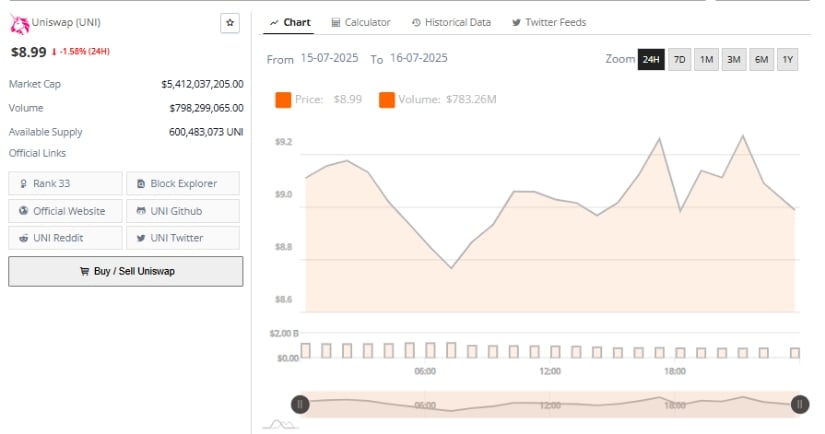

Ah, the great upward journey commenced on the fantastically arbitrary date of July 7, when the universe seemingly decided that something should rise, much like a loaf of bread left too long in the oven. Encountering resistance just past the illustrious $9.50 mark, it paused in a moment that could only be described as existential angst. And now, here we are, with the price nestled comfortably in the vicinity of $9.00, where it appears all the cool kids congregate while pondering the meaning of life—or at least the meaning of UNI trading at $8.97, down by a feeble 1.74%. 🥳

Technical Structure Stubbornly Clings to Support Like a Cat to a Curtain

Now, if we stare long and hard at the 1-hour UNI/USDT chart from that bastion of crypto wisdom called Binance, we see a delightful trend shift forming higher lows before shuffling awkwardly near that oh-so-tempting $9.50 resistance. Following a thrilling peak, UNI decided to play coy in a narrow, indecisive range between $8.90 and $9.30—an encapsulation of the short-term market’s crippling indecision. Would that it could have consulted a life coach! 🤷♂️

In this purgatorial zone, neither buyers nor sellers seem to be winning any prizes, but rest assured, UNI is still above those previous breakout levels, heroically clinging to its existence as if it were the last cookie in the jar.

Buyers, those gallant souls, have consistently swooped down to make their purchases during the dips—particularly if the price dabbles above the sacred threshold of $8.60–$8.80 support. This brave accumulation pattern seems to suggest that unicorns might still fly (or in this case, rise), unless something catastrophic happens like a breakdown beneath such important levels. 🦄

Now, let’s talk about that sparkling $9.30 level, which stands firm as the immediate resistance—so close yet so far! A successful breach could send us dancing blissfully towards the ephemeral $10.00 zone, but let’s not break out the confetti just yet; failure to clear this hurdle may mean even further range-bound frustration or, heaven forbid, a mild correction! 🍾

Momentum and Volume Indicators: More Complicated Than Your Family’s Group Chat

Meanwhile, in a galaxy not so far away, UNI’s trading volume boldly reached $783.26 million over the past 24 hours, with peak trading shenanigans happening somewhere between 12:00 and 18:00—an obvious window where traders were probably caffeinated and fantasizing about becoming instant millionaires. Sadly, as the day wore on, that momentum began to flatline like a boring lecture on paint drying.

With a market cap of $5.41 billion, UNI has snagged a respectable Rank 33 among the grand parade of digital assets, garnishing a trophy for participating in the all-important blockchain Olympics.

In a spectacular synchronicity, global open interest spiked wildly alongside price action, peaking at a curious $89.2 billion before it decided to flatten out at $89.046 billion during this riveting consolidation phase. All signs indicate that leveraged positions are still frolicking about, and the potential for chaos remains on the horizon like an angry cat ready to pounce. 😸

The clever traders keep their eyes peeled for that one pivotal catalyst—a dramatic movement in either direction could cause quite a ruckus and liquidate all the wrong bets. Exciting stuff, if you’re into existential trading crises.

Indicators Support a Constructive Bias: Where It’s Not Always Gloom and Doom

Now, let’s not be too gloomy just yet. Our dear old MACD continues to hang out in bullish territory, sporting a MACD line at 0.496 and a signal line that’s slightly less impressive at 0.345. The histogram, bless its heart, remains positive at 0.151, although the increasingly shorter bars might suggest someone’s been hitting the snooze button a bit too often. 😴

A crossover below the signal line would hint at short-term corrections, yet as long as UNI manages to stay above $8.60, the trajectory continues to look less like a roller coaster and more like a steady plane flight. Fingers crossed!

As for our dear friend, the Relative Strength Index (RSI), it’s currently cozying up at 65.28, comfortably in bullish territory without overstepping its boundaries and throwing a party against overbought conditions. With its constant upward trajectory since June, it seems the RSI has been caught in a pleasant reverie of interest. But beware! Above 70 might indicate it’s time for a little reality check, and as long as it shimmies above the midline, and the MACD doesn’t throw a tantrum, UNI might just tempt fate by revisiting its $9.50–$10.00 resistance zone in the not-too-distant future! 🎢

Read More

- Silver Rate Forecast

- Bored Rich Men and Fickle Fortunes: Bitcoin’s Latest Dance with Destiny (and Whales)

- Gold Rate Forecast

- Unlocking the Secrets of Token Launches: A Hilarious Journey into Crypto Madness!

- El Salvador’s AI Revolution: Nvidia Chips Power National Lab

- Brent Oil Forecast

- Is FLOKI About to Break the Internet? You Won’t Believe What Happens Next! 🚀

- Unmasking the Whale: Ethereum’s Shocking, Witty Crypto Power Move Revealed 😎

- China’s $16 Billion Bitcoin Bonanza: A Comedy of Errors! 💰😂

- Nigeria’s Crypto Miracle: From Grey List to Glory! 🚀

2025-07-16 20:15