Bitcoin exchange-traded funds (ETFs) have, with the grace of a seasoned ballerina, pirouetted into their fifth consecutive day of inflows, amassing a robust $302 million. Meanwhile, the ether ETFs, after a dazzling 19-day run, have stumbled slightly, experiencing a minor $2.18 million outflow. 🎶

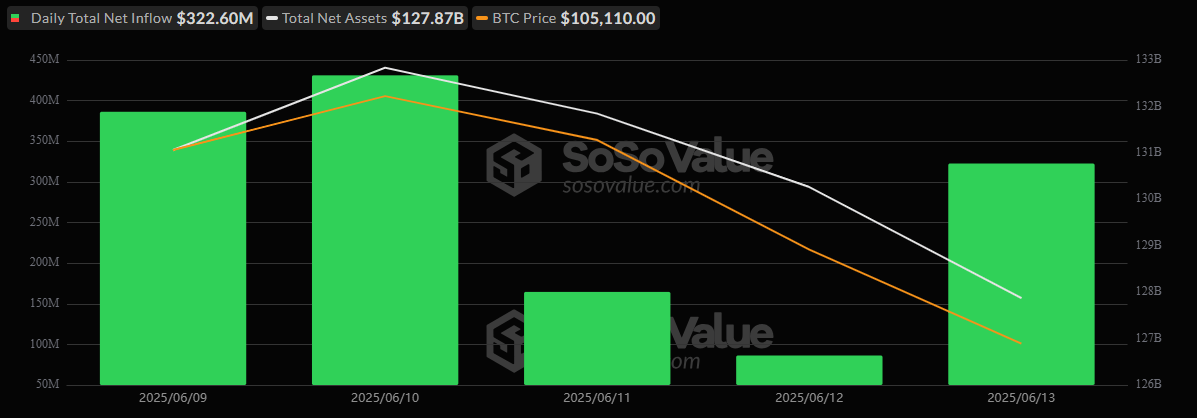

The week of June 9 to June 13 concluded with a flourish, as bitcoin ETF investors, with the precision of a Swiss watchmaker, added $301.62 million to the coffers, a testament to the renewed institutional confidence in the digital sovereign. 🕰️

The day, much like a grand opera, was dominated by Blackrock’s IBIT, which, in a performance worthy of a standing ovation, attracted an impressive $238.99 million. Fidelity’s FBTC, not to be outdone, added a respectable $25.24 million, while Bitwise’s BITB and Grayscale’s GBTC contributed $14.88 million and $9.11 million, respectively, each note in the symphony of success. 🎵

Smaller but no less significant contributions came from Grayscale’s Bitcoin Mini Trust ($7.45 million) and Vaneck’s HODL ($5.95 million), rounding off a day that was, in every sense, a green one. Notably, no bitcoin ETF recorded outflows, a fact that would have made even the most stoic of investors crack a smile. Total value traded hit $3.12 billion, with net assets settling at $127.96 billion, a figure that would make a king blush. 🏦

However, the ether ETFs, much like a character in a Russian novel, experienced a moment of introspection. Their 19-day historic inflow streak, a period of unbridled optimism, came to a close with a modest $2.18 million net outflow, a slight frown on an otherwise radiant face. 🤔

Grayscale’s Ether Mini Trust, in a bittersweet turn, brought in $6.67 million, but this was overshadowed by an $8.85 million outflow from Fidelity’s FETH, tipping the net balance into the red. Total value traded for ether ETFs remained elevated at $548.63 million, while net assets held firm at $10.03 billion, a reminder that even in the world of finance, there are no guarantees. 📈

As the crypto ETF market resumes in the new week, bitcoin remains the clear institutional favorite, a role it plays with the elegance of a seasoned actor, while ether, after a period of unbridled enthusiasm, takes a slight pause, perhaps to catch its breath. 🌟

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Gold Rate Forecast

- Brent Oil Forecast

- Bitcoin’s Wild Ride: $85K or Bust! 🚀📉

- Pakistan’s Hilarious Bitcoin Mining Adventure: Can It Save the Day?

- Is FLOKI About to Break the Internet? You Won’t Believe What Happens Next! 🚀

- Why Bitcoin Will Soon Be the Price of Your Childhood Dream and More

- Crypto Chaos Unleashed: Shocking Gains and Ironic Downfalls 😂

- Crypto Chaos: Powell Holds the Keys! 🔑

2025-06-16 19:29