Who is today’s champion, reigning tall above the crumbling crypto bazaar? None other than AERO, that spry, obstinate token of Aerodrome—a DEX built not on sand, but on Base. While other coins weep into their decentralized pillowcases, AERO parades with a near-3% rise today, obviously too proud to notice the cryptoverse’s collective hangover. 😏

But what started this upsurge? Ah, blame it on the grown-ups at Coinbase, who, in a fit of inspiration (or perhaps boredom), chose to toss Base chain DEX services into their main app. Suddenly, Aerodrome found the spotlight and began beckoning fresh-faced traders, waving its arms about like a nobleman on payday.

Spot Inflows or “How to Collect $2 Million Without Really Trying”

On June 13, that most unexpectedly generous of exchanges, Coinbase, flung open the doors to Base chain DEX and ushered in Aerodrome. The effect was instantaneous—a small expedition of liquidity marched straight in, led by hopeful investors and the ghost of easy money.

As if possessed by Gogolesque fervor, AERO soared nearly 40% this week. It hardly noticed the carnage in the markets around it, preferring instead to whirl about and shout, “Look at me! I’m the best-performing coin in all of Crypto-land!”

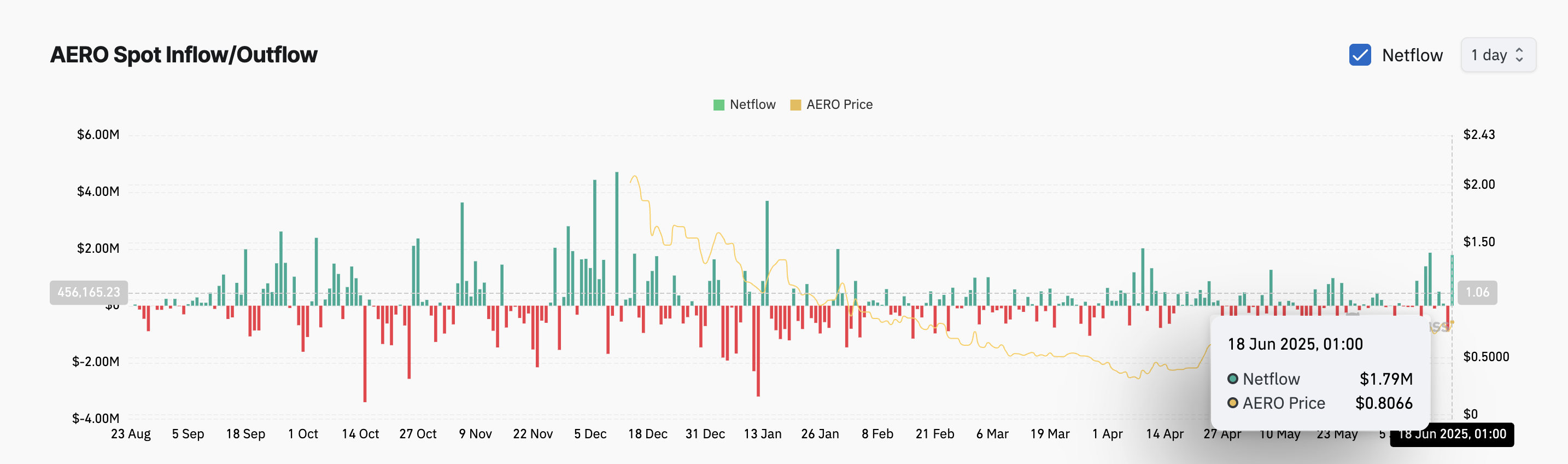

Today, AERO collected a spot inflow of $2 million, an amount that makes one wonder whether it’s actual capital or simply mischievous gremlins at work. (Coinglass swears it’s real, but have you seen those fellows?)

Now, dear reader, you might ask—what does this “spot inflow” nonsense mean? It means more well-intentioned souls are buying AERO on exchanges, perhaps in the hope it will out-soar even their mothers-in-law’s expectations. It is real demand, or so we’re told, filling the AERO market with bullish daydreams and a dollop of bluster. Unlike those derivative phantoms, spot inflows mean someone somewhere parted with their hard-earned fiat—probably while whispering “to the moon.” 🌝

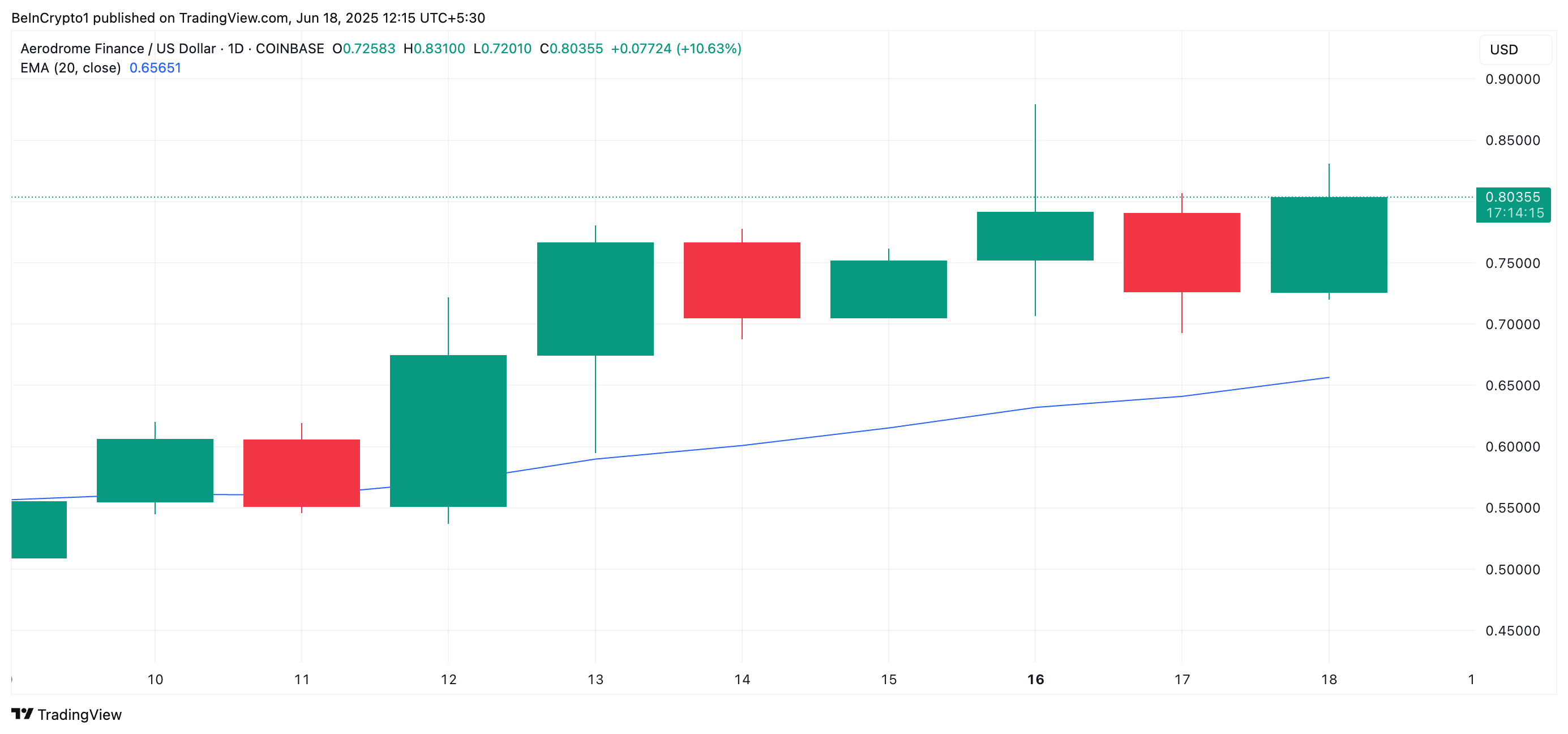

Meanwhile, the one-day AERO/USD chart graciously informed everyone that the coin is trading above its 20-day EMA. In other words, things are looking up—provided you don’t blink and miss it.

For those who measure life by EMAs: When AERO sits jauntily above its 20-day EMA, traders tend to believe in bullish fairy tales. Perhaps buyers are in control, or perhaps the chart is simply in a mischievous mood.

Breakout or Breakdown: Place Your Bets, Comrades!

The rally married AERO to a new love: the $0.76 resistance level, which it has now breached like a bureaucrat sneaking out of the office early on a Friday. If buyers keep their nerve, the next stop is $0.86. Should that too surrender, then perhaps—dear heavens!—$1.06 is not merely a dream. (How February would envy such heights!)

And yet, beneath every rally is a trapdoor. Should the market’s swirling humors turn sour, and sellers descend like tax collectors, AERO could tumble back below $0.76. The optimist will say “buy the dip”; the pessimist, “I told you so.” If things truly degenerate, $0.69 might greet us sooner than polite society would like.

And so the tale of AERO continues—soaring, tumbling, cackling at the discord of the markets while dreams and EMAs swirl in the air. Crypto, it seems, is always at the mercy of fortune… and Coinbase integrations. 🦅📉

Read More

- Silver Rate Forecast

- Unlocking the Secrets of Token Launches: A Hilarious Journey into Crypto Madness!

- Bored Rich Men and Fickle Fortunes: Bitcoin’s Latest Dance with Destiny (and Whales)

- El Salvador’s AI Revolution: Nvidia Chips Power National Lab

- Gold Rate Forecast

- Elon Musk’s Dogecoin Shenanigans: Billionaire’s Meme or Market Mayhem?

- ETH GBP PREDICTION. ETH cryptocurrency

- VET PREDICTION. VET cryptocurrency

- This Sneaky DOGE Support Could Spark A Wild Price Party 🚀🔥

- Bitcoin’s Wild Ride: Why Your Wallet is Crying and Your Gold is Smirking

2025-06-18 13:52