In the shadow of the digital age, the global cryptocurrency market has plunged into a chasm of despair, its once-gleaming towers now crumbling under the weight of human folly. 🌍💸 A 1% hemorrhage from its $3.8 trillion empire? A mere flicker of the eternal struggle between greed and reason. 🧠😂

What Happened?

Long Squeeze Triggers Chain Reaction

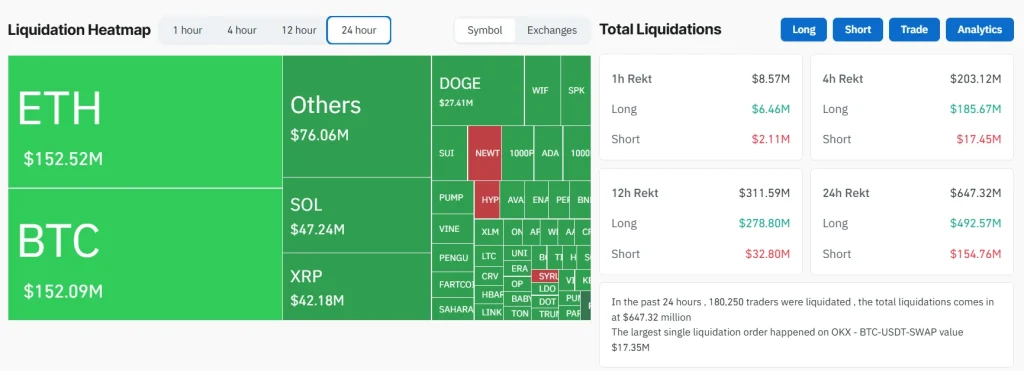

Bitcoin’s descent below $116k was not merely a price drop—it was a spiritual crisis, a moment when the fragile architecture of leverage crumbled like a house of cards. 🏚️💸 A staggering $585M in long liquidations? A testament to the hubris of those who believed they could outwit the market’s wrath. ETH, ever the loyal follower, lost $104M in its own delusions. Dogecoin and PAAL AI? Victims of the whims of a fickle crowd. 🐕🤖

The average funding rate, a sickly +0.008%, whispers of a market intoxicated by its own delusions. The domino effect? A ballet of automated sell-offs, each step deeper into the abyss. 🕵️♂️📉

Why Now?

Profit-Taking After a 30-Day Rally

After a 16% rally fueled by ETF dreams and retail FOMO, the market’s euphoria turned to panic. The 21-day RSI, that overworked sycophant, climbed to 74.25, a clear sign of overindulgence. 🍷📉 MACD, ever the pessimist, spat out a bearish divergence of -3.68B. Stablecoins, the cautious survivors, hoarded $11B in July—a temporary refuge from the storm. ⛑️

Altcoins Face Added Pressure

Rotation into Safety

Altcoins, the reckless gamblers of the crypto world, now face the wrath of a market turning its back on them. Bitcoin’s dominance, a cold and calculating 60.8%, signals a retreat to the familiar. Memecoins, once the darlings of the crowd, now lie in ruins, their hype evaporating like mist. 🦄🌀 The GENIUS Act’s regulations? A specter haunting every trade, a reminder that even in the digital realm, rules are inevitable. 🧩

Conclusion

This dip, though severe, is not a catastrophe but a warning. A high-leverage market, a fragile sentiment, and the ever-present fear of the unknown. The Fear & Greed Index, at 66, dances between hope and despair. If BTC can hold $115k before Friday’s PCE data, perhaps a new dawn awaits. But beware—the market’s whims are as fickle as the wind. 🌬️🔮

FAQs

What triggered the market drop today?

A cruel dance of long liquidations, overbought delusions, and the inevitable reckoning after a 30-day carnival. 🎪💸

Is this the start of a deeper correction?

Perhaps, but remember: the market is a fickle lover, and support levels are but promises written in sand. 🌊

What should I watch next?

Friday’s PCE data, Bitcoin’s $113k–$115k fortress, and the ETF inflow tide. A true test of endurance. 🧭📈

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- XRP ETF: Will Crenshaw’s Stubborn Soul Crush Crypto Dreams? 😱

- Crypto Courtroom Bombshell: The Surprising Maneuver That Could End It All

- Is Onyxcoin’s Rocket Losing Steam or Just Fueling Up? 🚀🧐

- Ethereum’s Wild Ride: Is It Just Getting Started? 🚀

2025-07-25 09:53