The winds of change are blowing through the meme coin market, as Ethereum (ETH) reclaims its throne in both institutional and retail circles.

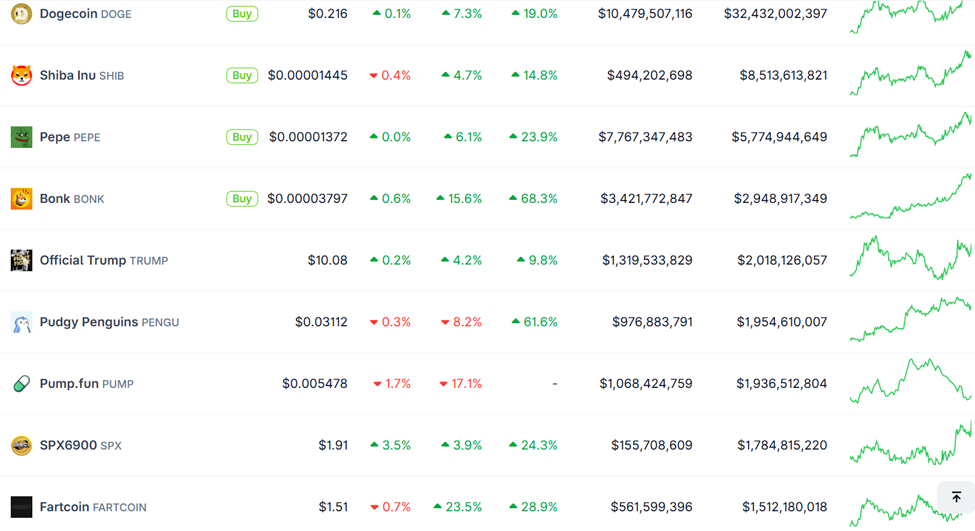

Traders are shifting their capital away from weaker narratives like PENGU (Pudgy Penguins) and PUMP (Pump.fun), and into tokens with stronger momentum and perceived fundamentals.

Ethereum’s Narrative Awakens the Meme Coin Season

Some meme coins, including Floki Inu (FLOKI), Bonk Inu (BONK), and Fartcoin (FART) are posting double-digit gains. Meanwhile, others, including PENGU and PUMP, are recording losses.

More specifically, FLOKI leads today’s gainers with a 40% pump, followed by BONK (+16%), Fartcoin (+18%), and PEPE (+5%).

Meanwhile, DOGE and SHIB added 7% and 4.5% respectively. In contrast, PENGU and PUMP have fallen out of favor, plunging 8% and 21% as of the latest CoinGecko data.

The broader meme coin market cap is up 6%, nearing the $80 billion mark. It aligns with a recent BeInCrypto report, which indicated the early signs of a meme coin season in July.

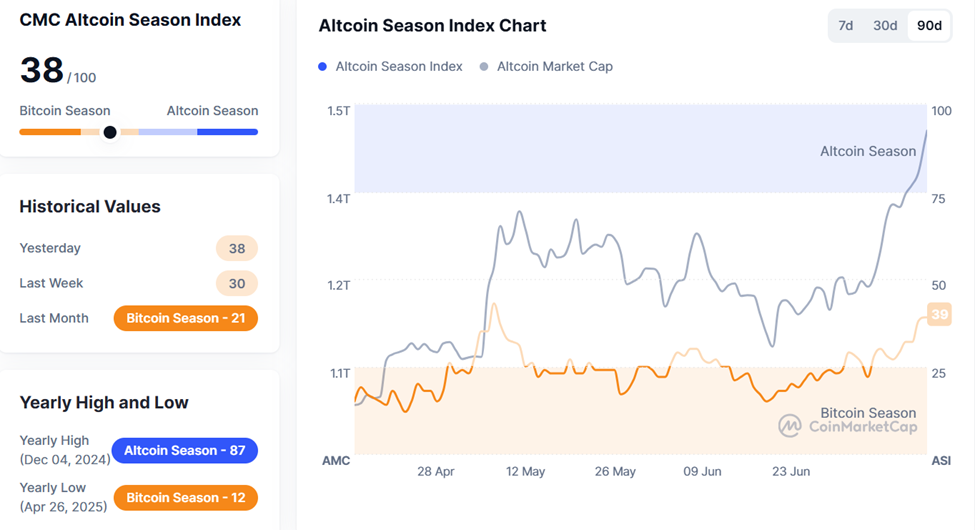

Elsewhere, on CoinMarketCap’s altcoin season index, the altcoin trend is accelerating, suggesting capital is actively rotating away from Bitcoin.

This capital rotation, coupled with a surge in meme coins, accentuates the onset of the colloquial altcoin season. Data on TradingView shows the altcoin market cap at $1.42 trillion, the highest since early February.

TOTAL3 just reclaimed the $1 Trillion mark#Altseason

— Gert van Lagen (@GertvanLagen) July 17, 2025

The assumption holds given meme coins’ role reflecting broader market sentiment, particularly among altcoins, with investors looking at this class of tokens as a speculative liquidity point. When the altcoin market is turning bullish, meme coins often reflect the sentiment first.

“Meme coins are a global shelling point for speculative liquidity. Anyone from any country can access them much more easily than any stock in the world,” wrote Andrew Kang in a recent post.

At the core of this reshuffle is Ethereum’s renewed narrative strength, which like XRP, is benefiting from the GENIUS Act.

The perception of the bill’s potential to restrict centralized yield-bearing stablecoins is stirring excitement. This could drive more capital into Ethereum-native DeFi protocols, ultimately boosting ETH’s long-term value proposition.

According to analyst Crypto Auris, speculators are already front-running the narrative.

Ethereum is ripping and the GENIUS Act might be a big reason why.

Here’s what’s driving $ETH (and why I think it’s just getting started):

Speculators seem to be front-running the narrative already (let’s be honest, many were likely positioning weeks ago), betting that…

— Crypto Auris (@crypto_auris) July 16, 2025

Ethereum-based tokens are thriving under this momentum, including SHIB, PEPE, and the top gainer, FLOKI.

Institutional players are riding on the same wave and sentiment, with Sharplink Gaming adding ETH to its treasury, only days after accelerating its buying spree.

We didn’t adopt $ETH to follow trends, we adopted it to lead

— SBET (SharpLink Gaming) (@SharpLinkGaming) July 16, 2025

With the latest purchase, it has surpassed the Ethereum Foundation. As institutional attention rises fast, meme coins running on Ethereum are following suit.

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Bored Rich Men and Fickle Fortunes: Bitcoin’s Latest Dance with Destiny (and Whales)

- Gold Rate Forecast

- Brent Oil Forecast

- Crypto Armageddon or Just Nap Time? Binance’s Secrets Unveiled! 💥🚀

- Crypto Drama: When State Stablecoins Fight Federal Overlords 😲

- Is FLOKI About to Break the Internet? You Won’t Believe What Happens Next! 🚀

- OMG! Altcoin Buybacks Are Wilder Than Your Aunt’s Stock Tips! 😱

- EUR MXN PREDICTION

2025-07-17 15:47