In the bustling heart of Singapore, the esteemed trading firm QCP Capital commenced its Monday missive with a rather blunt proclamation: “Implied vols continue to come under pressure, with BTC ensnared in a tight range as the summer sun approaches.” Ah, the market, like a restless child, drifts into the northern-hemisphere holiday season, reminiscent of the previous year when one-month at-the-money (ATM) volatility plummeted from a staggering 80 vols in March to a mere 40 by July. And yet, the spot price, much like a stubborn mule, repeatedly “failed to decisively breach the $70k level.” This year, however, we find ourselves perched upon a new, lofty plateau: BTC has languished between $100,000 and $110,000 for the better part of three weeks. How delightful! 🎉

The tranquility is palpable, extending beyond the flickering screens of Deribit’s options. The DVOL index, that faithful sentinel of 30-day implied volatility, hovers just above 40—one of its most languid prints in over two years. Realized volatility, even quieter, presents a curious case; even the one-year lows on implieds appear “optically rich,” as QCP so eloquently puts it. This valuation chasm has emboldened traders to sell gamma, leading to a slip in perpetual open interest. The favored hedge-fund basis trade—long spot via the new ETFs, short futures—has unwound, effectively siphoning what QCP dubs “the natural bid for vol” from the market. How charmingly chaotic! 😏

As the flows in the listed options market confirm this malaise, dealers report that July upside strikes around $130,000 and $140,000 are being rolled out to September “in meaningful size,” thus pushing bullish timelines further down the curve. Meanwhile, Deribit’s put-skew has flattened as short-dated hedges expire worthless—a dynamic that often precedes a directional move once macro catalysts arrive. Isn’t it just delightful how the market dances to its own tune? 💃

Now, as we gaze into the crystal ball, we see that this week could very well shatter Bitcoin’s lull. The catalysts, oh so uncomfortably close, are lined up like eager spectators. On Wednesday, the Bureau of Labor Statistics will unveil May’s consumer-price data. April’s headline CPI rose a modest 0.2% month-on-month and 2.3% year-on-year, while core prices advanced 0.2% on the month and 2.8% on the year. Economists, those ever-optimistic seers, anticipate a headline CPI quickening to 0.3% on the month and 2.5% year-on-year, with core CPI edging up to 0.3% and 2.9% respectively. How thrilling! 📈

But inflation is not the only macro variable in play. Friday’s stronger-than-expected US non-farm payrolls report—139,000 jobs versus a 130,000 consensus—rekindled dollar strength and knocked gold more than one percent lower, yet BTC “remained conspicuously unmoved,” QCP noted. The same divergence is evident this morning: US equity futures are slightly softer, spot gold is bid on safe-haven demand, and bitcoin is trading virtually unchanged. A true spectacle of indifference! 😒

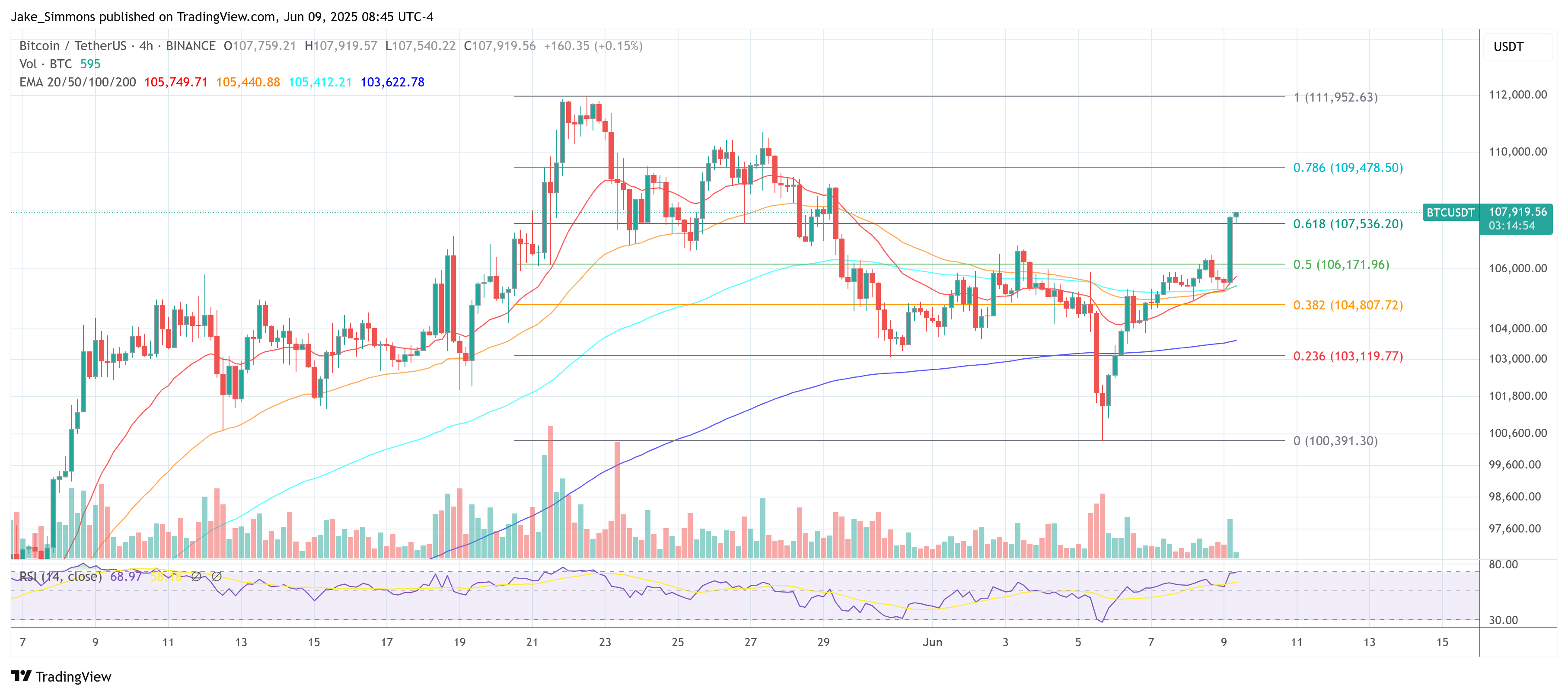

Geopolitics may provide the spark that inflation data has so far failed to ignite. Senior US and Chinese officials meet in London today (Monday) in what both sides are calling a push for a limited trade deal that would dial back export-control threats and myriad retaliatory tariffs. The stakes are high, dear reader, for tariffs have been feeding directly into the CPI basket and—via global risk sentiment—into bitcoin demand. “A clean break below $100k or above $110k would likely reawaken broader market interest,” QCP mused, “but we currently see no obvious near-term catalyst to drive such a move.” Ah, the fickle nature of the market! 🥴

Institutional positioning, too, hints at fatigue. US regulatory filings reveal that large hedge funds trimmed spot-ETF holdings in the first quarter as the lucrative cash-and-carry spread compressed. Net inflows across the 11 US bitcoin ETFs have slowed to a trickle since late May, leaving cumulative additions at roughly $44 billion—unchanged for almost a fortnight, according to Farside data. How quaint! 💤

For now, the market’s center of gravity is precisely where QCP asserts it to be: within the $100,000–$110,000 corridor. Volatility sellers continue to collect their premiums, and the risk-reward for momentum traders remains decidedly poor. Yet, with CPI, PPI, and high-stakes trade negotiations all converging within a 72-hour window, the premium that option writers are harvesting could soon appear meager. How deliciously ironic! 🍽️

If the inflation data surprises to the upside, a repricing of Fed-cut expectations could transform last week’s equity rally into a risk-off wobble, yanking bitcoin below six figures for the first time since April. Conversely, a benign print combined with even a symbolic easing of tariff rhetoric could flip the narrative to “soft landing, structural bid via ETFs,” reigniting topside optionality into the June quarter-end. In that scenario, the rolled-out September $140,000 calls might awaken far sooner than their buyers now expect. What a twist! 🎢

Either way, the clock on bitcoin’s summer doldrums is ticking loudly. “Without a compelling narrative to spark the next leg higher, signs of fatigue are emerging,” QCP warns. The narrative candidates arrive this week; whether they supply ignition or merely more noise will determine whether 2025’s range trade breaks—or cements itself as the dominant theme of another crypto summer. How thrillingly suspenseful! ⏳

At press time, BTC traded at $107,919.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- USD THB PREDICTION

- Crypto Whirlwind: How DeepBook’s Wild Ride Might Just Make You Smile 😏💸

- Brent Oil Forecast

- How Ethereum Became the Unexpected Hero of AI Finance 🚀💰

- Doge Doomed?! 😱🐳

- Crypto Clash: Bitcoin, Ethereum, or Solana – Who’s the September Superstar? 🌟

- Bitcoin’s $90K Standoff: Is It Playing Hard to Get or Just Confused? 🤔💸

- Ethereum’s Fee Fiasco: When Blockchains Play Hard to Get! 🤡

2025-06-09 23:49