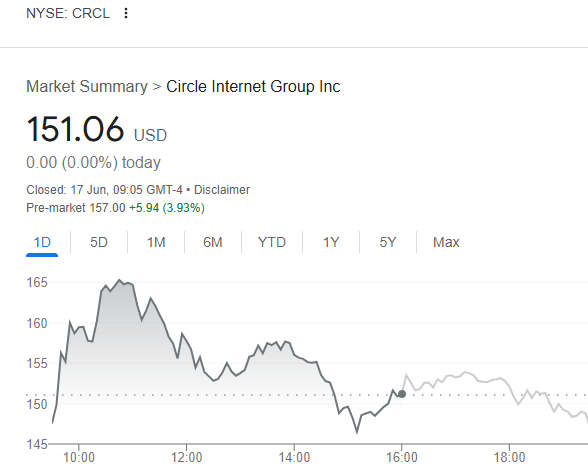

Oh, how the mighty have risen. Circle’s stock (NYSE: CRCL) reached the stratosphere on June 16, soaring to an astronomical $165.60, only to take a slight detour, closing just above $151. That’s a jaw-dropping 500% increase since its Nasdaq debut. But Arthur Hayes, Bitmex’s fearless co-founder, has some sobering words for the starry-eyed crowd. Replicating this performance? Well, good luck with that.

The “Stablecoin Revolution” – Or Is It?

Circle’s stock has become the financial equivalent of a roller coaster on June 16. After hitting a staggering $165.60 – the highest it has ever been – it came back down to earth, closing a little above $151. But hey, don’t let that fool you, that’s still a ridiculous 500% increase from its Nasdaq debut. The kind of success that makes other companies green with envy. Welcome to 2025, ladies and gentlemen, where IPOs don’t just happen – they explode.

This meteoric rise has led to whispers that Circle is merely the first domino in a long line of IPOs from companies eager to cash in on the growing investor interest in stablecoins. Circle’s success is apparently a sign that more stablecoin companies are about to take the plunge. A flood of IPOs? You bet. But let’s not get ahead of ourselves.

Arthur Hayes, who is not exactly known for sugarcoating things, has a rather cynical view on this whole trend. He’s warning the public that while Circle’s incredible surge might have everyone ready to throw their money at anything with “stablecoin” in the name, the next crop of IPOs will be nothing but “Circle copycats” with stocks more overpriced than a luxury yacht in Monaco. These wannabes, according to Hayes, will never catch up to Circle in terms of revenue generation.

The crypto kingpin’s warning comes at a time when the likes of Airbnb, Apple, Google, Meta, and X are all reportedly eyeing the stablecoin business. Can you imagine? Airbnb offering stablecoins for booking your next vacation rental? Meta trying to disrupt the whole system again after their little Libra fiasco? It’s a circus.

Stablecoin Mania – But Who’s Left Holding the Bag?

Don’t forget about the Trump administration, which, for reasons only they know, has been trying to lift regulations that were holding back the digital asset industry. Congress, that ever-cryptic body, is also allegedly working on passing legislation to legitimize stablecoins, which could send even more companies rushing to launch their own coins. So, brace yourselves – the stablecoin floodgates are about to open.

But Hayes isn’t buying it. He doesn’t think another stablecoin issuer will ever see a stock valuation quite like Circle’s – though that won’t stop copycats from trying. They’ll promise the moon, throw in some meaningless traditional finance (TradFi) credentials, and try to convince investors they’re the ones who’ll finally dethrone the legacy banks. Yeah, sure.

Hayes even goes as far as to say that the upcoming legislation could open the door for these “copycats” to create some sort of algorithmic stablecoin Ponzi scheme. But here’s the kicker: Hayes is warning investors not to short these stocks, because – get this – they’ll likely rip your face off. Both the macro and micro factors are aligned, so you’d better watch out if you’re thinking of betting against them.

“You’ve been warned,” Hayes quips. “Don’t go short. These stocks are going to crush you.”

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Bored Rich Men and Fickle Fortunes: Bitcoin’s Latest Dance with Destiny (and Whales)

- El Salvador’s AI Revolution: Nvidia Chips Power National Lab

- Unlocking the Secrets of Token Launches: A Hilarious Journey into Crypto Madness!

- Can Bitcoin Buck the Bear or Is It Just Playing Dress-Up at $87.5K? 🐻🤡

- Brent Oil Forecast

- JPY KRW PREDICTION

- Elon Musk’s Dogecoin Shenanigans: Billionaire’s Meme or Market Mayhem?

- Dogecoin to the Moon? 🚀

2025-06-18 10:59