Well now, after a raucous hullabaloo in Congress, the GENIUS Act is teetering on the edge of becoming law. This bill, which aims to wrangle the wild stallion that is the stablecoin industry across our fair land, is expected to be signed faster than a cat can lick its ear.

According to the fine folks at the Digital Chamber, a D.C.-based group that advocates for the blockchain industry (and probably has a few poker games on the side), the bill’s approval is likely to come before the end of June. This would be a boon for institutional adoption and might just give the US dollar a shot in the arm, making it the belle of the global ball once again. 💃

When Will the GENIUS Act Pass?

With all the pomp and circumstance, the GENIUS Act is ready to strut its stuff as a landmark bill that would federally regulate the US stablecoin industry. It’s like a new sheriff coming to town, but with less gunfights and more paperwork.

Despite the recent squabbles between the Republican and Democratic Senators (who seem to argue like cats and dogs), the bill has passed a key procedural vote. Kristopher Klaich, the Policy Director at The Digital Chamber, is as confident as a rooster in a henhouse about its impending approval.

“I feel pretty strongly that there won’t be more hiccups… I think the industry has been such a strong player in politics for the last couple of years and supporting campaigns… there’s a high cost for members that may be the stick in the mud,” he told BeInCrypto, probably while sipping on a mint julep.

According to Taylor Barr, the advocacy group’s Government Affairs and PAC Manager, a whopping 53 amendments have been made. That’s more amendments than a cat has lives!

“Majority leader Thune is committed to having what he’s calling a fully open amendment process, which means every single amendment has the full right to go through a debate vote and to have full closure on each amendment. So at the end of the day, that could be a three-week-long process,” Barr told BeInCrypto, likely while rolling his eyes.

However, Barr clarified that a fully open process with 53 individual debates is about as likely as finding a needle in a haystack. He expects these amendments to be divided into three or four groups, which should make things a tad more efficient, given that many are just rehashes of old ideas.

If Barr’s estimations are correct, the bill will pass before the end of this month. When it does, it’ll be a big deal for the greater crypto industry, like a dog finding a bone.

Understanding Stablecoin Impact

Stablecoins are arguably the most globally adopted digital asset. Unlike traditional cryptocurrencies like Bitcoin or altcoins, they provide worldwide access to a stable medium of exchange. It’s like having a dollar that doesn’t run away from you!

According to a January report by crypto exchange CEX.io, the total stablecoin transaction volume reached a staggering 27.6 trillion in 2024, surpassing Visa’s total payment volume and Mastercard’s by 7.7%. Talk about a financial heavyweight!

Tether and Circle are the big dogs in this yard, with market caps of $151 billion and $59 billion, respectively. Together, they hold an impressive 89% market share, according to rwa.xyz. 🐶

Their heavyweight presence in global economies makes a bill like the GENIUS Act all the more significant, especially when the US dollar is feeling a bit under the weather.

The Dollar’s Waning Influence

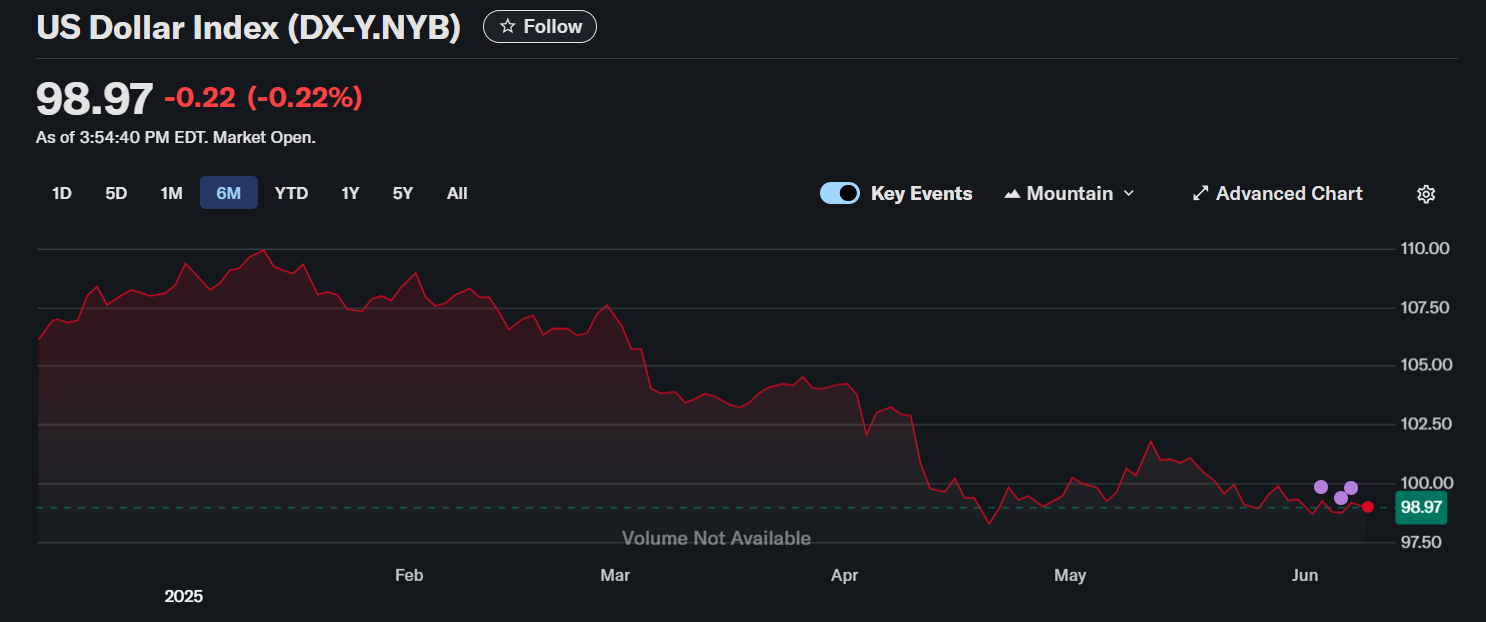

The US dollar started the year about as strong as a wet noodle. Just two days ago, the US Dollar Index (DXY)—a key measure heavily influenced by the euro—fell nearly 9% to just under 99. It’s the weakest calendar year opening since at least the mid-1980s. Yikes!

Faced with this data, along with ongoing trade uncertainties and recession fears, investors are fundamentally re-evaluating the dollar’s role in their portfolios. It’s like a game of musical chairs, and the music just stopped.

This situation, along with broader de-dollarization efforts by major US debt holders like China and Japan, intensifies concerns about the dollar’s future. 🥴

Data from Ark Invest illustrates this shift. In 2011, these three nations held 23% of the $10.1 trillion in outstanding US Treasury debt. By November 2024, despite the total outstanding US Treasury debt rising to $36 trillion, their combined holdings had dropped significantly to approximately 6%. That’s a drop faster than a hot potato!

This substantial decrease in holdings by key foreign creditors highlights growing worries about the dollar’s long-term stability and the United States’ ability to refinance its massive debt.

“Dollars are the world reserve currency. Demand for dollars has waned at the sovereign level. Over recent years, the largest purchasers of treasuries are cutting their holdings of treasuries. That is not a good situation for the United States as they try to refinance,” Klaich said, probably shaking his head in disbelief.

Klaich added that legislation like the GENIUS Act is crucial:

“In my mind, there’s very little more important than the stablecoin bill being passed from a macroeconomic perspective… If demand for dollars diminishes at the sovereign level, structurally speaking, if that is or can be replaced by demand at a retail individual level, that is a huge boon to the US government.”

The data behind Klaich’s statements seems to back his analysis, like a good pair of boots in a muddy field.

What Role Will Stablecoins Play in Future US Debt Demand?

The stablecoin market is poised for significant growth. According to an April report from Citigroup, the total stablecoin supply could reach $1.6 trillion by 2030. This growth could create a demand for US debt comparable to the historical levels supported by sovereign nations. Now that’s a tall tale worth telling!

The GENIUS Act could facilitate this transition, like a good map in a treasure hunt.

“Hopefully, when it passes, demand for stablecoins will explode because there are many companies and banks that are planning to introduce stablecoins that will provide the rails for them to operate at a consumer and business level. So the efficiencies companies and individuals realize will help push that,” Klaich explained, likely with a twinkle in his eye.

By serving areas and people neglected or undermined by traditional banking systems, stablecoins could also help counterbalance the global de-dollarization movement. It’s like giving a lifeline to a drowning sailor.

“It allows anybody in the world to access US dollars. What that affords the US from an economic warfare standpoint is significant,” Klaich added, probably feeling like a general preparing for battle.

With persistent inflation risks, the Federal Reserve is unlikely to buy back significant amounts of US treasuries. Therefore, encouraging stablecoin use allows this market to effectively replace currently ineffective financial mechanisms. It’s like finding a new way to skin a cat.

Amendments to the Bill

If the GENIUS Act is implemented correctly, the stablecoin industry could become a valuable financial tool for the US government to ensure long-term support for the US dollar. It’s like having a trusty steed in a race.

The bill underwent a difficult revision process. According to Barr, the process was tedious and politically challenging, like trying to herd cats.

“If you look at all of the progress we’ve made, we’ve worked on this for three Congresses now. We’ve worked on this [through] multiple different leaderships– minority, majority split. So we’re so close. We’ve done all this progress so we can see the finish line. We’re going to get there,” he said, probably with a sigh of relief.

However, multiple revisions were a prerequisite for its passage to ensure the bill responsibly addressed consumer protection, national security, and market integrity issues. It’s like making sure the ship is seaworthy before setting sail.

Klaich noted that these critical concerns were addressed fairly in the legislative process. He emphasized that recent versions of the bill effectively integrated these revisions.

“None of those issues are existential, and they’ve been negotiated into the latest version of the bill that’s being considered right now. I think the changes that have been made are reasonable and acceptable,” he said, likely feeling a sense of accomplishment.

The future will reveal if the bill passes and achieves its desired effect in helping the US overcome its complicated economic reality. It’s a waiting game, folks, and we’re all just players in this grand theater of life.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- USD THB PREDICTION

- You Won’t Believe How $3B in Real Estate Is Now Just Tokens. Mind-Blowing, Right?

- Doge Doomed?! 😱🐳

- Bitcoin’s Price Madness: A Comedy of Bulls and Bears 🎭💰

- Crypto Chaos: Hackers Make a Killing While CEOs Insist “Nothing’s Changed” 😒

- Bitcoin’s $90K Standoff: Is It Playing Hard to Get or Just Confused? 🤔💸

- Crypto Clash: Bitcoin, Ethereum, or Solana – Who’s the September Superstar? 🌟

2025-06-10 00:15