As the denizens of the financial world gaze towards a breakout above the fabled $3 mark, the tapestry woven upon the XRP charts reveals a majestic bullish formation, bolstered by both the fickle winds of technicalities and the broader currents of macroeconomic benevolence.

The Stoic $2.93: A Steadfast Beacon in the Sea of Volatility

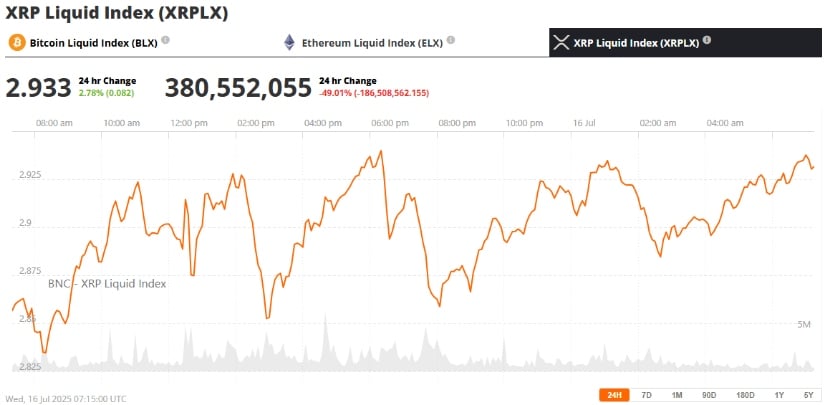

On the 16th of July, in the year of our Lord 2025, the price of XRP ascended with a flourish of 2.51%, landing firmly at $2.93, representing a noble 26% resurgence over the preceding week. Yet, alas! Daily trading volume dwindled by a disheartening 38%, settling just above $7.1 billion. One might expect this dip to herald morose tidings of waning demand, yet the steadfast price action beckons a more intricate narrative beneath.

Today’s XRP tableau suggests an edifice of institutional support counterbalancing the retreat of retail fervor. According to the oracle known as CoinDesk, XRP meandered within a modest range between $2.82 and $2.93, with four valiant attempts to breach the $2.93 citadel on the 15th thwarted. The forces of strategic institutional selling prevailed, whilst tenacious buy-side pressure lingered around the $2.85 realm.

The Dance of Institutional Players and ETF Whispers: A Jolly Rumba

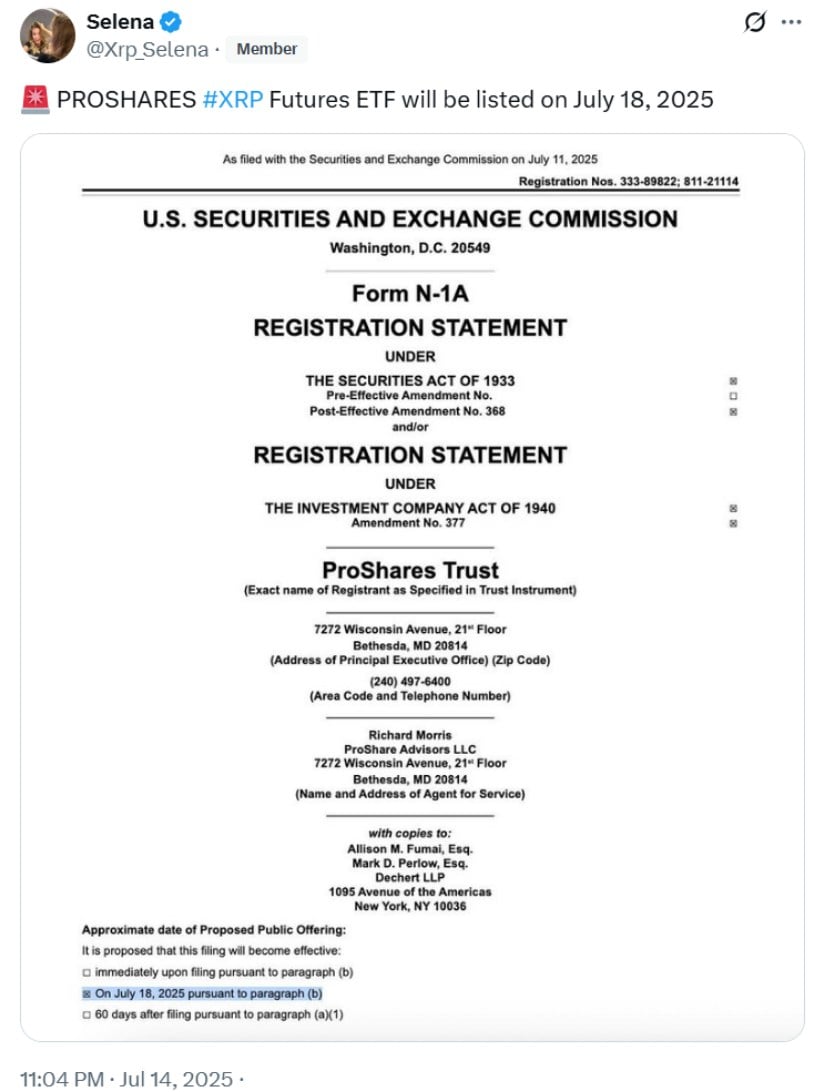

Ah, the sweet music of anticipation swells with the impending arrival of the ProShares XRP Futures ETF on July 18! As excitement escalates, institutional cabals rotate their positions like courtly dancers navigating a narrow ballroom. Treasury desks, those crafty courtiers, have clandestinely amassed XRP between $2.84 and $2.88 with an impressive display of volume, leaving behind the classic footprints of market interest as Tuesday’s trading waltzed into oblivion.

As the frenzy mounts, institutional machinations are afoot, with steady selling pressure lingering near the elusive $2.93 threshold, while wizened traders accumulate XRP with the poise of seasoned chess players around the $2.85 mark. This strategic reallocation hints at cautious optimism, echoing the sentiments of a reserved yet adventurous spirit, biding time until the ETF unfurls its leafy branches.

Gentle Breezes of Macro Trends Fuel XRP’s Noble Quest

Like a soft zephyr lifting a wayward leaf, macroeconomic shifts and the rumblings of political machinations lend buoyancy to the XRP vessel, which sails alongside its digitized comrades. Our dear President Trump, in his most recent foray into the digital realm, proclaimed high-flying glories for tech stocks and cryptocurrencies, beseeching the Federal Reserve to reduce interest rates with uncharacteristic haste due to the elusive specter of inflation.

This directive could unleash torrents of digital enthusiasm, particularly for XRP, whose worth extends beyond mere speculation to serve as an effective global payment tool. Lower interest rates render holding non-yielding assets less burdensome, thus making XRP an intriguing prospect for both the institutional elite and the lay investor.

//bravenewcoin.com/wp-content/uploads/2025/07/Bnc-Jul-16-28.jpg”/>

The ability of XRP to maintain such exalted heights alongside Bitcoin’s soaring achievements underscores a robust undercurrent of buying enthusiasm. Should XRP finally leap above the $2.93 impasse and sustain a close, the psychological allure of $3.00 beckons, paving the way for further gains if the trajectory remains unbroken.

This cheerfully optimistic XRP price prediction aligns closely with the market’s buoyant spirits, predicting that a confirmed breakout could usher XRP’s current stabilization into a triumphant rally, further energized by the anticipated ETF and shifting macroeconomic tides.

The Shadow of Regulatory Uncertainty: A Cautionary Tale

Despite the illuminating prospects, a lingering fog of regulatory ambiguity haunts the XRP narrative. The Ripple versus SEC saga, though fading from the forefront in recent weeks, is yet unresolved and continues to cast a delicate pall over institutional sentiment. Several corporate desks tread carefully, awaiting tidings of clarity in this tumultuous saga.

Yet, glimmers of hope emerge from recent judicial rulings favoring Ripple, igniting optimism among XRP’s aficionados. If the Ripple SEC affair were to achieve definitive resolution, there exists a widespread consciousness that XRP could unlock pathways to higher institutional engagement, broadening its market influence.

Outlook: The Next Chapter in the XRP Epic Beyond the $3 Threshold?

The fabled break above the $3 threshold would not merely signify a technical triumph but would embody a psychological victory for today’s XRP aficionados. With a convergence of supportive fundamentals, noteworthy technical indicators, and the winds of macroeconomic change, the 2025 XRP price prediction stands resplendent, especially if future occurrences, such as the ETF launch, attract a steady influx of capital.

Nevertheless, let us not abandon prudence entirely. Price consolidation and occasional retracements shall surely dance along the path, particularly near the volumes of resistance that loom like ancient fortresses. Yet, as XRP continues to exhibit a formidable structure and cultivate investor confidence, the probabilities favor a rising tide in the horizon.

Whether this second chapter propels XRP to $4 and beyond rests upon the intricate evolution of global monetary policies and the pace at which regulatory clarity takes shape. Meanwhile, XRP remains one of the most scrutinized tokens in the vibrant realm of cryptocurrency, as both fervent bulls and cautious bears await with bated breath for the forthcoming grand escapade.

Read More

- Gold Rate Forecast

- Crypto Riches or Fool’s Gold? 🤑

- Silver Rate Forecast

- Brent Oil Forecast

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

2025-07-16 18:25