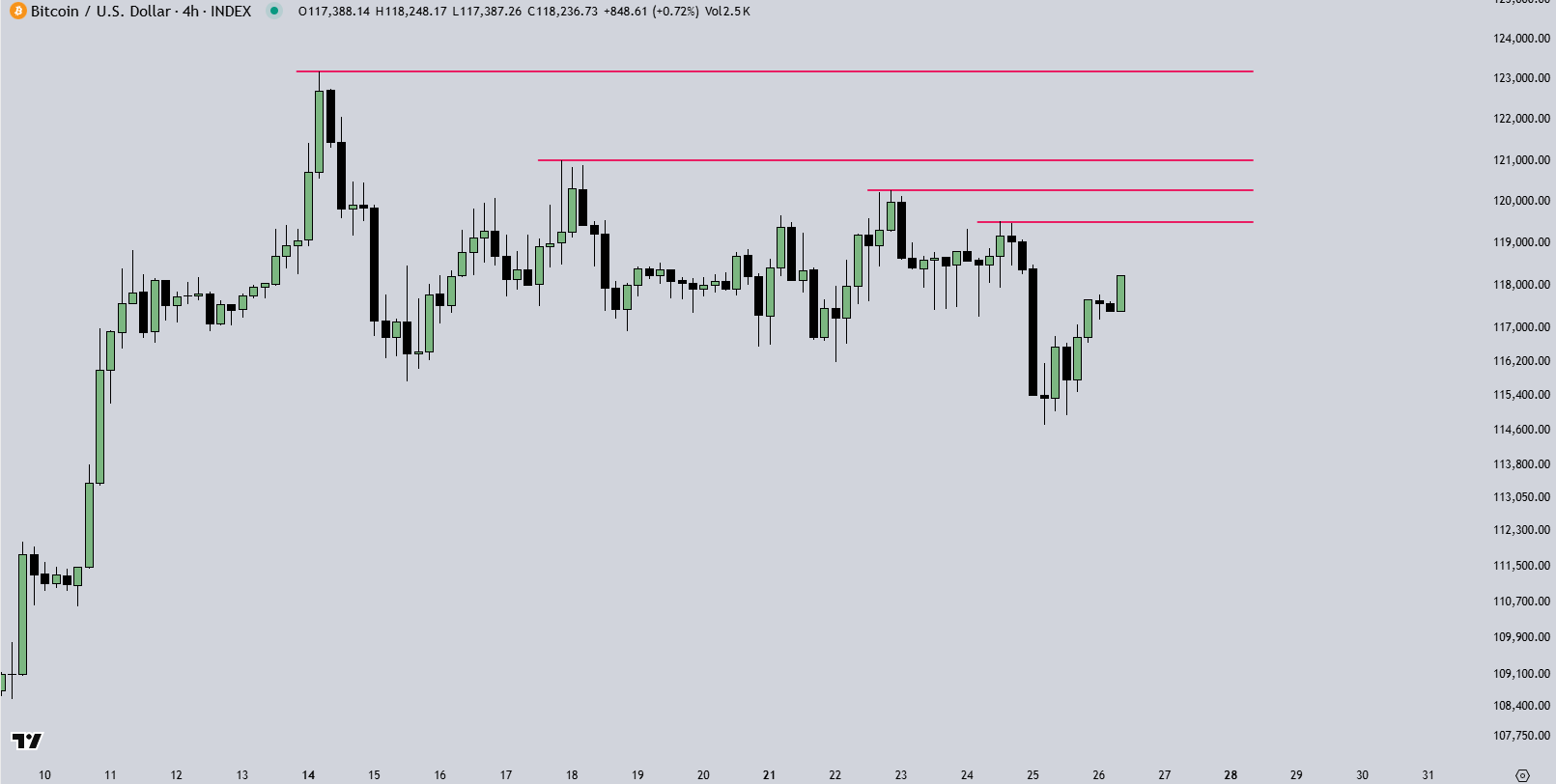

Methinks the market makers, those dashing rakes of finance, have orchestrated a most cunning trap. First, they feigned disinterest, allowing the price to plummet and flush out the faint-hearted longs—a ruse as old as the trading pits themselves! 🎩💸 But lo! A reversal was afoot, sweeping liquidity from support levels like a rogue stealing tarts at a country fair. The bears, lulled into complacency, found themselves dashed upon the rocks of £118,000, their liquidations ringing like a comedic bell.

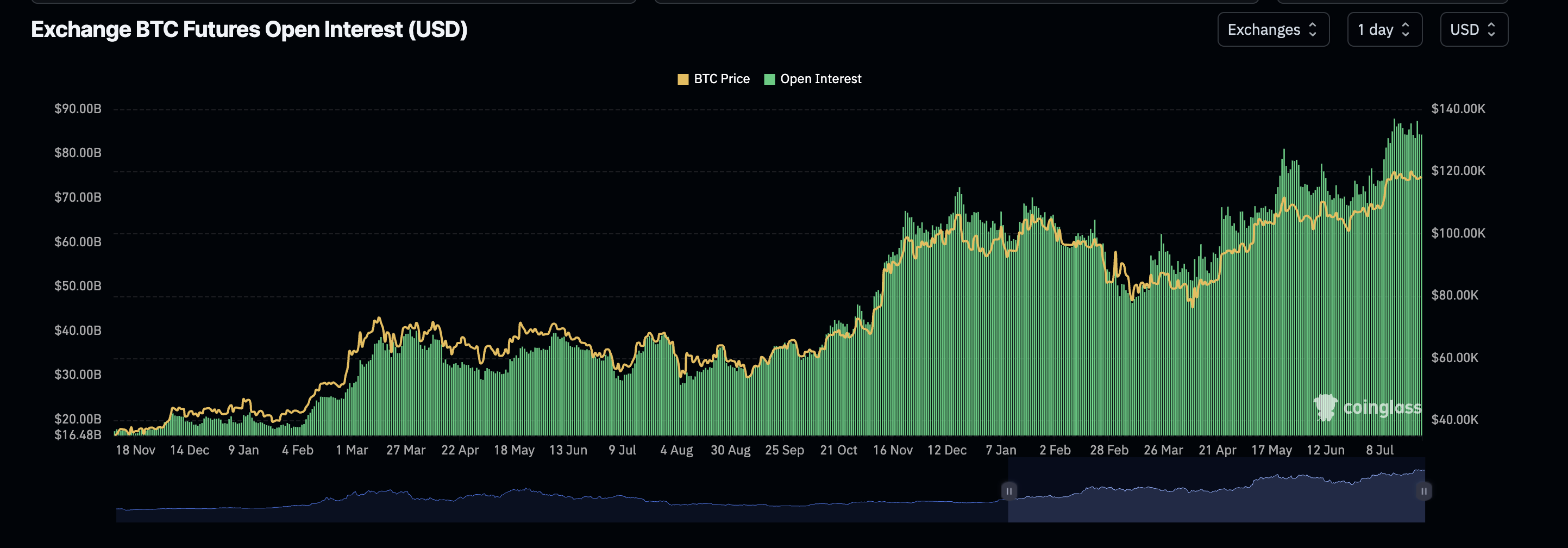

Meanwhile, the Bitcoin funding rate—ever a fickle companion—didst fall below 0.01%, as if exhausted by the week’s drama. And the Bitcoin Premium, once proud, slunk back into negativity, much like a suitor denied at a ball. Yet open interest swelled, as if traders, blind to caution, rushed to bet upon Bitcoin’s next caper. Luca, ever the astute observer, notes this as a telltale sign of short positions trembling in anticipation. 🚨

Open Interest: A Tale of Hubris and High Stakes

As Bitcoin’s price dallied between £115,000 and £120,000, open interest surged to heights unseen—a £87.89 billion spectacle! Traders, both wise and foolish, continue to wager fortunes, their Long/Short ratio a precarious 53.97% shorts. One might liken it to a Regency-era ball where everyone’s betrothed is a gamble. 🎰

Should this squeeze persist—and truly, one suspects it shall—the price may yet rocket skyward, trampling shorts with all the delicacy of a bull in a china shop. One can almost hear the collective gasp of traders as their positions dissolve into the ether. 🚀

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- One Weird Trick: Billionaires Flock to Crypto-Ready Trump Tower in Dubai! 🏦🏙️

- USD THB PREDICTION

- When Will the Long Traders Finally Give Up? 🤔

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- How Ethereum Became the Unexpected Hero of AI Finance 🚀💰

- Bitcoin’s $90K Standoff: Is It Playing Hard to Get or Just Confused? 🤔💸

- Bitcoin Beats Amazon! 🍕 The Day Crypto Took Over the World

2025-07-28 10:27