Insurance serves as one of finance’s fundamental building blocks – an indispensable structure that supports every significant market, ranging from commodities to credit. For centuries, since the 1600s, no flourishing financial environment has existed without a solid insurance framework in place: participants need reliable indicators of risk before investing their capital.

In the initial phase of Decentralized Finance (DeFi), areas such as lending, exchanges, and derivatives were prioritized, with insurance being considered later or not at all in a basic form. As DeFi moves towards its next significant growth point, integrating advanced, institutional-level insurance models will be essential for tapping into vast capital reserves and ensuring lasting robustness.

A Brief History of Risk and Insurance

Insurance has been around for quite some time, with its roots tracing back to the 16th century when Gerolamo Cardano‘s initial studies on games of chance paved the way for probabilistic reasoning. This allowed uncertainty to be expressed mathematically, a concept that would later become fundamental in modern blockchain technology (named after him).

During the 1600s, significant letter exchanges took place between Blaise Pascal and Pierre de Fermat, establishing the practical foundation for the study of probability theory. This shift in understanding transformed what was once considered a mystical concept, chance, into something that could be measured and quantified as a science.

In the 19th century, Carl Friedrich Gauss’s development of the normal distribution provided a systematic method for statisticians to model variations from an average value. This groundbreaking discovery was crucial in advancing the field of actuarial science.

In the early days of the 20th century, Louis Bachelier’s groundbreaking research on the unpredictable movement of asset prices laid the foundation for contemporary quantitative finance. His work has influenced various aspects, including the valuation of options and strategies for managing risk.

In the latter part of that century, Harry Markowitz’s Portfolio Theory redefined diversification by making it a quantifiable process, providing a robust structure for managing risk and returns.

The Black-Scholes-Merton model significantly contributed to the field by offering a practical method for calculating implied volatilities and pricing options, which are essential building blocks in today’s derivative markets.

More recently, pioneers such as Paul Embrechts and Philippe Artzner have significantly expanded risk theory by introducing copula statistical models and coherent risk measures. This advancement allows for a structured approach to accounting for rare, high-impact risks and interconnections between different systems.

Is DeFi Insurable?

Insurance necessitates four fundamental conditions: variety in potential risks, a risk reward that exceeds the cost of capital, expandable sources of capital, and exposures that can be measured. Decentralized Finance (DeFi) undeniably provides quantifiable risks – protocol exploits, manipulated oracles, and governance attacks – but it still faces obstacles in becoming insurable.

Initial endeavors in Decentralized Finance (DeFi) insurance were met with challenges such as insufficient actuarial complexity, unproven financial frameworks, and expensive premiums stemming from the substantial value tied up in the investment opportunities available.

Furthermore, the fast-paced evolution of Decentralized Finance (DeFi) leads to a constantly changing security scenario: weaknesses found in one system rarely correspond directly to those in another, and the pace of coding modifications often surpasses the ability of conventional risk evaluators to keep up.

As a forward-thinking crypto investor, navigating through the dynamic and ever-changing landscape of digital assets, I recognize the need for innovative insurance solutions. These advanced insurance structures should be capable of adapting swiftly to shifting risk landscapes – akin to next-generation architectures that can dynamically adapt to evolving hazard profiles. In simpler terms, we need high-price insurance capital that can flexibly respond to the fluctuating risks inherent in our crypto investments.

The fundamental principle of any insurance system is the expense associated with accumulating capital. Decentralized Finance (DeFi) insurance pools usually take in Ethereum, Bitcoin, or stablecoins, which can generate returns through staking, lending, or liquidity provisions on the blockchain. To entice underwriters, insurers need to provide rates higher than these inherent yields, leading to increased premiums. This situation creates a conundrum known as a “Catch-22”: high premiums may discourage protocol teams, while low capital costs can weaken coverage capacity and solvent reserves.

To overcome this standstill, it would be beneficial for market designers to explore non-traditional funding options. Institutional investors such as pension funds, endowments, and hedge funds have immense reserves of capital that focus on long-term investments. By creating insurance products that align with these investors’ risk-reward thresholds (for example, structured tranches offering potential gains in exchange for assuming first-loss positions), Decentralized Finance (DeFi) insurance structures can maintain a reasonable cost of capital, ensuring both affordability and solvency.

The Law of Large Numbers Fails in DeFi

In simpler terms, Jakob Bernoulli’s law of large numbers is crucial in insurance because as the number of policies increases, the actual losses we experience start to match up with what we expect, making it possible for us to accurately calculate insurance premiums. The mortality tables created by Edmond Halley and Abraham de Moivre are a good example of this principle; they take population statistics and use them to set reliable premium rates.

As a DeFi analyst, I’ve noticed that the young DeFi ecosystem is limited to a finite and sometimes interconnected group of protocols. Incidents like manipulation of multiple protocol oracles can reveal underlying dependencies that contradict our assumption of independence.

Instead of depending only on the amount covered, DeFi insurance should make use of a multi-layered approach: entering into reinsurance contracts with different risk groups, dividing capital into tiers to distribute losses according to their importance, and setting up automatic payouts using parametric triggers that react to blockchain data (like price fluctuations or oracle discrepancies). This structure can mimic the stabilizing effects traditional insurers experience.

Challenges Quantifying DeFi Risk

In the realm of Decentralized Finance (DeFi), quantitative risk modeling is still at an early stage of development. With just a few years’ worth of historical data and vast differences between various smart contract platforms, projecting risk from one platform to another comes with considerable uncertainty. Previous attacks on platforms like Venus, Bancor, or Compound provide valuable forensic insights but have limited predictive power when it comes to identifying potential vulnerabilities in newer protocols such as Aave v3 and Uniswap v4.

Developing strong Decentralized Finance (DeFi) risk structures necessitates a combination of methods: merging on-chain data analysis for continuous monitoring of exposure levels, rigorous examination of smart contract code through formal verification techniques, utilizing oracles to validate external events, and subjecting the system to extensive testing under simulated attack scenarios.

Machine learning models can enhance these techniques – grouping strategies based on programming patterns, transaction activities, or administrative structures – but they need to be cautious about overfitting when dealing with limited data. Sharing anonymized data about vulnerabilities and system failures between risk groups, comprising both protocol teams and insurers, could provide a more substantial basis for future machine learning models.

Toward an Institutional DeFi Insurance Market

In its present size, Decentralized Finance (DeFi) is in need of a trustworthy insurance mechanism. Integrating advanced, scalable insurance systems will not just safeguard funds but also transform potential threats like flash loan attacks, governance vulnerabilities, oracle malfunctions into quantifiable financial risks. By tailoring the design to match institutional risk tolerances, employing diverse risk management strategies, and enhancing mathematical risk analysis, a flourishing DeFi insurance sector could unlock hitherto untapped capital resources.

This kind of ecosystem delivers increased liquidity depth, boosts trust among counterparties, and invites more players such as family offices and sovereign wealth funds, turning Decentralized Finance (DeFi) from an exploratory realm into a crucial pillar in international finance.

This article’s opinions belong to the writer alone; they don’t represent the views of CoinDesk, Inc., its proprietors, or associated entities.

Ether Treasury Firm BTCS Surges 100% on $100M ETH Buying Plan

Tornado Cash Judge Will Not Permit Van Loon Verdict to Be Discussed During Upcoming Trial

U.S. Sanctions North Korean IT Workers Over ‘Cyber Espionage,’ Crypto Thefts

Hedera’s HBAR Rises After Inclusion in Grayscale Fund

FLOKI Explodes 12% on Massive Volume, Potentially Signalling Bullish Momentum

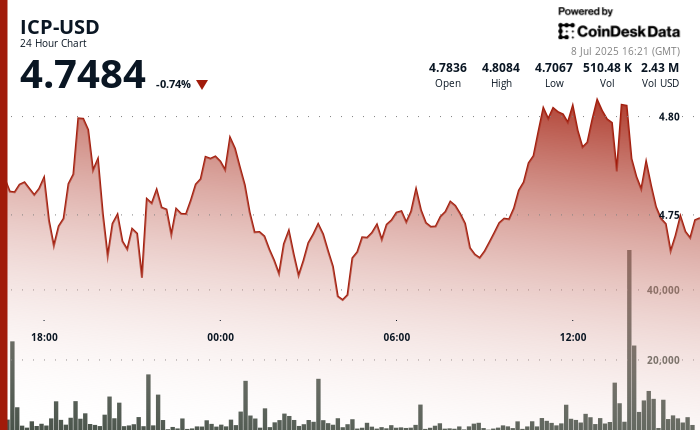

ICP Maintains Bullish Structure Setting $4.72 as a Foundation for Next Move Higher

Ether Treasury Firm BTCS Surges 100% on $100M ETH Buying Plan

Trump-Linked Truth Social Plans Crypto ETF as Digital Asset Franchise Expands

Jack Dorsey Unveils Bitchat: Offline, Encrypted Messaging Inspired by Bitcoin

Metaplanet Wants to Use Bitcoin Holdings for Acquisitions: FT

Bonk.fun Grabs 55% of Solana Token Issuance Share, Pushes BONK Demand

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Gold Rate Forecast

- USD RUB PREDICTION

- EUR UAH PREDICTION

- Brent Oil Forecast

- USD TRY PREDICTION

- EUR USD PREDICTION

- Why Switzerland’s Bank Said “No Thanks” to Bitcoin (And Probably Enjoys Paper Money More)

- When Crypto Meets Caution: South Korea’s Stablecoin Dilemma 🤔💰

2025-07-08 22:41