Ah, the sweet, intoxicating scent of institutional money flowing into Ethereum—an unstoppable tide of greed, ambition, and misplaced optimism. Analysts are practically having a meltdown as Ethereum now teeters on the edge of the $3,800 to $4,000 range. Who knew crypto could be so… thrilling?

Ethereum Price Today: Institutions Throw Money at ETH Like It’s Candy

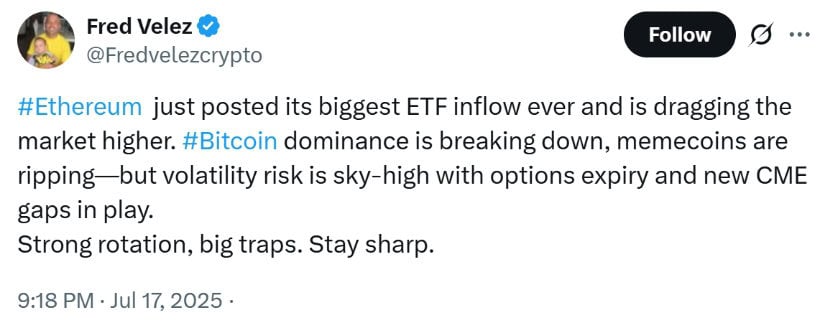

Oh, the drama! In just one week, Ethereum’s price surged over 21%, breaking through the critical $3,298 resistance level like a wrecking ball. It peaked at a joyous $3,435. Data from The Block and TradingView reveal that this price jump wasn’t some random fluke. No, it was all thanks to a record $726 million in ETF inflows. Spot Ethereum ETFs now hold nearly 4.95 million ETH—the highest on record, like a dystopian crypto nightmare come to life.

“Ethereum isn’t just some flashy trading asset anymore,” says Rachael Lucas, a crypto analyst from BTC Markets. “It’s a long-term institutional treasure.” (Well, someone’s trying to sound important.) The combined ETF holdings now make up a neat 4% of Ethereum’s total market cap. Big numbers, bigger egos.

Whale Accumulation: ‘Let’s Make This Thing Too Big to Fail’

And here’s where the plot thickens. Ethereum’s bullish surge is fueled by whales—yes, the ones with more ETH than they know what to do with. On-chain data reveals that nearly 1.49 million ETH was scooped up by large holders in July alone. A 95% increase from last month. Does anyone else feel like the rich are getting richer while the little guys watch from their dusty desks?

And now for the pièce de résistance: SharpLink Gaming, a company from Minneapolis, has become the largest corporate ETH holder, even surpassing the Ethereum Foundation. With over 111,000 ETH worth a staggering $343 million, their holdings are 99.7% staked. Makes you wonder if they’re investing in crypto or buying up the future itself.

“Ethereum’s breakout isn’t just about price—it’s a statement about how institutions view digital assets,” says Jamie Elkaleh, the CMO at Bitget Wallet. If that wasn’t cryptic enough for you.

Ethereum ETF News: A Record Month for Spot Funds… Because Why Not?

Ethereum spot ETFs are having a record month—$2.27 billion in inflows for July, with BlackRock’s ETHA fund alone nabbing nearly $500 million. Analysts claim that these ETF inflows are the main reason behind Ethereum’s recent price surge. Of course, it’s all just a game of who can throw more money into the pit.

“The Ethereum Foundation’s renewed focus and the rise of new treasury firms have injected new life into the ecosystem,” says Steven Zheng, Research Director at The Block. You don’t say.

Technical Analysis: Ethereum Breaks Out, Feels Like a Teenager on Prom Night

Ethereum has broken out of a multi-week ascending triangle—because triangles are, apparently, the new breakout pattern of choice. The RSI is high but not overbought, while the MACD divergence and EMAs confirm that the upward momentum is real. If only these numbers could solve the world’s problems. But, alas, it’s just crypto. 🙄

Open interest has skyrocketed to $50.22 billion, with a 63.55% increase in options volume and $177 million in short liquidations. Binance data shows a 2.82 long/short ratio among top traders. Sounds like a fancy way of saying, “Everything’s going up… for now.” 🤷♂️

Fundamental Drivers: Staking, Regulation, and That Ever-Present Risk

Beyond all the ETF mania, let’s not forget the power of staking. Institutional players are locking up their precious ETH, making it even harder to get your hands on some. U.S. lawmakers, meanwhile, are crafting crypto legislation like it’s the next blockbuster movie. But—surprise—there’s always a catch. Regulatory risks are on the rise, with a $10 million crypto seizure and a $1.1 million ETH hack on BigONE exchange. Because who doesn’t love a good scandal?

Ethereum Price Outlook: Eyes on $4,000 (and Possibly $5,900… Or Maybe Not)

Analysts are seeing $3,800 to $4,000 in Ethereum’s near future, which sounds like a solid bet. Some are even predicting a rise to $5,900 if the stars align. As always, fresh buying opportunities might pop up as Ethereum dances its way to new heights. Just don’t forget to do your research—unless you like gambling with your life savings. 😏

With record ETF inflows, an influx of institutional interest, and technical indicators pointing skyward, Ethereum looks set to dominate the altcoin scene for the foreseeable future. But remember: caution is key. After all, what’s crypto without a little chaos?

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Crypto Drama: Coinbase Ditches MOVE—Scandal, Swoon & a $100M Hangover 🍸

- Crypto Dinner: Where Politics Meets Meme Coins and Laughter! 😂🍽️

- Brent Oil Forecast

- Bitcoin Billionaire’s Bizarre Stock Scheme: Will It Collapse or Conquer? 🤔

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

2025-07-17 23:39