Greetings, dear reader, and welcome to the Asia Pacific Morning Brief—your most necessary digest of crypto affairs that are ever so crucial in these times of financial uncertainty. Do try to keep your composure as you read on.

Now, do fetch yourself a cup of green tea, a beverage far too gentle for the market madness that we are about to uncover. Today’s topics: South Korean crypto volumes soar by an impressive 264%, with Bitcoin reaching the dizzying height of $120K; Talos, ever the opportunist, has purchased Coin Metrics for a sum surpassing $100 million amidst the latest wave of consolidation; and, in a move that could only be described as audacious, Trump’s World Liberty tokens are now open for public trading, following a rather dramatic governance vote.

South Korean Trading Surges by 264%, but alas! No Kimchi Premium to be Found

In South Korea, cryptocurrency exchanges have reported daily trading volumes surpassing a staggering $8 billion—an increase of 264% compared to the previous year. This surge comes as Bitcoin reaches an all-time high of $120,000, breathing new life into the once-buried investor interest across the region. One might even say it has sparked a wild frenzy—if one were prone to exaggeration.

Market optimism, ever fragile, has been lifted by the anticipation of “Crypto Week” events in the United States; but alas, the price of Bitcoin in Korea is trading 1.7% below the global rate. And where, you might ask, is the infamous “Kimchi Premium,” that once-thriving anomaly where Korean exchanges would list cryptocurrencies at prices higher than those found elsewhere? Gone, my dear reader, gone—likely a casualty of regulatory constraints and the limitations on arbitrage opportunities that now govern the marketplace. How utterly dull.

Meanwhile, the Korean stock market has been showing some newfound vigour, with the KOSPI index climbing 15% since President Lee Jae-Myung took office in June, likely propelled by his market-friendly policies and reforms. Perhaps we shall see more of this in the days to come—or perhaps not. Who can say?

Trump’s World Liberty Financial Tokens: A New Token for the Masses!

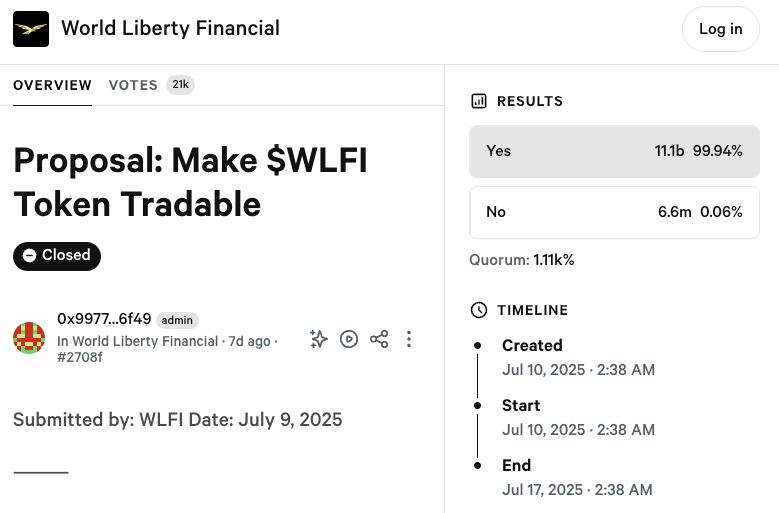

In what can only be described as a move most theatrical, World Liberty Financial, a project backed by none other than President Trump, is now allowing the public to trade its WLFI tokens after a vote concluded on Wednesday. Yes, you read that correctly—no longer the exclusive domain of wealthy investors. The Ethereum-based decentralized finance project, which plans to offer crypto borrowing and lending services (though it has yet to launch said services), is branching out into the public sphere. How democratic!

The governance token, with all the grandeur of such things, allows holders to vote on project changes while retaining its tradeable value on exchanges. Previously, this privilege was reserved only for the financially elite, but now, thanks to some most fortunate events, it is available to all. It is said that the project has recently received a $100 million investment from the UAE-based Aqua 1 Foundation, though concerns remain regarding potential conflicts of interest—what with Trump’s rather princely windfall of $57.3 million from token sales. How quaint, indeed.

Talos Makes a Move: Acquires Coin Metrics for Over $100M as Crypto Consolidation Rages On

And now, for the latest in a series of acquisitions that may leave some of us shaking our heads, New York-based Talos, a provider of digital asset trading infrastructure, has secured the services of Coin Metrics, a blockchain data firm, for a tidy sum exceeding $100 million. This acquisition marks yet another chapter in the ongoing consolidation wave sweeping through the crypto industry, alongside Stripe’s purchase of the stablecoin company Bridge for a rather princely $1.1 billion. One must wonder how much longer such spending sprees can last.

Talos, founded in 2018 by a group of Wall Street veterans, has grand ambitions of becoming the go-to platform for institutional crypto trading. By acquiring Coin Metrics, it gains access to invaluable data on both on-chain and off-chain activities. Anton Katz, the CEO, claims that the regulatory shift under President Trump has accelerated institutional adoption. How thrilling for all involved, as major financial institutions clamor for comprehensive digital asset infrastructure solutions. What a world, my dear friends!

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Gold Rate Forecast

- Bored Rich Men and Fickle Fortunes: Bitcoin’s Latest Dance with Destiny (and Whales)

- Unlocking the Secrets of Token Launches: A Hilarious Journey into Crypto Madness!

- Brent Oil Forecast

- Will SUI’s Price Chart Unleash a Parabolic Tsunami? 🌪️

- Crypto Chaos: Powell Holds the Keys! 🔑

- Bitgo’s Grand NYSE Waltz: A Tale of Votes, Crypto, and Vanity 🕺💰

- Nigeria’s Crypto Miracle: From Grey List to Glory! 🚀

2025-07-17 06:16