Oh, the crypto world has never seen such a deluge of dollars! Last week, the inflows more than tripled, reaching a whopping $3.7 billion by the time the clock struck midnight on July 5. This wasn’t just any old week; it was the second-highest weekly inflow ever recorded, and it’s all thanks to the big boys—yes, the institutions—showing up with their deep pockets and even deeper interest in digital gold.

And if you thought Bitcoin (BTC) was just sitting on its laurels, think again! This digital wonder has been breaking records left and right, hitting all-time highs (ATH) that would make even the most jaded investor sit up and take notice. 🚀

Institutional Demand Surges as Crypto Inflows Soar and Bitcoin Nears Gold Parity

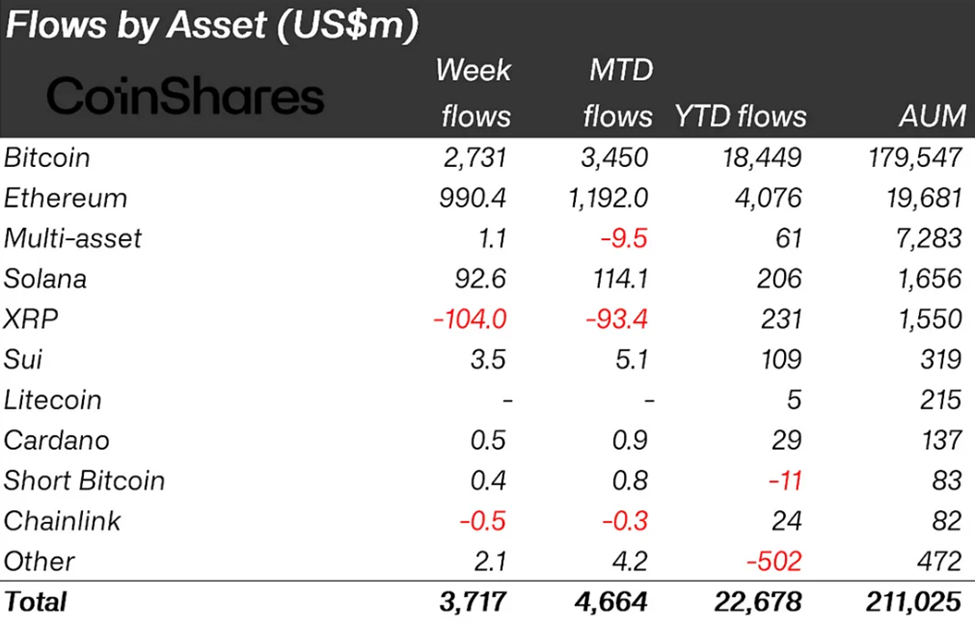

According to the latest CoinShares report, the floodgates opened wide, with $3.7 billion pouring into the crypto ecosystem. This surge pushed the total assets under management (AuM) to a staggering $211 billion, a new all-time high. Can you believe it? We’ve officially broken the $200 billion barrier, and it’s only going to get bigger from here.

James Butterfill, the head of research at CoinShares, couldn’t help but chuckle at the 13-week streak of consecutive inflows. “It’s like a never-ending party,” he quipped, “and the guests just keep bringing more and more cash to the dance floor.” Year-to-date (YTD) inflows have hit $22.7 billion, and the cumulative inflows over the 13-week run have reached a mind-boggling $21.8 billion.

But the real kicker came on July 10, when the third-largest daily inflow in history was recorded. This suggests that the crypto market is not just bullish, but downright euphoric, with investors ready to throw caution to the wind and dive headfirst into the digital asset pool. 🏊♂️

Bitcoin and Ethereum Dominate Inflows

Bitcoin, the granddaddy of cryptocurrencies, led the charge with a staggering $2.7 billion in weekly inflows. This pushed its total AuM to $179.5 billion, which is now a whopping 54% of the total AuM held in gold ETPs. That’s right, folks, Bitcoin is now more than half as valuable as all the gold ETPs combined. Who would’ve thought? 🤔

Short Bitcoin products, on the other hand, saw minimal movement, suggesting that investors are firmly convinced that the price will keep climbing. Meanwhile, Ethereum, the cool kid on the block, posted $990 million in inflows, marking its fourth-largest week on record and its 12th straight week of positive flows. It’s like Ethereum is the new kid at school, and everyone wants to be its friend. 🤝

Ethereum’s performance is a testament to the growing investor preference for this versatile cryptocurrency, especially with the surge in staking and the anticipation of key ecosystem upgrades. Over the past 12 weeks, Ethereum inflows have totaled nearly 19.5% of its total AuM, compared to just 9.8% for Bitcoin. It’s a clear sign that the capital is rotating into ETH at a faster rate than ever before.

Butterfill attributes the growing popularity of US-listed crypto ETPs to improving regulatory clarity and heightened macroeconomic volatility. “It’s like the Wild West, but with a bit more structure,” he mused. “Investors are finally getting the clarity they need to feel comfortable jumping in.”

Not everyone is riding the wave, though. XRP, the underdog of the altcoin world, recorded the largest weekly outflows at $104 million. This could be a sign of declining sentiment, especially with over $1.47 billion in XRP sent to exchanges, suggesting an impending price drop. 📉

The back-to-back billion-dollar weeks are a clear indication that the digital asset market is in full growth mode. With ETP trading volumes doubling this year’s weekly average to $29 billion, the stage is set for even more upside as capital continues to reallocate across crypto asset classes.

So, buckle up, folks, because the crypto rollercoaster is just getting started! 🎢

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Is Onyxcoin’s Rocket Losing Steam or Just Fueling Up? 🚀🧐

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- XRP ETF: Will Crenshaw’s Stubborn Soul Crush Crypto Dreams? 😱

- Ethereum’s Wild Ride: Is It Just Getting Started? 🚀

- Crypto Dinner: Where Politics Meets Meme Coins and Laughter! 😂🍽️

2025-07-14 16:51