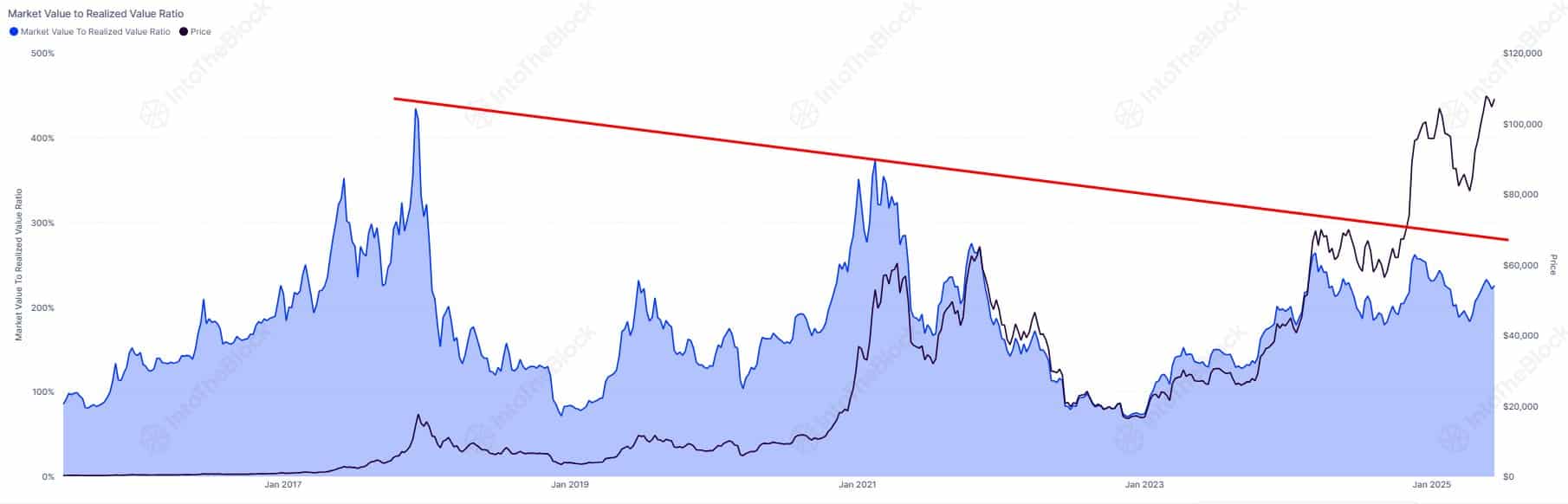

- MVRV at 2.25: in bull market terms, we’re not even through the drinks trolley yet. 🛒

- Exchange outflows up, short-term holders still lounging about—nobody’s leaping for the exit. 🛋️

Bitcoin, that perennial darling of finance and the only thing more unpredictable than Aunt Agatha at the Christmas sherry, continues to saunter above the $104K level. And yet—here’s the shocker, old bean—on-chain signals seem reluctant to cue up the confetti. There’s no trumpet-blaring or parades; more of a discreet nod and a “Let’s not get ahead of ourselves.”

The market is awash with undervaluation statistics, grumpy mutterings from the peanut gallery, and nary a sign of excitable newcomers offloading their precious coins. It’s almost as if the bull run is quietly checking its watch, not quite ready to dash for the train. 🚂

MVRV says: “Sorry, chum, not the top—Don’t pack your bags”

MVRV ratio is lounging at 2.25, yet the Bitcoin price is strutting about at $104K. In previous bull shindigs, higher MVRV was the signal to run for the hills, but this time? The number says, “Keep calm and order another G&T.” Price action looks suspiciously healthy, like a cucumber sandwich in a sea of speculative trifle.

Why all the sour faces, despite Bitcoin busting $100K?

Weighted Sentiment has nosedived to -0.723, which is essentially market speak for everyone standing around muttering, “It’ll never last.” Classic contrarians would argue: when everyone’s bracing for a pie to the face, the real surprise is probably a cake. Negative sentiment often signals that the party’s still got life—few folks are snatching up profits, and the rest look genuinely bewildered to be here at all.

In this comedy of errors, weak resistance means there’s room for another round—waiter, a bottle for the table!

NVT and Puell Multiple: Undervalued or just modest?

If the NVT Golden Cross and Puell Multiple could speak, they’d say, “Don’t mind us, we’re just quietly declining, nothing to see here.” Down 23% and 25% apiece, these metrics indicate nobody on the network is clutching pearls. Miners remain unflustered; on-chain action is positively sedate. In plain English: the soufflé’s still rising, and it’s not powered by froth.

Investors suddenly fond of long walks (i.e., holding)?

Exchange data reveals a 10.72% increase in coins strolling out the door, while incoming ones drop 10.27%. The message? More people are grabbing Bitcoin off the table and heading for the cellar, intent on holding, not pawning Grandma’s silver. This behavior often prefaces a classic supply squeeze, to the delight of devoted HODLers everywhere.

Short-term holders—a study in British reserve

Realized Cap HODL Waves have short-term (0d–1d) enthusiasm at a paltry 0.278. Usually at this point, shorter-term types are all but scaling lampposts in celebration. Instead? Not so much as a squeak. This reluctance to cash out means the market’s robust enough to handle an impromptu Conga—the seasoned hands stay at the helm, eyes on the horizon.

Long liquidations: Will the levee break?

Per Binance’s Liquidation Map, the party’s about to get interesting right under $104K. Drop below and there’s a domino effect of forced sells, the kind that makes traders spill their tea. But wait! Just above, there sits a nest of shorts ready for a singe—should price shoot up, there’s potential for a mighty short squeeze. Markets, it seems, are perched on a wire, and someone’s playing the kazoo.

To summarize, Bitcoin has shattered $100K, earned a polite round of applause, and utterly failed to produce the wild-eyed euphoria we typically expect. Instead, we’re left with mild optimism, holders clutching coins like prized poodles, and a market so reserved it would not look out of place at the Drones Club.

Long-term risk? Sure, but as of now, the ship remains steady, with only leverage and sentiment ready to toss a banana peel in the path. Cheers all round—until the next scene-stealer.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- Brent Oil Forecast

- Bitcoin Beats Amazon! 🍕 The Day Crypto Took Over the World

- Banks Might Actually Need XRP When Sh*t Hits the Fan—CEO Spills Tea

- Silver Rate Forecast

2025-06-18 23:11