In the bustling world of Ethereum, where fortunes are made and lost with the swiftness of a gentleman’s nod, the past month has seen a peculiar dance of wealth. The grand estates of the digital realm, those vast wallets holding more Ether than one could count, have been quietly amassing their treasures, while the smaller, more modest holdings of the retail traders have been hastily cashing out. The network, much like a ballroom, has seen its fair share of chaos, yet the nobility of the crypto world have not been deterred in their pursuit of more.

The Nobility and Their Expanding Estates

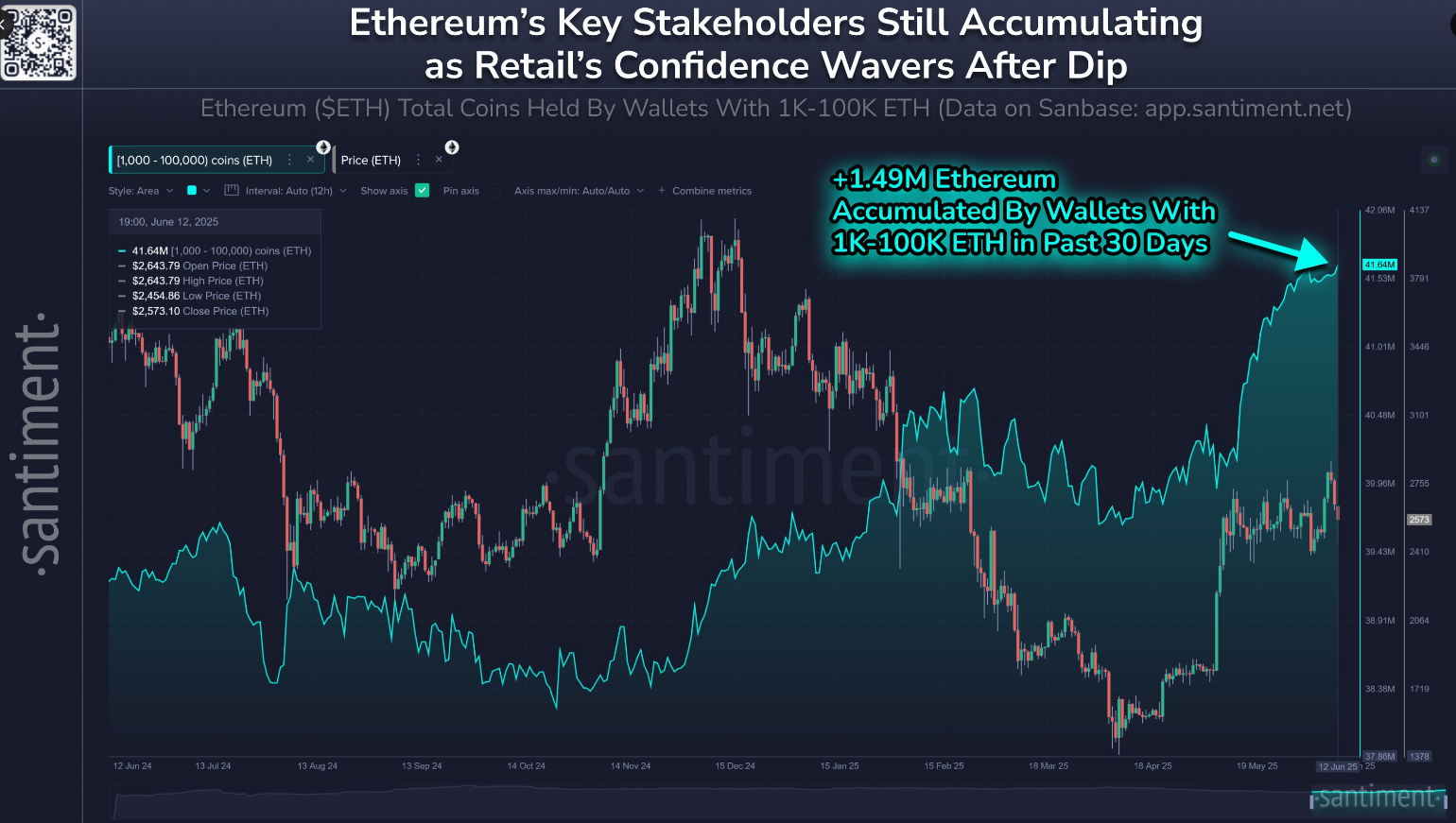

According to the esteemed analysts at Santiment, the wallets of the aristocracy, those holding between 1,000 and 100,000 ETH, have seen a net increase of nearly 1.5 million ETH over the last 30 days. This impressive accumulation represents a 3.70% rise in their combined holdings, a testament to their unwavering belief in the value of Ethereum, even as the market remains in a state of indecision.

These noble accounts now control over 41 million ETH, a staggering quarter of all Ether in circulation. It is a clear indication that the grandees of the crypto world see the current market conditions as an opportunity to expand their estates, much to the chagrin of the retail traders who have taken their modest profits and fled the scene.

There are currently 6,392 wallets holding between 1K and 100K Ethereum. Over the past month alone, these key whale and shark wallets have rapidly added more coins as retail traders have taken profit.

During these past 30 days, a net of +1.49M more $ETH has been accumulated by…

— Santiment (@santimentfeed) June 13, 2025

The Market’s Muted Waltz

Ethereum’s price, much like a lady at a ball who is not quite the belle of the evening, has been rather subdued. According to the reports from CoinGecko, Ether has risen by a modest 5% in the last 14 days and 5.4% over the past month. It currently trades around $2,625, a far cry from its all-time high. The market’s lack of enthusiasm suggests that neither buyers nor sellers are fully committed, yet the nobility continues to accumulate, waiting for the next grand event to spark a new wave of interest.

The Rise of Layer 2 and Beyond

On-chain data reveals that the nobility is not merely content with hoarding Ether; they are also directing their attention to more sophisticated services. The transaction volume in the Ethereum Name Service has surged by over 300% in the second week of July, while lending protocols on Ethereum have seen a more than 200% increase. Transfers of USDC on layer 2 networks—Base, Arbitrum, and Optimism—have all posted triple-digit gains. These figures suggest a growing interest in the use of scaling layers and services beyond the simple act of trading.

Institutional interest, much like a well-heeled suitor, has been strong. US spot Ether products have seen inflows for 19 consecutive days, bringing in a total of $1.37 billion, with the majority flowing into BlackRock’s iShares Ethereum Trust. Even on the day the streak ended, the funds recorded only a modest $2 million in outflows, a minor setback in what has been a robust courtship of Ether by large financial firms.

While the grand estates continue to expand their holdings, the smaller traders are content to lock in their gains. Network activity on services and layer 2s is surging, and institutions are still pouring fresh capital into Ethereum via ETFs. For now, Ether remains in a tight range, but when the right catalyst presents itself, the quiet accumulation of coins in the grand wallets could very well tip the scales in favor of a bullish trend.

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Gold Rate Forecast

- The Hilarious Collapse of Floki: Can It Bounce Back or Just Keep Drooling?

- Brent Oil Forecast

- Why Bitcoin Will Soon Be the Price of Your Childhood Dream and More

- Wallet Wars! TRON, $100 Million, and the Blockchain Blacklist Brouhaha 🤡

- Is Jack Ma’s Alibaba Secretly Betting Big on Ethereum? Find Out! 🚀

- Bitcoin’s Wild Ride: $85K or Bust! 🚀📉

- Bitcoin Apocalypse Imminent?! 😱

2025-06-16 13:38