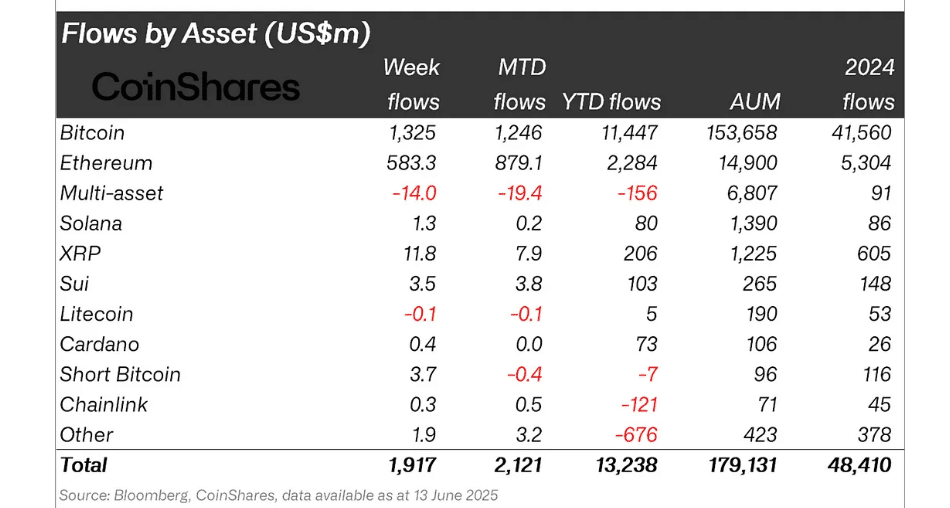

On the trembling stage of world affairs, while sabres clatter and diplomats gnash their teeth, the cryptic river of finance surges onward. Last week alone, cryptocurrency vessels—ETFs and all their leveraged brethren—saw $1.9 billion flood into their hulls. Yes, once more, the tide rose for the ninth week running, carrying the year’s sum to a staggering $13.2 billion. ($179 billion in digital dreams, if anyone’s counting.)

From the autumn haze, Bitcoin stands first, collecting more than $1.3 billion as though it were overdue rent. Ethereum follows, sturdy and silent, carrying $583.3 million upon its shoulders—although one can’t shake the feeling it’s silently judging everyone. Third in this mad parade is XRP, hoisting $11.8 million and possibly wondering if everyone forgot its invitation until the last minute.

The whisper in marble corridors is clear: old finance, the creaking carriages of Wall Street, now find cryptocurrencies irresistible. Diversification or desperation? History alone will snicker at their intentions.

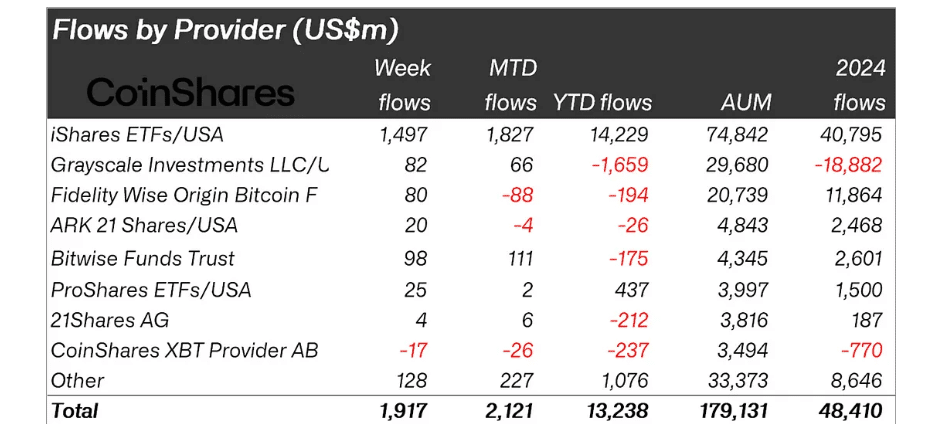

BlackRock’s ETFs in the U.S. stride like colossi, accounting for nearly 70% of all inflows—leaving others (Grayscale, Fidelity, ARK 21 Shares, Bitwise, and the merry band) to sweep up the crumbs. At family dinners, they tell tales of their 2% contribution and pray for a growth spurt.

Meanwhile, iShares IBIT, that beast of Bitcoin ETFs—launched with Coinbase—has devoured $70 billion faster than you can say “conventional wisdom.” (Wall Street, eat your heart out… Or, in this case, your hat.)

James Butterfill, who must endure being Head of Research at CoinShares, observed, “Despite geopolitical drama, digital assets attracted inflows alongside gold.” Gold only barely managed to keep its cool—after all these years as king, dethroned by pixelated coins.

institutional investors have taken to digital assets like moths to a blockchain. This market, so fattened by ETF feasting, owes less to frenzied retail mobs and more to suits searching desperately for something new to believe in—preferably something decimalized and unpronounceable. 🥂

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Gold Rate Forecast

- SUI ETF? Oh, the Drama! 🤑

- Brent Oil Forecast

- Cryptocurrency Moonshot? Mantle’s 35% Surge Will Make Your Head Spin! 🚀💸

- USD MXN PREDICTION

- Crypto’s Dandy Escape: Band-Aids and Banter for the Currency Conundrum 😏

- Bitcoin’s Wild Ride: $85K or Bust! 🚀📉

- When Crypto Meets Caution: South Korea’s Stablecoin Dilemma 🤔💰

2025-06-16 13:57