In a frankly baffling turn of events that could only occur in the thrilling universe of cryptocurrency, bitcoin is currently price-tagged at a staggering $117,932 to $118,185 on this fine Monday morning of July 21, 2025. Yes, you read that right, a cosmic market cap of $2.36 trillion, and a delightful daily trading volume of $46.19 billion is out there floating in the digital ether! Price movements today have been oscillating more than a hyperactive dolphin, with a low of $116,779 and a high of $119,523, suggesting a period of relaxation within a broadly bullish trend. 🐬

Bitcoin

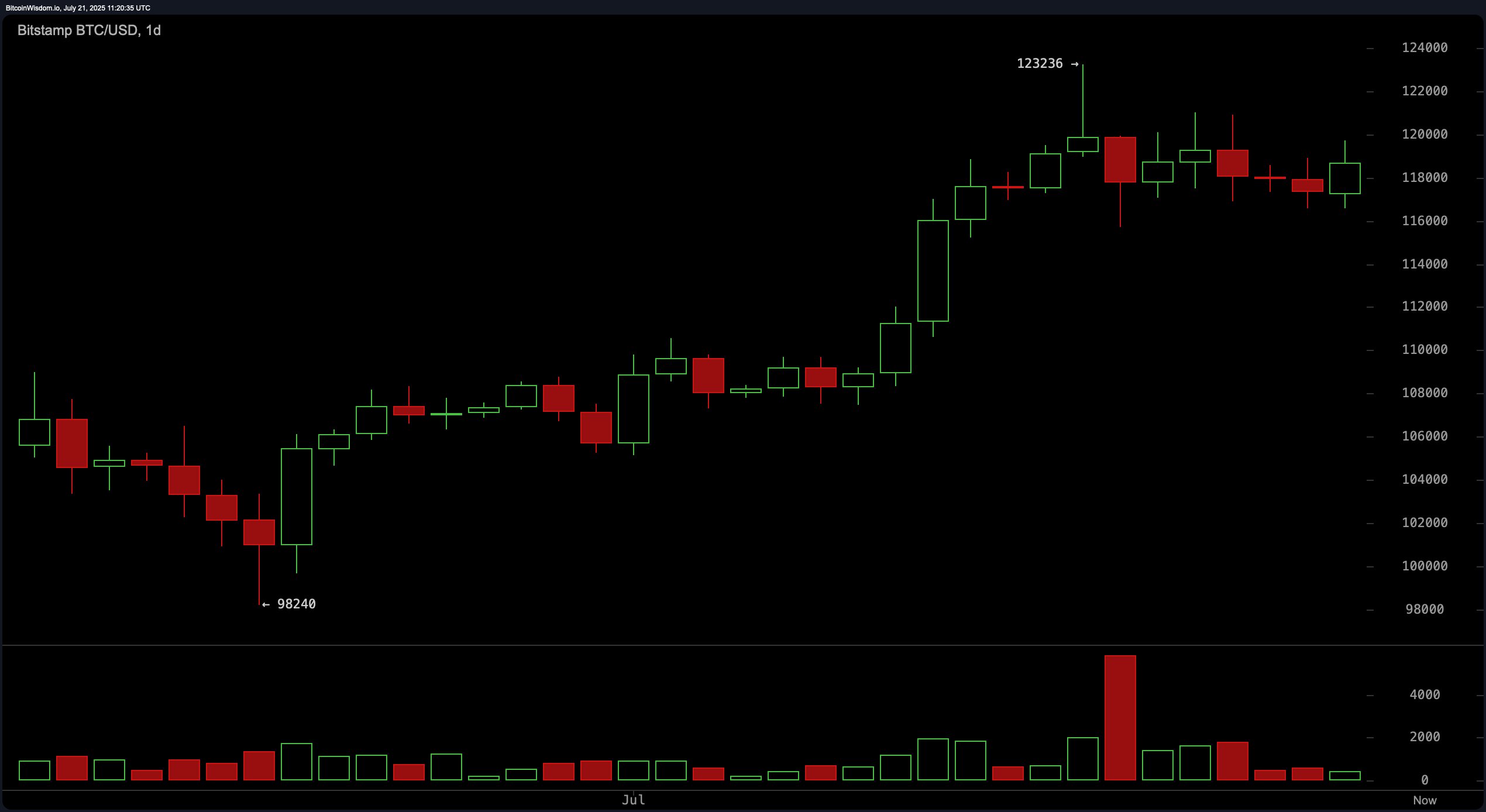

On our daily map of existence, bitcoin has managed to keep its forward momentum alive after wrestling its way back from the dark depths of $98,240. After a brief moment of euphoria at $123,236, we now enter a consolidation phase that’s as tight as a pair of trousers after Thanksgiving dinner—reduced volume included! Should it venture above the mystical $123,236 resistance with a cacophony of cheers (otherwise known as volume confirmation), we may very well witness the continuation of this hopeful uptrend, with targets that are not so much beyond $127,000 as they are darting towards some distant planet! Traders with a taste for caution are affectionately advised to place their stop-losses below $117,500. Beware the breakdown! Should bitcoin slip beneath $115,000, the bullish setup would be tossed into a deep, dark cosmic void.

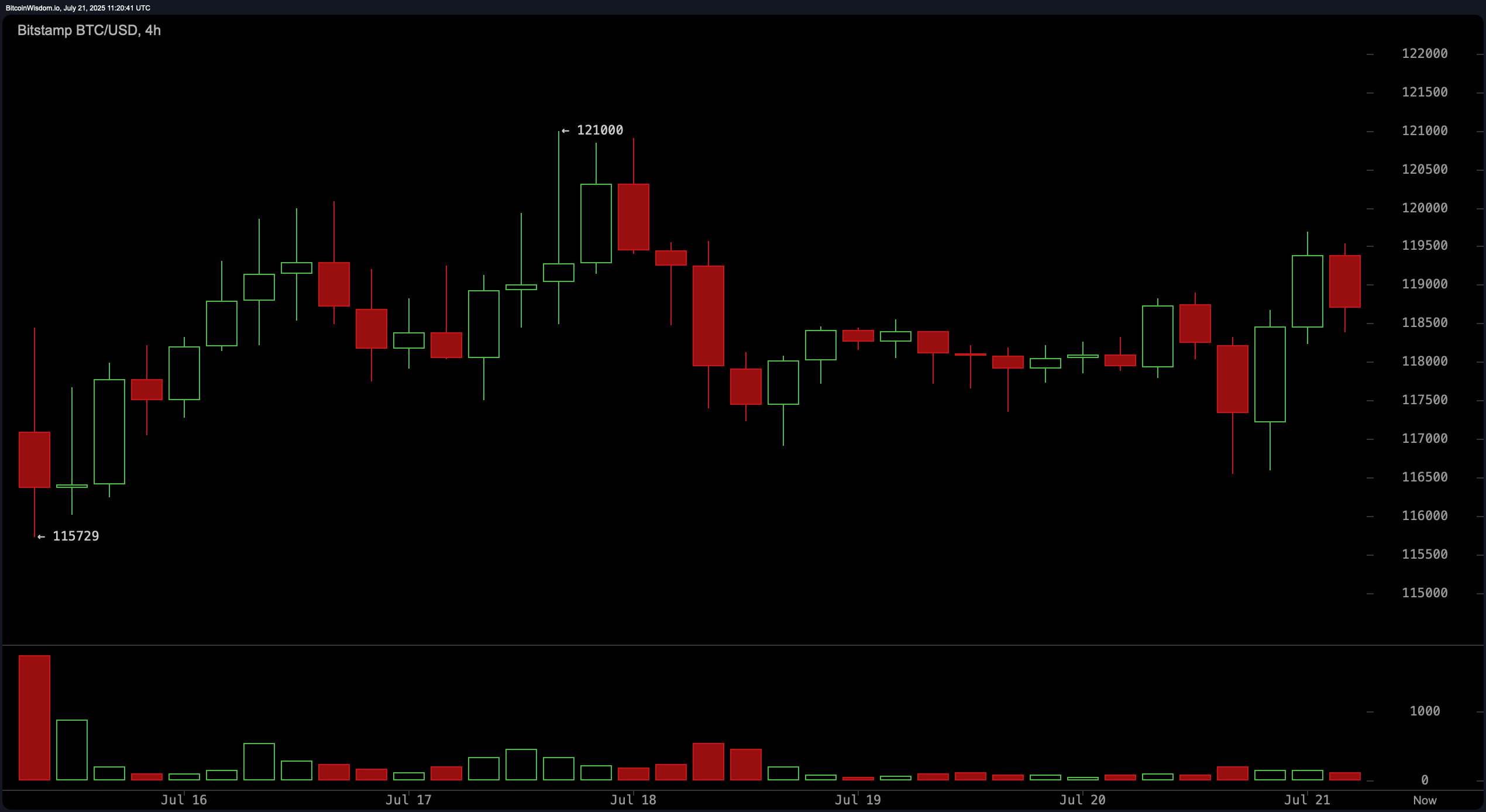

Peeking into the 4-hour chart, we see bitcoin attempting to pull itself up like a cat out of a bathtub after a medium-term splash around $121,000. Support seems to be established firmly around $115,729—no knockoffs here, folks! The emergence of higher lows is as delightful as finding a forgotten chocolate bar, indicating a bullish mood that even Marvin the Paranoid Android could get behind. A confirmed breakout above $120,000 would serve as an entry point worthy of a fanfare, with targets lurking between the legendary $122,000 and $123,000. Cautious souls should keep their stop-loss below $116,000—one does not want to trip and fall into the abyss!🌌

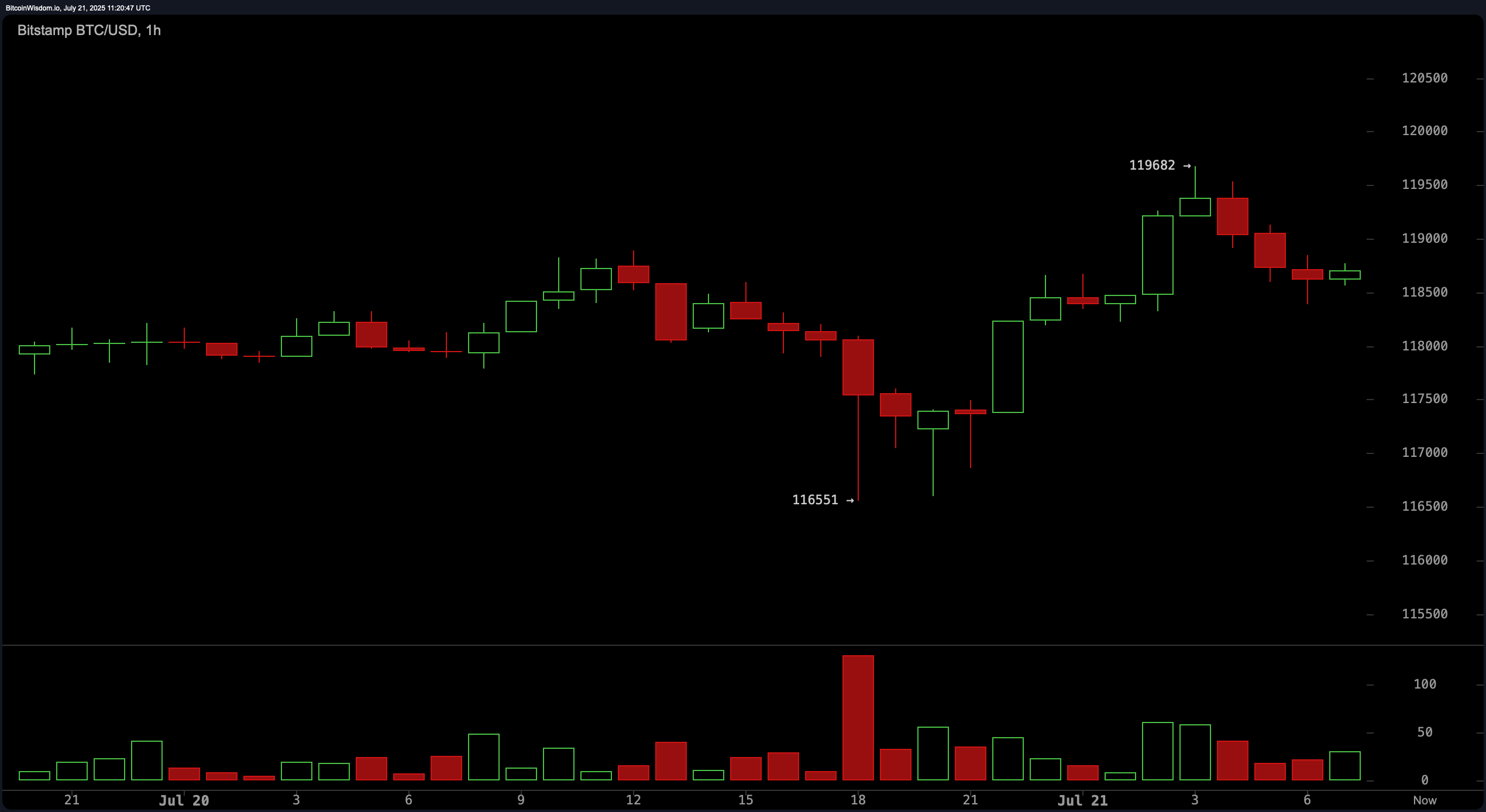

Short-term price action on the one-hour BTC/USD chart is reminiscent of a rollercoaster designed by a particularly indecisive architect, bouncing from $116,551 to a resistance point at $119,500. Current movements may seem like a pullback—cue dramatic music! The low volume during this phase suggests it’s just a pit stop before the continuation party begins again. Traders might consider entry within the thrilling $118,000 to $118,500 support zone, espying especially if a bullish engulfing candle or a mini-volume surge appears. A stop-loss near $116,500 ought to be a rousing reminder that caution is a virtue, unlike inebriated space travel. 🚀

According to our mystical oracle, the oscillator data presents a mixed but stable outlook. The relative strength index (RSI) is hanging out at a vibrant 66, the Stochastic is happily swaying at 67, and the commodity channel index (CCI) is lounging at 59—all comfortably nestled in neutral zones, neither overbought nor oversold, as serene as a cat after a successful mouse hunt. The average directional index (ADX) is reporting from a moderately trending market at 28, while the Awesome oscillator gives a chirp of 7,744—a harmony of neutrality! Interestingly, the momentum indicator, like a grumpy old man, is signaling a mild bear signal at 1,090. Meanwhile, the moving average convergence divergence (MACD) stands at 3,019, decidedly championing the bulls like a devoted fan club!

In the land of moving averages (MAs), all the major players are forming a bullish alliance. The major exponential moving averages (EMAs) and simple moving averages (SMAs) range from 10 to 200 periods, all in perfect alignment like planets in a celestial dance. The 10-period EMA is glittering at $117,380 while the 200-period SMA is languishing at $97,962. This convergence below our current price offers a robust support setup, affirming our bullish vibe. Traders are kindly requested to closely monitor volume during breakout attempts and adopt a buy-the-dip strategy, assuming bitcoin holds steadfast above $116,000, lest the universe align unfavorably.

Bull Verdict:

Bitcoin’s price architecture across all major timeframes gleefully endorses a bullish outlook. The consistent buy signals from moving averages and a tech-savvy consolidation phase further suggest that if we hold above $116,000 and manage to break through $123,236 with a crescendo of strong volume, a sustained rally towards $127,000 or even further into the realms of speculation appears all too likely! 🎉

Bear Verdict:

Despite the splendid overarching bullish trend, a distinct lack of strong oscillator confirmation coupled with a delicate reliance on crucial support levels introduces shades of existential dread. A breakdown below $115,000 per bitcoin with sufficient volume could obliterate our pumped-up bullish setup, prompting the onset of a cosmically overwhelming correction and sending the medium-term upward trajectory spiraling into disarray. 🐻✨

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- New ETF: Bitcoin and Gold Tango to Save Your Wallet from Currency Woes!

- Fantasy.top’s Desperate Dash to Base: A Crypto Comedy 🎭

- SEI’s Suicide Dive to $0.20! 🚀😱 Or the Greatest Trick Since Woland Came to Moscow?

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- EUR UAH PREDICTION

- Crypto Drama: Sui’s Price Soars Like a Pigeon in a Storm! 🐦💸

- Vanguard Calls Bitcoin a Digital Labubu 🧸- Will It Survive the Circus?

2025-07-21 16:14