Well, I’ll be hornswoggled—Solana’s printing money like a Mississippi steamboat captain with a new press, notching up over a billion in application revenue for the second quarter in a row! 🚂💰

The Solana Foundation’s Network Health Report (thicker than a Yale lawyer’s brief and published June 20) reckons this gold rush owes much to some witchery they call “protocol efficiency,” hordes of restless developers, and validator incentives juicier than summer watermelon. If you’re not sure what a validator incentive is, imagine someone bribing you with twenty peach pies just to stand guard on the riverbank.

Solana Becomes the Silliest Cash Cow Blockchain, All Thanks to Meme Coins🐮🤣

Turns out, January 2025 was wilder than a fox in a henhouse, with Solana app revenue tumbling in at $806 million—yes, that’s in one month! Someone fetch me my smelling salts. February lagged behind a touch at $376 million, but combined, that quarter racked up more dollars than the steamboats saw in the whole Gold Rush.

But why all this racket? Meme coins! This newfangled crypto casino has found its calling as the playground for meme coin aficionados. If you’re itching to gamble, meme coin launchers like Pump.fun—no kidding, that’s the real name—are handing out tickets faster than a carnival barker at the tilt-a-whirl.

Throw in political tokens like Trump and Melania memes, and you’ve got yourself a real blockchain hootenanny. User activity (and, I suspect, questionable decision-making) shot through the roof like a Fourth of July firework.

Don’t be fooled—these tokens aren’t just for grins and gripes. They raked in genuine fees, swelling Solana’s GDP faster than you can say “blockchain balderdash.”

All this fee-ruckus means the decentralized exchanges and assorted on-chain mischief have become the network’s new barometer of success. Developers are sticking to Solana like river mud to a boot, eyeing those fat returns and praying the ride never ends. The network’s busy rolling that loot back into infrastructure. (Somewhere, an old railroad tycoon is nodding in admiration.)

Solana Smokes Ethereum by 7,000% in the Great TPS Derby 🚀🐎

As for reeling in developers? Solana’s got more recruits than a Civil War muster call. It topped the leaderboards in 2024, keeping over 3,200 monthly active code-slingers, and growing engagement by 83%—which is just the right amount of suspiciously high.

The network’s steadier than a clock at a watchmaker’s convention, with 100% uptime for 16 whole months—even in the middle of January’s daily trading fiesta, which hit $39 billion (someone, somewhere, is losing sleep over this).

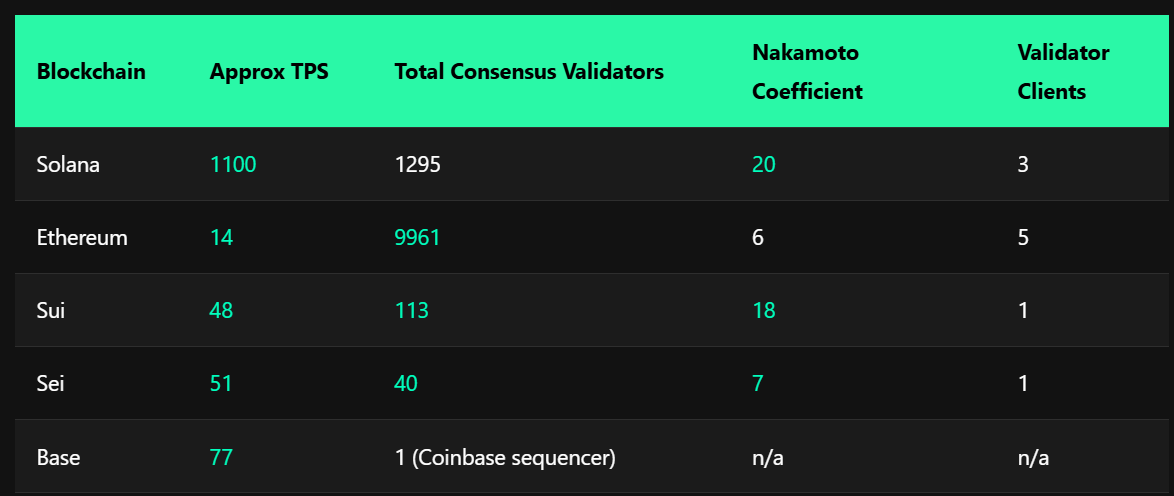

Technical leaps mean relay times are now under 400 milliseconds. Not even Twain’s telegraph could beat that. And Solana’s pushing about 1,100 transactions per second—the blockchain equivalent of a six-horse stagecoach lapping Ethereum’s poor one-mule cart stuck at 14.

Validators, those unsung heroes, are raking in rewards: on January 19, 2025, real economic value clocked in at a mouth-watering $56.9 million. Last year you had to cough up 50,000 SOL just to break even, but these days, 16,000 SOL will do. That’s what I call inflation—except it’s in reverse and nobody’s complaining.

Solana validators are thriving. REV hit an all-time high of $56.9M on January 19, 2025, with quarterly REV now averaging ~$800M.

In three years, breakeven stake has dropped from ~50k SOL (2022) to just 16k SOL (2025).

— Solana (@solana) June 20, 2025

If you ask me, Solana’s pedal-to-the-metal attitude in performance, developer wrangling, and greenback gathering paints a picture of a network refusing to die young. For now, it’s got the biggest hat at the blockchain rodeo—just don’t ask what’s hiding underneath. 🎩💸

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Gold Rate Forecast

- Brent Oil Forecast

- Why Switzerland’s Bank Said “No Thanks” to Bitcoin (And Probably Enjoys Paper Money More)

- Bitcoin’s Wild Ride: $85K or Bust! 🚀📉

- SHIB PREDICTION. SHIB cryptocurrency

- ProShares Dives into XRP Futures ETF: The Countdown Begins! 🚀

- Crypto Dreams Shattered: PI’s $100M Fund Debuts, Token Sinks Below $1 Anyway 😬

- Pakistan’s Hilarious Bitcoin Mining Adventure: Can It Save the Day?

2025-06-21 17:34