In the quiet, monotonous life of a market analyst, one wonders if the world’s fate hinges on a digital coin—Bitcoin. Presently, it teeters on the edge of some grand, almost comical, explosion, as if it were a boy throwing stones at a palace window—hopeful, reckless, and filled with a strange sort of determination. Doctor Profit, with his enigmatic predictions, whispers of a surge up to 170%, as if Bitcoin were a phoenix emerging from ashes, or perhaps just a particularly ambitious bird. With a Golden Cross shining like a lighthouse and $100K looming like a solemn monument, the market is trembling, waiting for June 11 to reveal its secrets—possibly with more drama than a village melodrama. 🎭

Bitcoin’s Bold Attempt to Break Free—Or Just Showing Off?

In early June, Bitcoin was modestly trading at a shy $104,588.85, but had a brief flirtation with a 4.10% dip—an unfortunate dance step—between June 3–5. Yet, like a stubborn old man at a dance, it bounced back sharply from $100,400 on June 6, gaining 2.74% in a single day, as if to say, “You thought I was finished?” Now, it stands at approximately $106,664, growing more confident, more daring. Doctor Profit, perched on his digital soapbox, claims that Bitcoin is trying to flirt with a diagonal resistance line—perhaps an invitation to a grand ball, or simply a flirtation with disaster. He warns, with a grin, that a bullish breakout could send BTC soaring by 70–170%. Who knew charts could be so flirtatious? 🧐

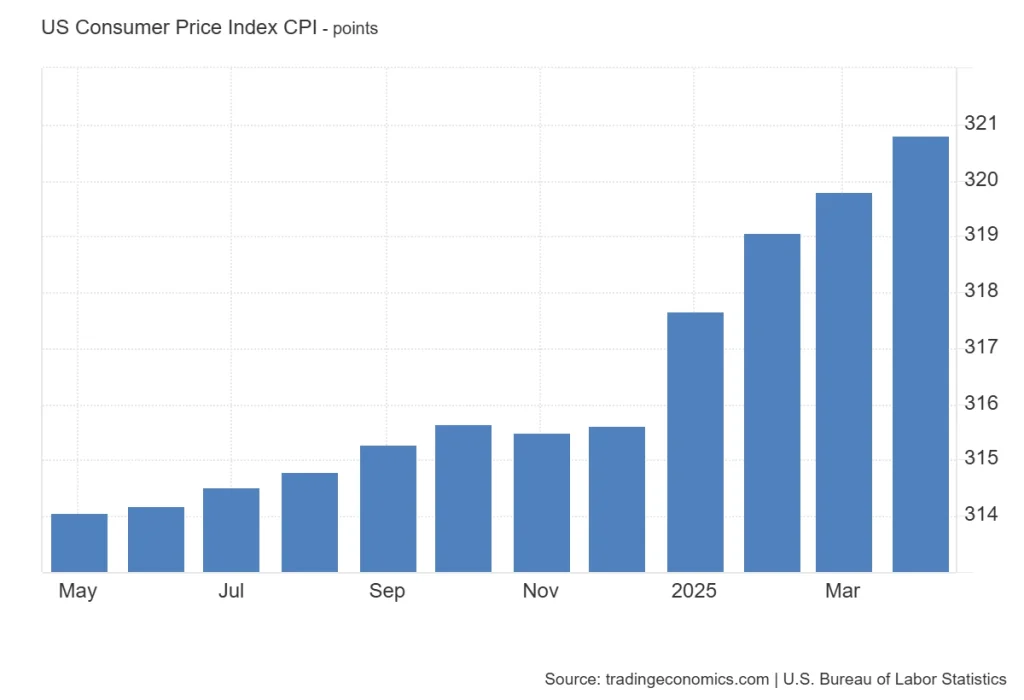

Ah, CPI—The Market’s Mischievous Pixie

This June 11, the US will unveil its CPI data—like opening night at the opera, but for inflation. Last April, CPI crept up from 319.799 to 320.795, and this month, it’s expected to reach 321.9, or so says the all-knowing TEForecast. The media holds its breath, like villagers awaiting witchcraft or a village wedding. Meanwhile, the inflation rate, which in April was a modest 2.3%, might rise to 2.5%. Or, and here’s the twist, it might surprise everyone and stay between 2.1% and 2.3%. A lower CPI could unleash optimism—or at least a good laugh—potentially prompting the Fed to cut rates, and, consequently, send Bitcoin on another wild ride. 💸

The Next Step in the Bitcoin Opera: $108K–$110K?

Doctor Profit, with a twinkle in his eye, points out a liquidity cluster between $108,000 and $110,000, which could be Bitcoin’s next target—like a stubborn donkey aiming for the mountain. If it manages to push past this zone, the door might open for a rally grander than any village feast, leading to heights unseen. Or maybe just another interesting chapter in this ongoing, perhaps foolish, saga of digital gold. If you’re feeling brave—or merely amused—watch that zone with anticipation, for it might just be the next act with a twist even Chekhov couldn’t have scripted.

Read More

- Gold Rate Forecast

- XRP: The Calm Before the Storm?

- SEC’s Crypto Custody Circus: Who’s Guarding Your Digital Gold? 🎪💰

- Suspected Team Wallet Sent $47M of TRUMP to Crypto Exchanges: Dump Incoming?

- X Accounts Go Rogue: The Flare Security Scare You Won’t Forget

- Is Now the Time to Buy Bitcoin? Shocking Market Signals Unveiled!

- Bitcoin’s Plunge: Are Traders Running for the Hills? 🤑💨

- Silver Rate Forecast

- Mysterious Moves: Crypto Titans’ Bold Bet or Folly? 🤔

- Bitcoin’s $90K Standoff: Is It Playing Hard to Get or Just Confused? 🤔💸

2025-06-09 13:55