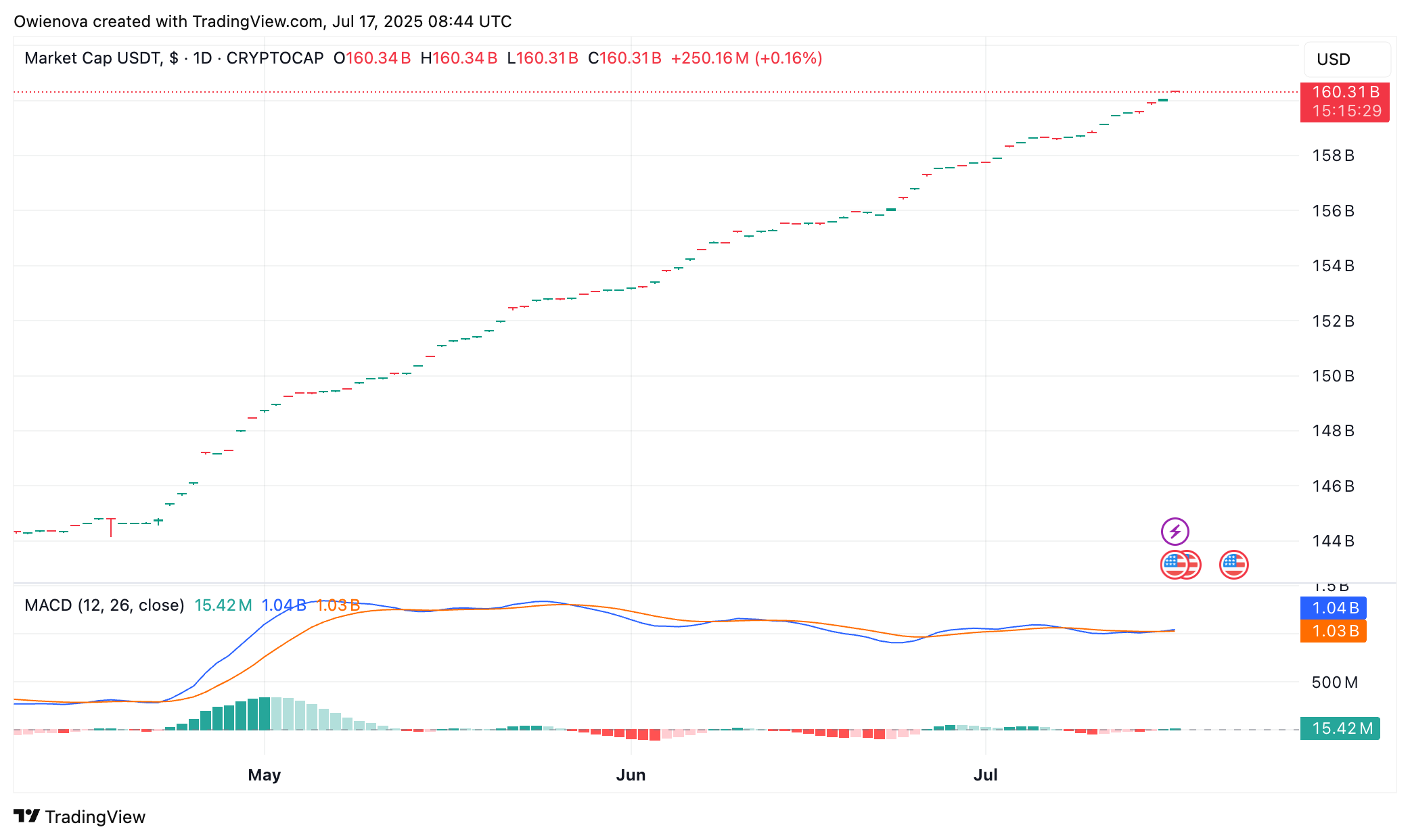

Amid the kaleidoscopic whirl of the crypto market, where digital assets dance to the tune of speculative fervor, Tether’s USDT has pirouetted into a new realm of significance, reaching a staggering $160 billion in market value. 🎉 This feat, as monumental as it is, serves as a testament to the stablecoin’s enduring charm and the market’s insatiable appetite for liquidity and stability.

A $160 Billion Supply Mark For Tether’s USDT

With a flourish, Tether’s USDT has gracefully surpassed the $160 billion mark in circulation, a milestone that would make even the most jaded market observer pause and take notice. This achievement, a veritable crescendo in the symphony of the crypto market, is underpinned by the resurgence of assets like Bitcoin and Ethereum, which have been breaking barriers with the zeal of a young colt in a race.

USDT, the darling of both controlled and decentralized finance ecosystems, has become an indispensable conduit for liquidity, stability, and cross-border transactions. Its role in the digital asset field is as crucial as the air we breathe, and as ubiquitous as the internet itself. 🌐

Paolo Ardoino, the Chief Executive Officer (CEO) of Tether, has taken to the X (formerly Twitter) platform to celebrate this milestone with the enthusiasm of a child on Christmas morning. According to Ardoino, this is “a statement of the unrivaled utility of USDT as the digital dollar for billions of people living in emerging markets and developing countries.”

Ardoino’s gratitude to the community for this “mind-blowing milestone” is as heartfelt as it is strategic. Tether’s rapid expansion is not just a sign of a maturing market but also a testament to the growing reliance on stablecoins as the bedrock of international cryptocurrency trade. 🌍

Another significant development is the substantial increase in monthly on-chain transfer volume. The CEO’s data reveals that USDT now averages $1 trillion in on-chain volume on a monthly basis, a figure that would make the heads of traditional financial institutions spin with envy.

The on-chain volume has been rising steadily, from a modest $14.8 billion to a staggering $1.1 trillion per month, representing a 7400% growth since 2020. This meteoric rise is a clear indication of the blockchain’s role as the liquidity backbone of the crypto industry, a role it plays with the grace of a seasoned ballerina.

Moreover, the active user count has seen a surge that would make the population of a small country blush. Ardoino’s post reveals that Tether’s active users have skyrocketed from 2.8 million to 450 million, a 160x increase since 2020. This growth is as impressive as it is bewildering, a testament to the stablecoin’s ability to attract and retain users in a market as volatile as the sea.

Will The Stablecoin Leader Lose Its Dominance To Upcoming Counterparts?

Despite its remarkable growth in market value, on-chain transfer volume, and active user count, Tether is not without its challenges. The specter of upcoming regulated stablecoins, such as Ripple’s dollar-pegged token, RLUSD, looms large on the horizon, threatening to cast a shadow over USDT’s dominance.

Regulations, those pesky but necessary guardians of the financial world, are being developed globally, and they may yet impact the dominance of USDT. The stablecoin’s reluctance to provide transparency regarding its underlying assets has not gone unnoticed by the authorities, who are as keen as hounds on the scent of a fox.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Crypto Drama: Coinbase Ditches MOVE—Scandal, Swoon & a $100M Hangover 🍸

- Ethereum’s Wild Ride: Is It Just Getting Started? 🚀

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Coinbase’s Meme Coin Frenzy: A Tale of Farts and Fortunes 🚀💰

- Bitcoin Billionaire’s Bizarre Stock Scheme: Will It Collapse or Conquer? 🤔

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

2025-07-17 23:13