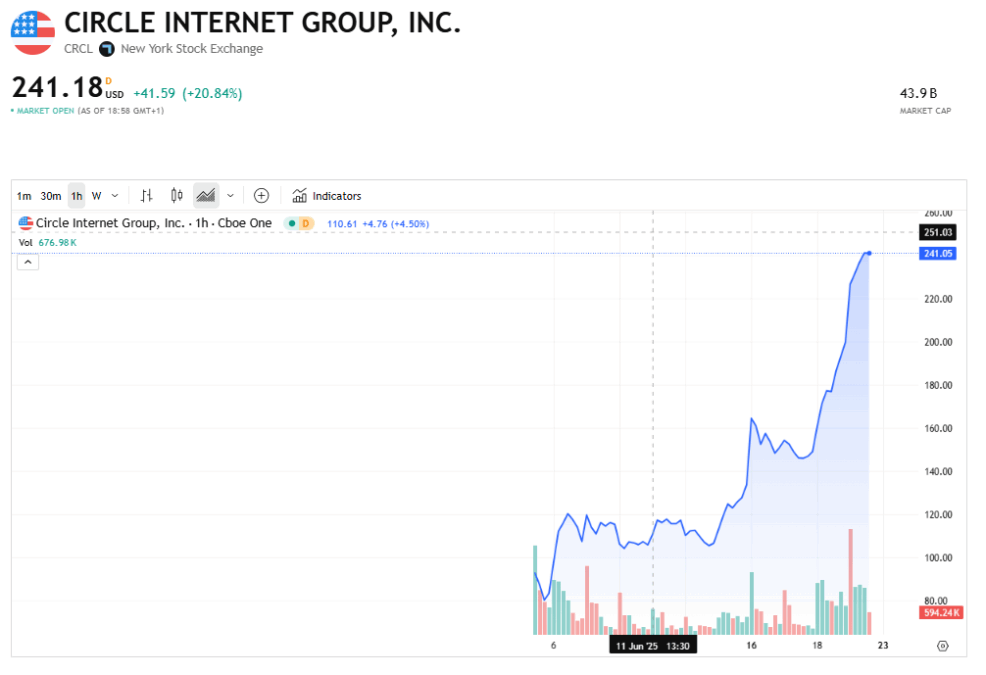

In a turn of events that would make even the most seasoned debutante blush, Circle, pioneer of publicly-traded stablecoin derring-do, found its stock whirling upwards by 20% in daytime frolic, hot on the heels of the U.S. Senate’s rather theatrical approval of the GENIUS Act on a Tuesday so electric even the martinis shook. Picture it: Circle’s somewhat demure share price, languishing at $148, suddenly pirouettes to a show-stopping $227—presumably with a collective gasp from Wall Street and much waving of monogrammed handkerchiefs. That’s a breathtaking 53% leap, darling, all before one could say ‘regulatory compliance’ without yawning.

For those less versed in digital finery, the GENIUS Act promises to wrap the world of stablecoins—those blockchain baubles pegged so loyally to the unglamorous U.S. dollar—in a dazzling array of audits, full reserves, and the kind of anti-money laundering rules that make even Swiss bankers look nervously at their ledgers.

No need to fetch the champagne just yet—our legislative opera hasn’t quite reached its finale. The bill must still tango with the House of Representatives, but one Senate standing ovation has already sent crypto markets into a foxtrot. Circle, thrice-cheered patron of USDC (the second-obvious-to-Tether’s USDT), enjoys seeing its stock waltz to around $241 at curtain call.

Ever the institution with a flair for drama, Circle sashayed onto the New York Stock Exchange this month under “CRCL.” The opening-day spectacle saw prices leap from $31 to $69, closing at $82.23, which means anyone clever enough to buy early is now approximately six times wealthier, probably shopping for gold-plated NFTs and silk smoking jackets as we speak.

Other stablecoins (yes, even the Coinbase) enjoyed a respectable 20% leap, proving that nothing says “market confidence” quite like a piece of legislation no one has actually read. The crypto set view the bill as an all-clear from Washington, with banks and businesses poised at the entrance like eager contestants in a high-stakes ballroom competition.

Circle’s CEO, Jeremy Allaire, quite overcome with excitement, gushed on X (formerly known as Twitter, for those who still send telegrams): “History is being made.” One imagines him dispatching this missive while standing atop a pile of fiat currency, top hat askew, monocle glinting.

On Friday, Seaport Global bestowed Circle with its first ‘buy’ rating, presumably after a champagne breakfast. Analyst Jeff Cantwell, dazzling us with projections, assures the world the stablecoin market could balloon from a paltry $260 billion to a positively vulgar $2 trillion, with Circle raking in $3.5 billion next year. “Top-tier disruptor,” he declared, as if the world hadn’t had enough top-tier disruption already.

And who should weigh in but President Donald Trump himself, urging Congress to promptly usher the bill to his desk—no amendments, no add-ons, just good old-fashioned urgency, like ordering fast food with extra fries. Truly, the theater never ends.

As if this weren’t bedazzling enough, Shopify now offers USDC payments for all its users, and rumor has it that tech titans—Meta, Google, Airbnb, X—are eyeing stablecoins like guests sizing up the last canapé. One can only wonder: if digital money is the future, will we all need better Wi-Fi to spend it? 🥂💸

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Gold Rate Forecast

- Brent Oil Forecast

- Bitcoin’s Wild Ride: $85K or Bust! 🚀📉

- Crypto Chaos Unleashed: Shocking Gains and Ironic Downfalls 😂

- Bitcoin Apocalypse Imminent?! 😱

- Why Switzerland’s Bank Said “No Thanks” to Bitcoin (And Probably Enjoys Paper Money More)

- Crypto Dreams Shattered: PI’s $100M Fund Debuts, Token Sinks Below $1 Anyway 😬

- Ethereum’s Drama: Why ETH Is Dancing, Whales Are Shopping, and Bitcoin Is Jealous 🐋🔥

2025-06-20 22:24