What to Know (Before You FOMO in):

- Ether’s implied volatility shot up faster than your favorite meme—big swings incoming! 🚀💥

- Institutions aren’t just watching—they’re throwing money at ETH like it’s the jackpot. $812 million in two weeks! 💸

- Traders prefer ETH call options, betting on more upside—because who doesn’t love a good gamble? 🎲

Ethereum‘s ether—once lurking shyly behind Bitcoin’s giant shadow—has now decided to strut into the spotlight, probably flashing a digital grin.

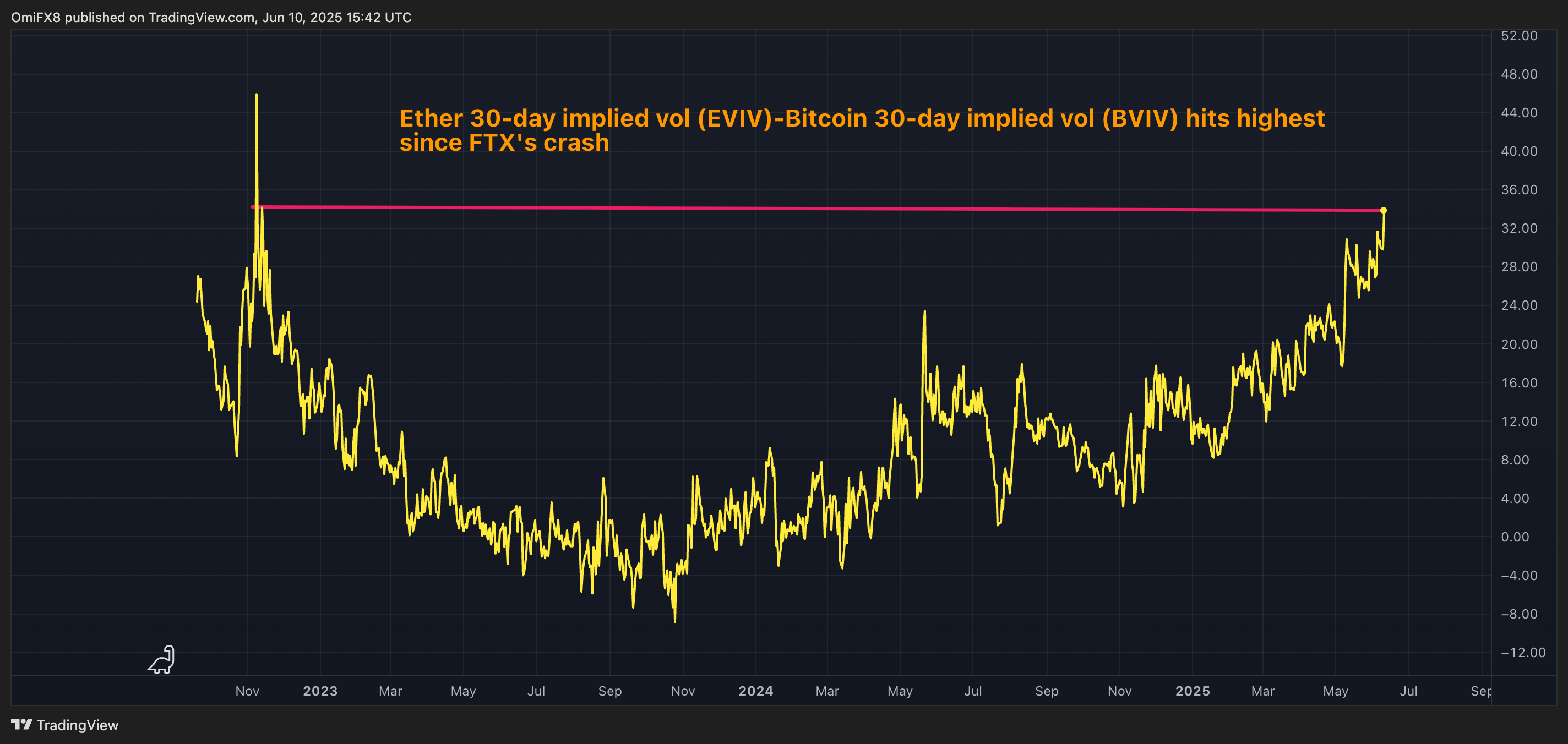

Data from TradingView reveals that the spread between Volmex’s annualized 30-day ether implied volatility (EVIV) and bitcoin’s (BVIV) has skyrocketed to 34%, the highest since that glorious November 2022, when FTX went *poof* and billions evaporated faster than your paycheck.

This widening gap screams only one thing: more wild swings are coming, like a rollercoaster that’s had one too many energy drinks. The crypto market’s mood, it seems, is a remix of “don’t trust, just FOMO.”

Recently, Ether has outperformed Bitcoin, climbing 8% in a day to $2,728—making the king of crypto look like a little prince. Meanwhile, Bitcoin only nudged up 1%. CoinDesk data confirms Ether’s new party vibe—forget passive, it’s all about that upward rush.

“Ethereum is pumping up with new money,” said Alex Kuptsikevich, market analyst. “In two weeks, ETH ETFs soaked up $812 million—biggest splash of the year so far.”  While Bitcoin ETFs could only manage less than $400 million, ETH’s got the glow—talk about a crypto Cinderella story.

While Bitcoin ETFs could only manage less than $400 million, ETH’s got the glow—talk about a crypto Cinderella story.

And according to Singapore’s QCP, the stars are aligning for Ethereum. Think: US Senate’s GENIUS Act (no, it’s not a comic book), Circle’s IPO dreams (fancy paper, anyone?), and stablecoins dancing through regulators’ hoops. All good signs for Ethereum becoming the blockchain superstar.

Options markets also show love—ETH calls cost more than puts, trading at a 2-3% premium for March 2027, while Bitcoin options hum a modest 0.5-1.5% tune. Traders are betting big on Ether’s uptrend—because who wants safety when you can ride the volatility wave? 🌊

In the words of Block Scholes: “ETH options markets are on fire—30-day call-skew hit 6.24% and funding rates spiked to 0.009%. Volatility’s back in style!” And the market’s just getting warmed up. 🔥

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Brent Oil Forecast

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

- Silver Rate Forecast

- Banks Might Actually Need XRP When Sh*t Hits the Fan—CEO Spills Tea

2025-06-10 20:22