Oh, the fickle affections of the financial world! It appears Ether ETFs are currently the toast of the town, merrily accumulating $534 million, whilst Bitcoin ETFs, well, they’re having a bit of a wobble, aren’t they? A second day of outflows totaling $68 million. How dreadfully common. Still, trading is frightfully brisk, and those Ether products are practically bursting toward $20 billion in net assets.

Ether ETFs Hit 13-Day Streak While Bitcoin ETFs Struggle With Another $68 Million Exit – Honestly!

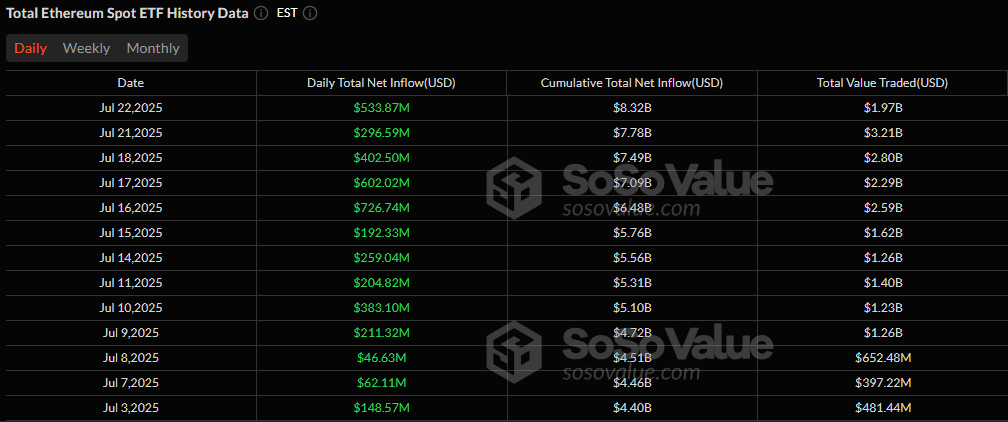

The sudden enthusiasm for Ether exchange-traded funds (ETFs) is becoming rather difficult to overlook, wouldn’t you agree? For the second day running, Bitcoin ETFs have stumbled, experiencing $67.93 million in departures, whilst Ether ETFs positively gallop ahead with $533.87 million in fresh arrivals. Most diverting.

Ether ETFs, bless their little hearts, continue their positively green march, securing their 13th consecutive day of inflows and amassing a rather impressive $533.87 million. Blackrock’s ETHA is leading the charge, snaffling up $426.22 million, while Grayscale’s Ether Mini Trust adds a respectable $72.64 million and Fidelity’s FETH chips in with $35.01 million. Remarkably, not a single Ether ETF has experienced an outflow – a rather clear indication of unyielding bullish, dare I say, optimism.

Trading volumes for Ether ETFs remain quite steady at $1.97 billion, and net assets are creeping ever closer to that rather symbolic $20 billion milestone. One does wonder what all the fuss is about. 🧐

Bitcoin’s little hiccup, you see, was caused by rather substantial redemptions from Bitwise’s BITB, losing $42.27 million, and Ark 21Shares’ ARKB, parting with $33.18 million. A paltry $7.51 million inflow into Grayscale’s GBTC did little to improve the overall mood. Such a bore.

Despite these outflows, trading activity remains robust at $4.01 billion, and net assets stand at a perfectly respectable $154.77 billion, suggesting this might just be a brief pause for breath, rather than a full-blown trend reversal. One hopes so, at least. 🙏

As Ether ETFs maintain their historic inflow streak and Bitcoin ETFs experience minor turbulence, the market narrative appears to be decisively tilting toward Ether dominance in the short term. Don’t say I didn’t warn you! 😉

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Is Onyxcoin’s Rocket Losing Steam or Just Fueling Up? 🚀🧐

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- Pudgy Penguins: The Meme Coin That Dares to Be Different 🐧✨

- Ethereum’s Wild Ride: Is It Just Getting Started? 🚀

- NFTs Soar to New Heights: Is the Bull Run Truly Back? 🚀💰

2025-07-23 23:03