Title: “Japan’s Bitcoin Surge: Public Firms Seek Shelter from Yen’s Woes (And the Madness of Modern Finance)”

Ah, the crypto market! A place where Japanese public companies—those towering, respectable entities like Metaplanet, ANAP, Remixpoint, and Gumi—are suddenly throwing their hats into the volatile ring. It’s as if the world has turned upside down, or perhaps just gone mad. The yen is weak, interest rates are as low as they can get, and investment opportunities? Well, don’t make me laugh.

Japan, once the epitome of economic strength, is now responding in its own unique way, perhaps seeking solace in the cold, hard embrace of Bitcoin. But what other choice do they have? These companies, driven by the whims of an economy that seems to teeter on the brink, are turning to crypto as a way to hedge against the inevitable chaos of the financial world.

The Great Japanese Bitcoin Wave: Public Companies Dabble in Crypto—Who Would’ve Thought?

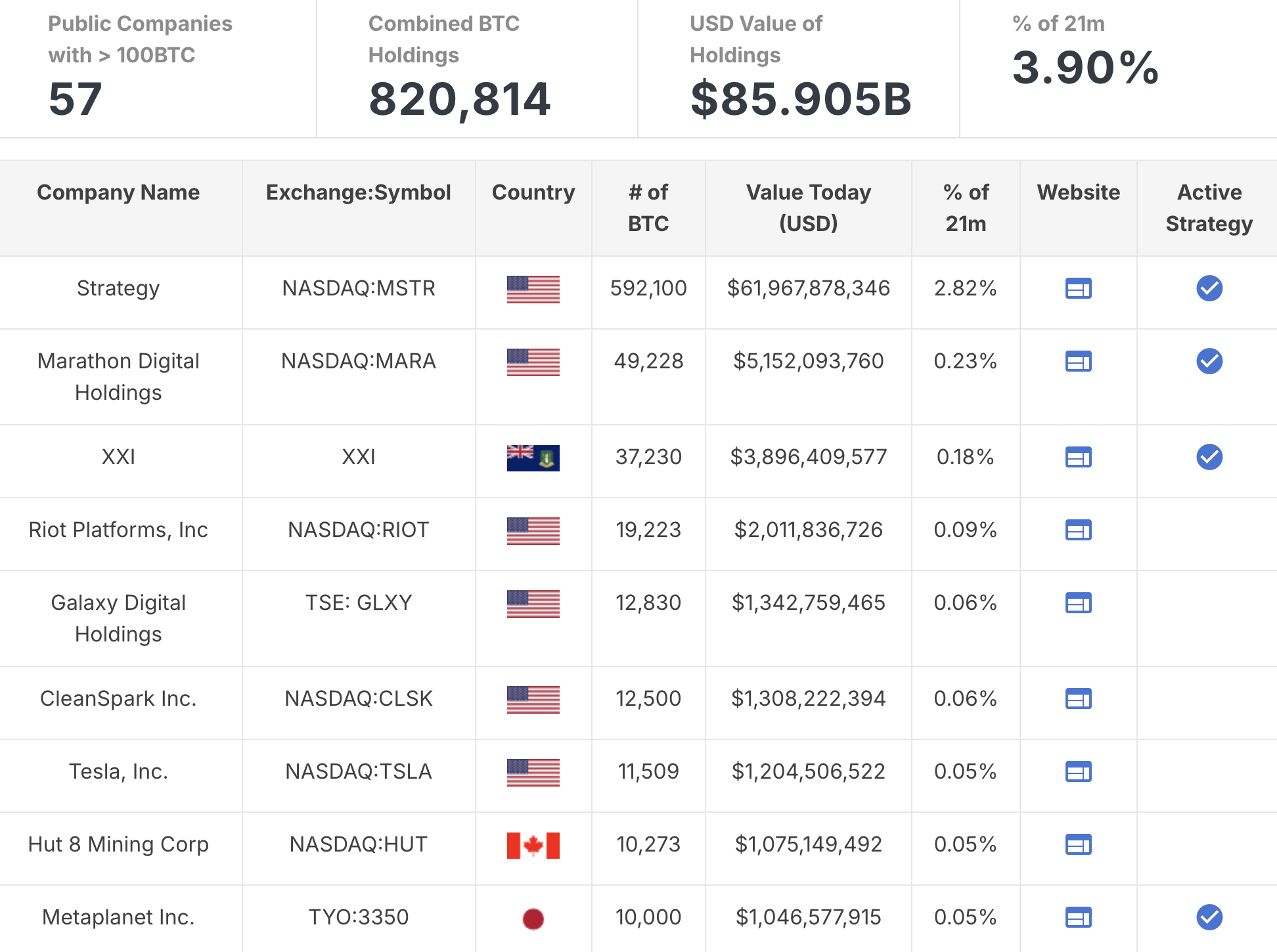

As the data from Bitcoin Magazine shows, Japanese public companies have suddenly found themselves hoarding Bitcoin—more than 820,000 BTC worth over $85 billion to be precise. Strategy, the name that rings through the crypto halls, holds a staggering 592,000 BTC. Yes, you heard that right: nearly 600,000 Bitcoin. Oh, to be Strategy. 🤑

Metaplanet, the so-called “Goliath” of the region, has emerged to challenge Strategy’s dominance, like a younger sibling eager to take the crown. Their stock price has recently danced with joy, thanks to this bold foray into crypto. Meanwhile, Asia watches with bated breath as new players continue to emerge, like fresh sprouts after a storm. Nature, after all, abhors a vacuum.

//beincrypto.com/wp-content/uploads/2025/06/usd-jpy.png”/>

According to the Bank of Japan’s own research (oh, they’ve noticed!), their policy, designed to stimulate the economy, has instead done a fine job of devaluing the yen. With Bitcoin’s inflation-resistant properties, it’s no wonder companies are flocking to it like moths to a flame. 🦋 But I digress—moths may be attracted to light, but these companies are hoping that Bitcoin is their shining beacon of hope in a world gone mad.

Next up is the lack of domestic opportunities for making a quick buck. Oh yes, when government bonds and traditional assets yield next to nothing, where do you turn? The answer, my friend, is crypto, or more specifically, Bitcoin. Just ask MicroStrategy in the US—they’ve been at it for years, hoarding Bitcoin like a dragon hoards gold. And let’s not forget the meteoric rise in stock prices of companies like Metaplanet, proving that investor confidence in this strategy is, if not robust, at least somewhat comforting.

And yet, in the midst of all this chaos, Japan’s legal framework for cryptocurrencies provides a sense of stability—at least on paper. The Financial Services Agency (FSA) has set up regulations that make the whole thing feel *almost* legitimate. KYC? Check. AML? Check. Cryptocurrencies? Not quite legal tender, but recognized nonetheless. It’s a far cry from the draconian measures in other countries, where companies can only dream of such regulatory leniency. But let’s not forget—safe as it may seem, the storm is always just over the horizon.

And then we have the risks—oh, the sweet risks. Bitcoin’s volatility, the constant fluctuation in price, and the whims of global monetary policies. These aren’t exactly things you can rely on for a good night’s sleep. What’s more, the recent decision by the Bank of Japan to finally end its negative interest rate policy may, in the end, turn the entire financial landscape upside down. The future is uncertain, and as always, it’s the companies who are left holding the bag who will feel the burn.

In conclusion, Japan’s embrace of Bitcoin is both a sign of desperation and a nod to the inevitable future. The yen is weak, the opportunities are few, and so, in typical fashion, the nation turns to the digital gold rush. Will it pay off? Or will these companies find themselves buried under a mountain of digital debt? Only time will tell, and let’s face it—what’s the fun of living in the present if you can’t speculate about the future? 😏

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Gold Rate Forecast

- Bored Rich Men and Fickle Fortunes: Bitcoin’s Latest Dance with Destiny (and Whales)

- Unlocking the Secrets of Token Launches: A Hilarious Journey into Crypto Madness!

- Brent Oil Forecast

- ETH Does What Now?! 😱

- Unmasking the Whale: Ethereum’s Shocking, Witty Crypto Power Move Revealed 😎

- Bitcoin’s Next Move Will SHOCK You! $85K or $83K?

- Gary Gensler Throws Shade at Altcoins but Gives Bitcoin a Wink 🚀💼

2025-06-20 11:21