So, here we are, folks! Tron (TRX) has decided to throw a little party, reaching a fabulous 5-month high. But wait—hold your horses! The recent bullish momentum seems to be losing its sparkle, hinting at a potential price correction. Oh, the drama! 🎭

While TRX has been strutting its stuff, there are whispers that it might be a tad overvalued in the short term. Could a pullback be on the horizon? Grab your popcorn! 🍿

Tron Is Overvalued (Shocking, I Know!)

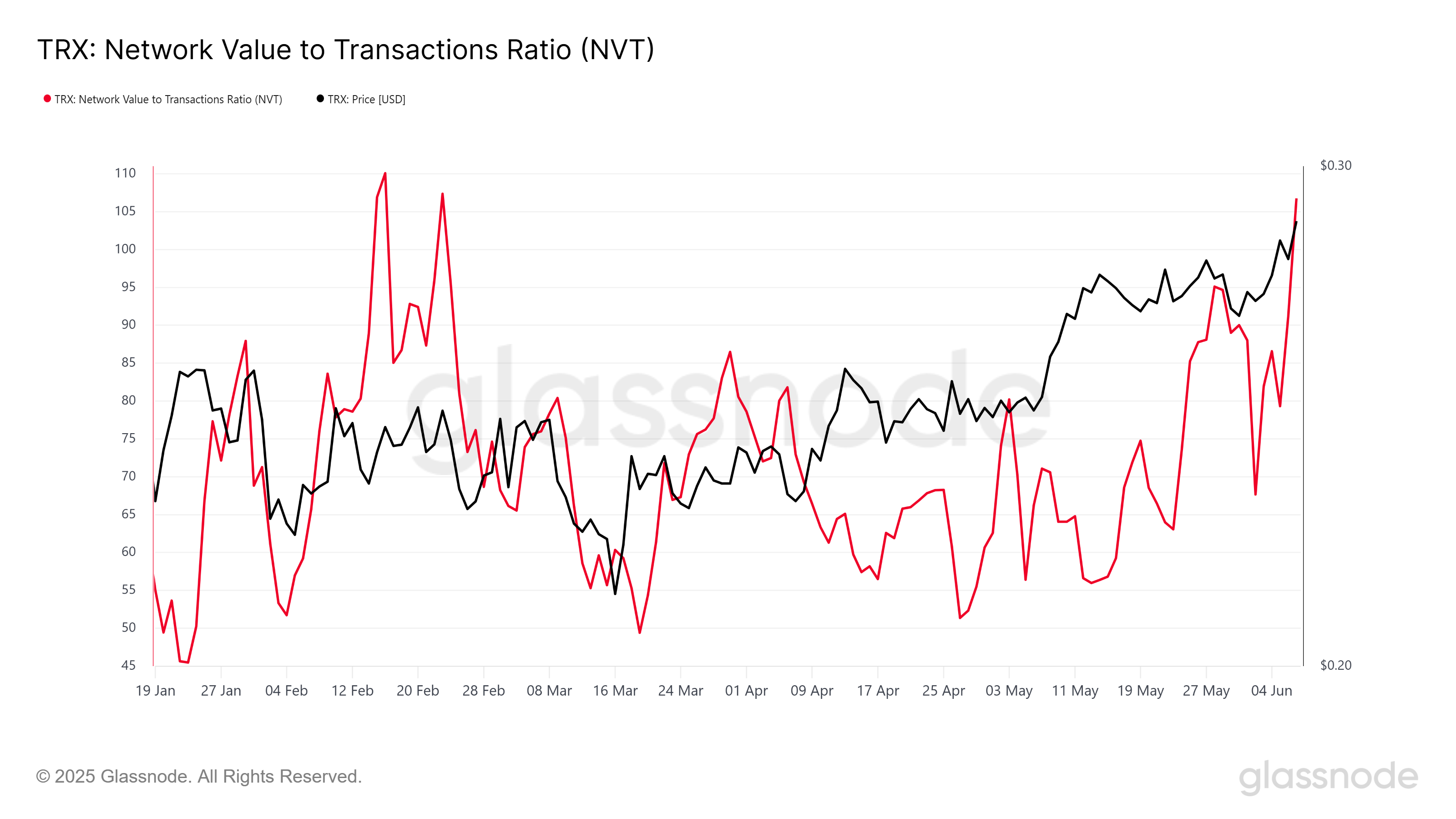

The Network Value to Transactions (NVT) ratio for Tron has spiked like a teenager’s mood swings, reaching its highest level in a month and a half. NVT measures the ratio between a network’s market value and its transaction volume.

A rising NVT often signals that the market value of an asset is outpacing its transactional activity, suggesting overvaluation. In the case of TRX, this increase in NVT is a potential red flag. 🚩

With the NVT ratio rising, TRX could face downward pressure as investors adjust their expectations. The token’s overvaluation could lead to a sell-off, especially if market sentiment shifts toward caution.

So, a price correction seems likely, especially if the broader cryptocurrency market decides to take a chill pill. 🧘♀️

But wait! Despite the overvaluation concerns, the overall macro momentum for TRX might not lead to a dramatic correction. The IntoTheBlock’s IOMAP indicator shows a strong demand zone between $0.268 and $0.276, where around 13.89 billion TRX, worth nearly $4 billion, was purchased. 💰

This substantial accumulation zone provides a buffer for TRX, as investors who buy at these levels are unlikely to sell without a profit. Smart cookies! 🍪

The demand zone is crucial because it represents a price floor that may prevent TRX from falling too far. As the market has demonstrated interest in this price range, the chances of TRX dropping below $0.276 in the short term are reduced.

If TRX does experience a correction, it is expected to find solid support within this zone, keeping the price above the critical $0.276 level. Fingers crossed! 🤞

Will TRX Price Take A Dip? (Spoiler Alert: Maybe!)

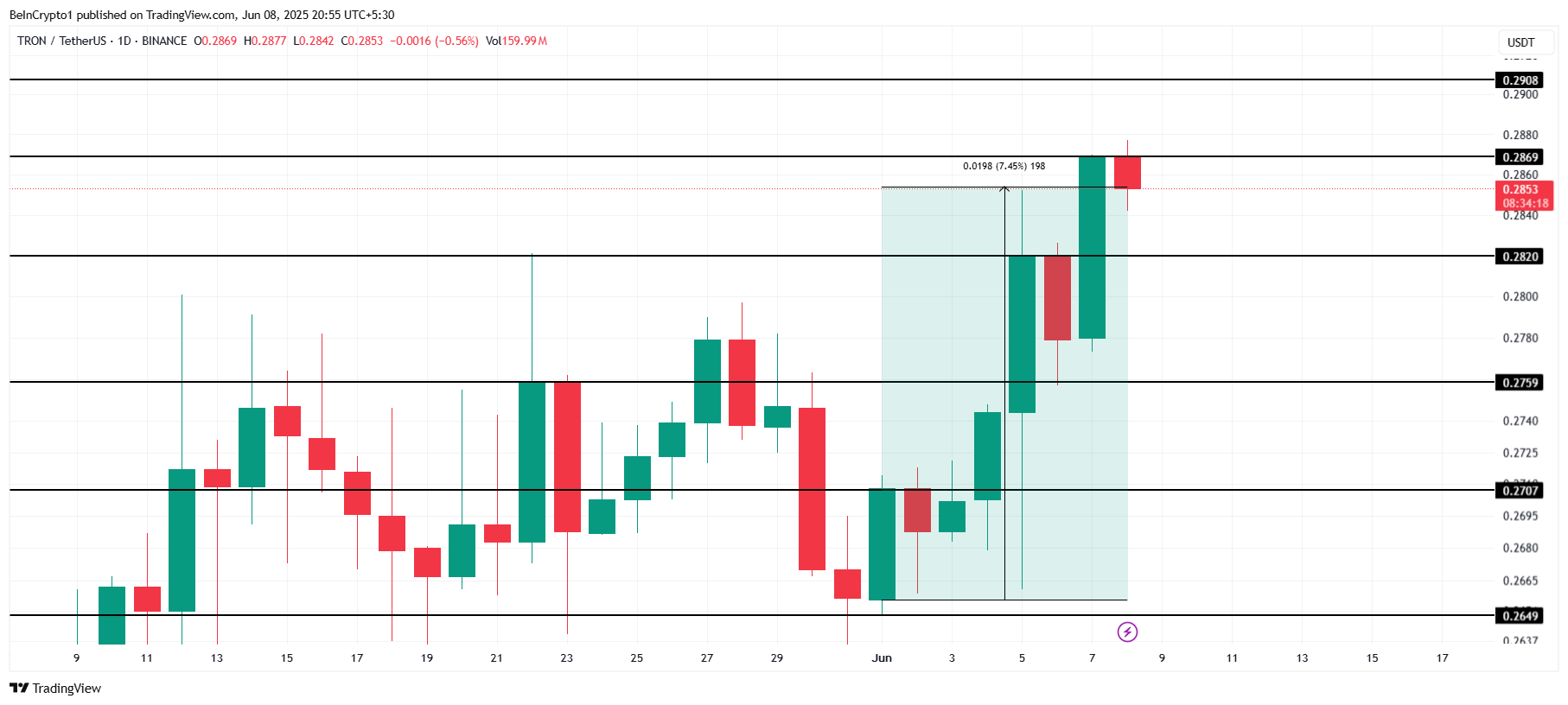

TRX has gained a whopping 7.45% over the past week, trading at $0.285 at the time of writing. It is currently facing resistance at $0.286, which has proven to be a challenging level to break. Given the recent rise in price, the token is nearing a critical point.

If TRX fails to breach the $0.286 resistance, it could face a pullback as investors take profits. Oh, the suspense! 😱

Should the overvalued condition trigger a price decline, TRX could drop below $0.282 and head toward the $0.275 support level. A fall below this level is unlikely due to the strong demand zone around $0.268 to $0.276, which should provide support for the price. The correction is expected to be moderate, with the demand zone preventing a more severe decline.

On the other hand, if the broader market remains bullish, TRX may push past the $0.286 resistance level. A successful breach of this barrier could see TRX move toward $0.290. This would invalidate the bearish outlook and set the stage for further price appreciation. 🎉

Read More

- Gold Rate Forecast

- XRP: The Calm Before the Storm?

- Is Now the Time to Buy Bitcoin? Shocking Market Signals Unveiled!

- Bitcoin’s Plunge: Are Traders Running for the Hills? 🤑💨

- Suspected Team Wallet Sent $47M of TRUMP to Crypto Exchanges: Dump Incoming?

- X Accounts Go Rogue: The Flare Security Scare You Won’t Forget

- SEC’s Crypto Custody Circus: Who’s Guarding Your Digital Gold? 🎪💰

- Doge Doomed?! 😱🐳

- You Won’t Believe What Bitcoin Whales Are Doing—And How It Could Wreck the Market 🚨

- Silver Rate Forecast

2025-06-08 22:06