Greetings! Here’s your Daily Cryptocurrency Digest – a concise overview of the day’s crucial cryptocurrency updates.

Take a moment to sip on some coffee while you explore the expanding influence of Bitcoin (BTC). According to Max Keiser, this digital currency poses a significant threat to the very roots of established governmental authority.

Crypto News of the Day: Centralized Bitcoin Holdings Under Threat of Government Crackdown

In the chaos as governments struggle to manage the uncontrollable, Max Keiser issues a cautionary statement: Centralized Bitcoins might become the initial focus during a potential surge of digital asset restrictions and clampdowns.

Through a centralized context, the Bitcoin innovator is referring to Bitcoins that are stored within Exchange-Traded Funds (ETFs) and corporate vaults, as highlighted in our latest article from the US Crypto News.

As a crypto investor, I find myself in agreement with Keiser’s comments, echoing Bram Kanstein’s sentiment that Bitcoin treasury companies grasping the essence of BTC are poised to revolutionize finance, much like a powerful force of nature.

By 2035, the startup advisor and mentor referred to these firms as the future titans of Wall Street. He posited that if Bitcoin were to take over Wall Street, it would establish itself as a lasting phenomenon. However, Keiser expressed unease about this scenario.

Is it possible that we’re overlooking an error in reconnecting Bitcoin with government control? After all, isn’t one of the key benefits of Bitcoin to keep money independent from state control? What do you think about this idea?

— Max Keiser (@maxkeiser) July 16, 2025

As an analyst, I’d like to emphasize my concerns about the increasing dependence on centralized custodians for storing Bitcoin, a point I recently made in a conversation with BeInCrypto.

In the course of Bitcoin gradually testing the boundaries of conventional banking systems, Keiser anticipates that a counteraction led by the government is not merely possible, but unavoidable.

The most recent cautionary statement emerges as we witness a surge in the institutional acceptance of Bitcoin. This surge is highlighted by the rapid expansion of U.S.-traded spot ETFs and the accumulation of this cryptocurrency by publicly-traded companies like MicroStrategy, now known as Strategy.

Although it’s boosted demand and influenced price movements, Keiser points out that the Bitcoin held indirectly is still susceptible to potential risks.

As a researcher studying the digital currency landscape, I’ve come to realize that many individuals underestimate the subversive nature of Bitcoin. It poses a significant challenge to central banking systems and national governments by effectively undermining their traditional financial control mechanisms.

Additionally, Kaiser cautions that while Bitcoin offers financial autonomy, those who do not secure control over their assets could potentially lose them completely.

The world is on the verge of shattering into countless independent fragments, but the government may seize any Bitcoins held by intermediaries such as ETF providers, Bitcoin trusts, or custodians,” Keiser stated further.

Why Institutional Bitcoin Holdings Could Trigger a State Crackdown

Keiser posits that the divide is becoming apparent between the advocates of decentralized personal autonomy in finance (DeFi) and those who uphold centralized financial systems (TradFi).

Instead of viewing the continuous acquisition of Bitcoin by companies such as MicroStrategy as merely a passive investment approach, it can be seen as an economic tactic akin to warfare.

According to Keiser, both MSTR and similar entities are aggressively targeting the state and U.S. dollar, which in turn is boosting the value of Bitcoin.

In his opinion, the attack won’t be left without response. Comparable to past government actions restricting gold ownership and financial confidentiality, he foresees regulatory action being taken promptly when sufficient pressure is applied.

As a researcher, I’d like to emphasize that it’s crucial to be aware of potential risks: Authorities may seize control of Bitcoins held by third parties. This means any Bitcoin not under your direct control could be at risk of confiscation. In the blink of an eye, your Bitcoin holdings might vanish as swiftly as the Epstein list.

From my perspective as an analyst, while some see the acceptance of ETFs and institutional investment as indicators of widespread adoption for Bitcoin, Keiser posits that this perspective overlooks the broader geopolitical and ideological consequences of its growing influence.

To have complete control over his Bitcoin, he believes that it’s essential for him to possess it directly, without the involvement of any third parties like intermediaries, custodians, or corporate structures.

Combining Kaiser’s cautions, it becomes clear that the general perception shifts towards the notion that true power resides not so much in possession, but in the ability to exert control, as perceived by the authorities.

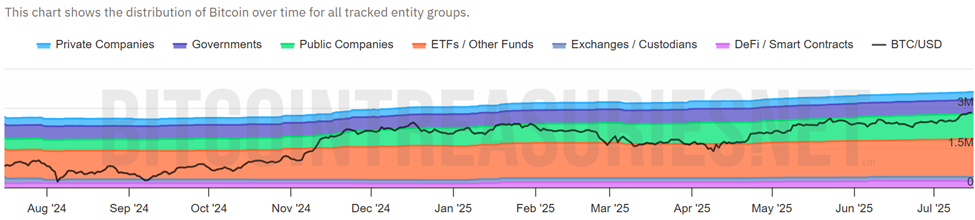

Chart of the Day

Byte-Sized Alpha

Crypto Equities Pre-Market Overview

| Company | At the Close of July 15 | Pre-Market Overview |

| Strategy (MSTR) | $442.31 | $448.88 (+1.49%) |

| Coinbase Global (COIN) | $388.02 | $389.73 (+0.44%) |

| Galaxy Digital Holdings (GLXY) | $20.86 | $21.21 (+1.68%) |

| MARA Holdings (MARA) | $18.76 | $19.22 (+2.45%) |

| Riot Platforms (RIOT) | $12.10 | $12.34 (+1.98%) |

| Core Scientific (CORZ) | $13.76 | $13.80 (+0.29%) |

Read More

- Gold Rate Forecast

- Crypto Riches or Fool’s Gold? 🤑

- Silver Rate Forecast

- Brent Oil Forecast

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

2025-07-16 18:36