In this week of peculiar phenomena and fickle fortune, our dear Ethereum found itself rushing toward the heavens, surging past what mere mortals deigned as a formidable barrier; an intriguing twist as the inflows of exchange-traded funds reached unparalleled heights, while the quantity of coins languishing in the exchanges saw a most dramatic decline. One can’t help but wonder—are we pawns in a cosmic game of speculation? (Insert ominous music here) 🎵

Lo and behold, Ethereum (ETH) leaped to a bewildering high of $3,037—a rise of over 120% from its abysmal nadir earlier this year! It is as if some unseen hand guided it upward, its market capitalization now an illustrious $356 billion, securely cementing its status as the second-largest cryptocurrency, second only to Bitcoin, that old, grumpy lighthouse in a stormy sea of uncertainty.📈

The ever-ambitious Ethereum ETFs continued their relentless pursuit of wealth this week, with an astonishing inflow surpassing the $5 billion threshold. Indeed, they amassed a whopping $907 million just this week, eclipsing the previous week’s simpler trove of $219 million. Ah, investors in America can be whimsical creatures, can’t they? 💸

Yet amidst this veritable feast of financial jubilation, we observed a peculiar paradox; the yearning for ETH grew in tandem with the withdrawal of the coins from exchanges, as if the very act of buying and selling were akin to a tragic love affair. The supply dwindled to a meager 7.35 million, a stark contrast to the blustery heights of over 10.6 million we once witnessed. Who could have imagined this curious interplay? 🤔

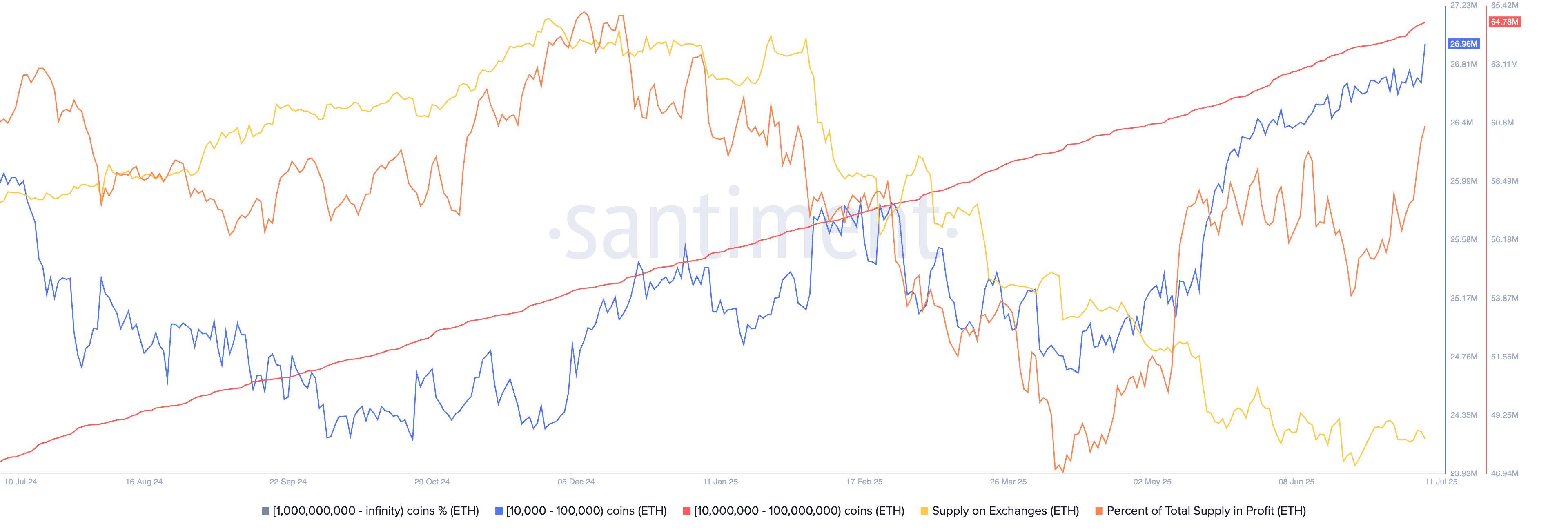

The data revealed another nugget of absurdity—around 80% of Ethereum holders found themselves ensconced in the comforts of profit, the highest since the bitter winter of January. Ah, the whales have awoken from their slumber, and they are not just awake, but ravenous! 🐋

The fortunate recipients of 10,000 to 100,000 ETH coins have increased their booty to a staggering 26 million, while those with the audacity to own between 10 million and 100 million now possess 64.7 million, a veritable feast for the greed-hungry sharks circling the waters of fortune.

But wait, there’s more—like a capitalism-infused infomercial! The price of Ethereum experienced a joyous leap forward after SharpLink, that pedestrian Nasdaq-listed company, decided to acquire 10,000 ETH coins. The audacious investors’ list swelled with other notable figures; companies like BTCS and BitMine Immersion—oh, the names are nearly too rich to fathom!💼

Upon closer inspection, Ethereum’s realm flourished with stablecoins within its domain swelling to a record $130 billion. The adjusted volume? A staggering $573 billion! This ecosystem thrives amongst a sea of paradoxes and profit, oozing with tantalizing hope and nerves aplenty.

Ethereum Price Technical Analysis

Examining the cryptic daily chart, it appears Ethereum painted its own glorious odyssey, breaching the major resistance level at $2,885—its summit since the May debacle—while gallantly scaling the upper rim of a bullish flag pattern. Such audacity! 🔥

In a fleeting moment of clarity, Ethereum brushed past the psychological milestone of $3,000, a revelation akin to a long-lost lover knocking at your door after years in exile. It even soared beyond the 50% Fibonacci Retracement level—a clear signal that the bulls have donned their armor and are ready for battle. 🐂⚔️

As fate would have it, ETH price has formed a golden cross pattern, like a melodramatic novel, as the 50-day and 200-day moving averages kissed one another in a grandiose dance. Might this lead to further gains? Shall we dare to dream of the enchanted $4,000? The stage is set, dear reader, and the audience awaits.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Crypto Riches or Fool’s Gold? 🤑

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Bitcoin Miners’ Revenue Tumbles 11% – Will They Surrender? 🤯

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

2025-07-12 18:10