So, Bitcoin is hanging around $105,384 on June 8, 2025, like it’s debating whether to go out or stay in. Market cap? A cool $2.09 trillion. Trading volume? $15.81 billion because apparently everyone’s still trading their hopes and dreams. It’s been bouncing between $105,112 and $105,891—like that one friend who can’t decide where to eat. So basically, it’s stable… for now.

Bitcoin

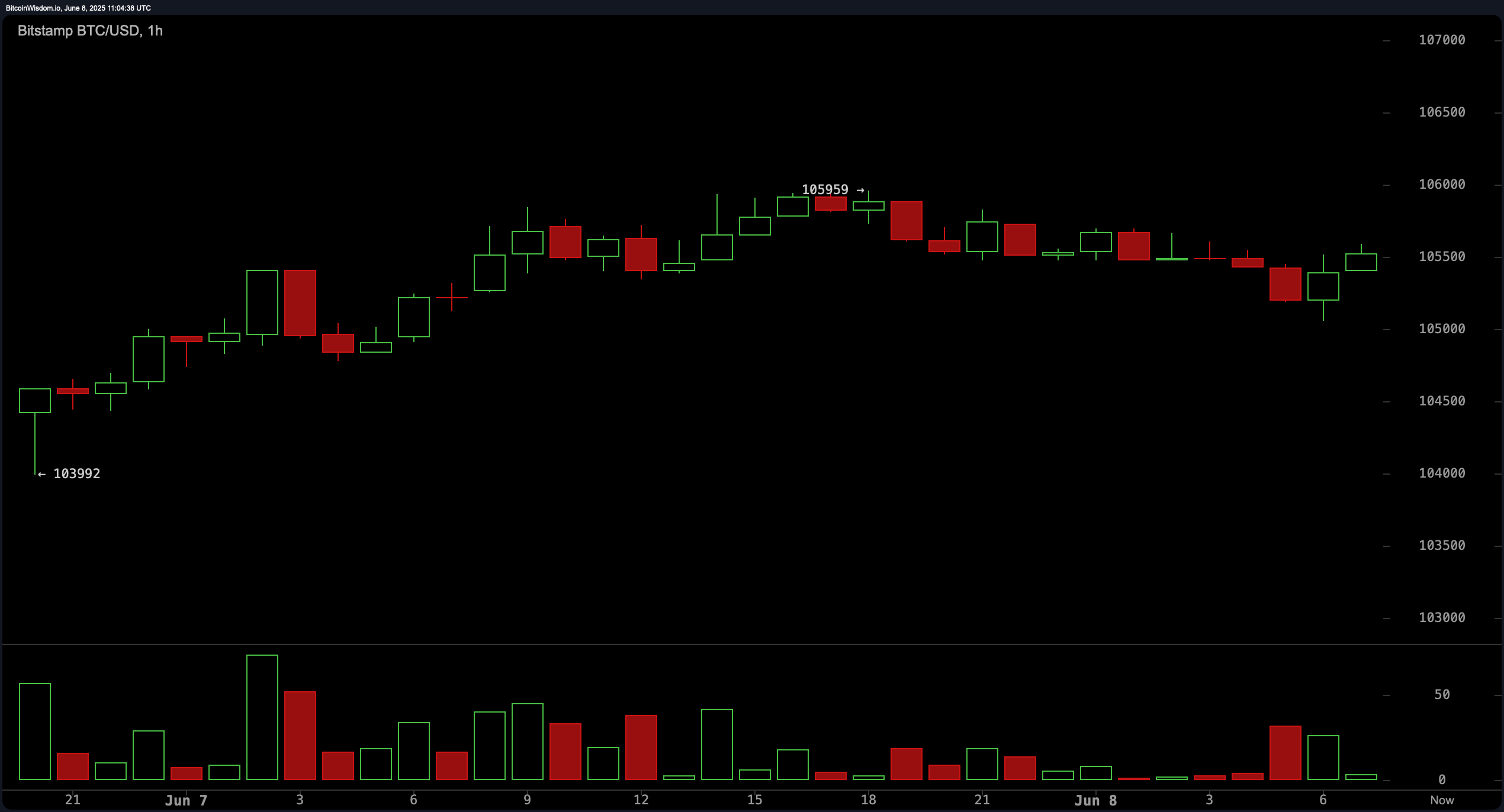

The 1-hour chart shows Bitcoin playing it safe, sitting between $105,000 and $106,000. It’s like that awkward first date where nobody wants to make the move. The last peak at $106,000? Rounded like a ripe melon, hinting that bullish hype might be weakening. Support? Sitting pretty at $104,500. If Bitcoin suddenly gets a burst of confidence above $106,000 with volume that isn’t just musical chairs, it could go shoot for the stars again. But if it dips to $104,800 with fewer sellers, could be a good time to buy short-term. Exit strategy? Target $106,500–$107,000, with stop-loss just below $104,500 because nobody likes a surprise crash.

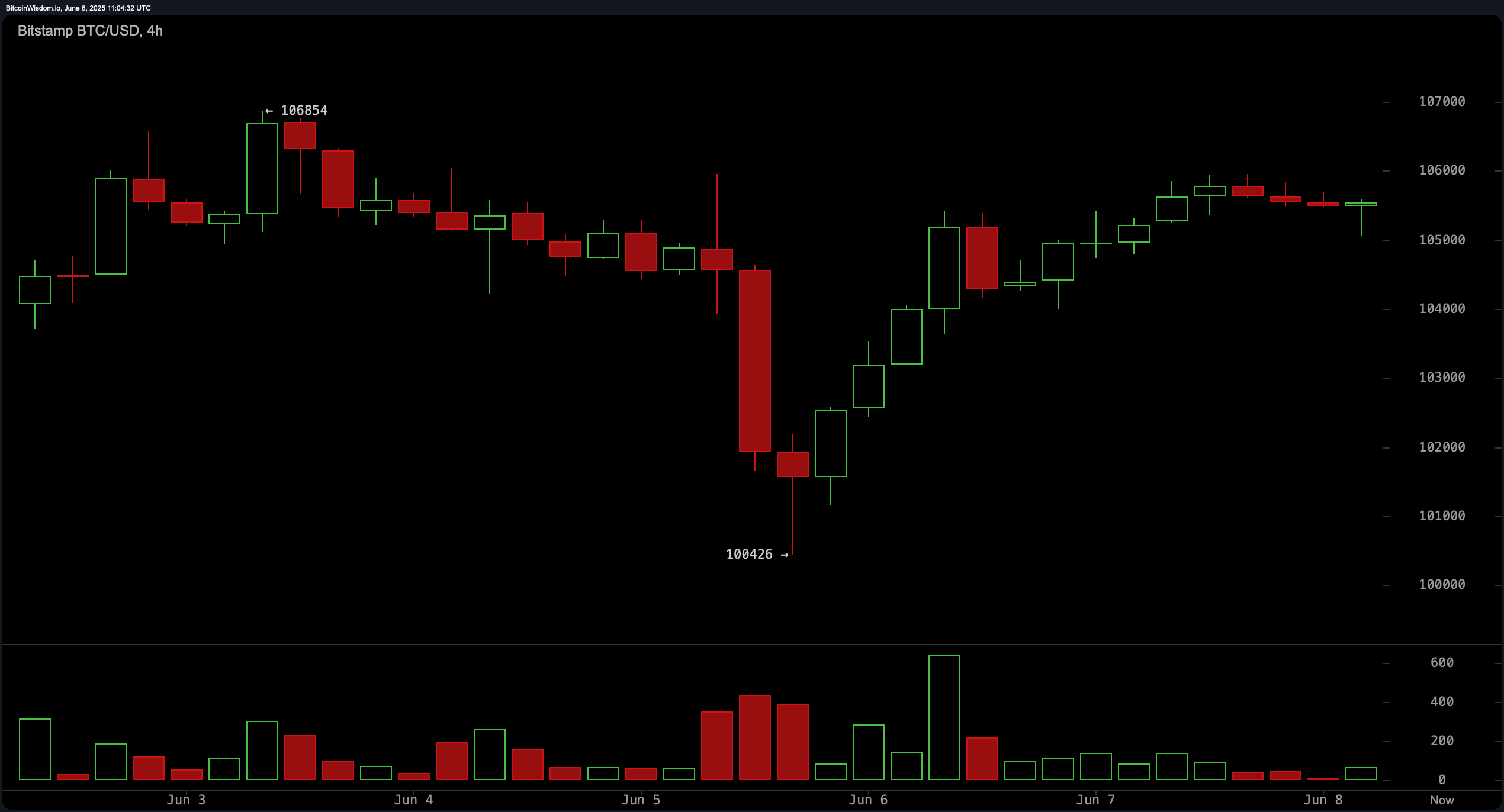

Zooming out to the 4-hour chart, Bitcoin did a classic V-shaped recovery—like the plot of every bad romantic comedy—after bottoming at $100,426. It’s been making higher highs and higher lows, which sounds impressive unless you remember it’s all just a jiggle of market indecision near $106,800. Break above that, and we’re in “bull run” territory. Rejection? Back to the $102,500–$103,000 zone—like trying to find your keys but still missing them. For now, traders are eyeing $104,500–$105,000 for entry, aiming to cash out at $107,000–$108,000—because who doesn’t love a rollercoaster with a safety harness?

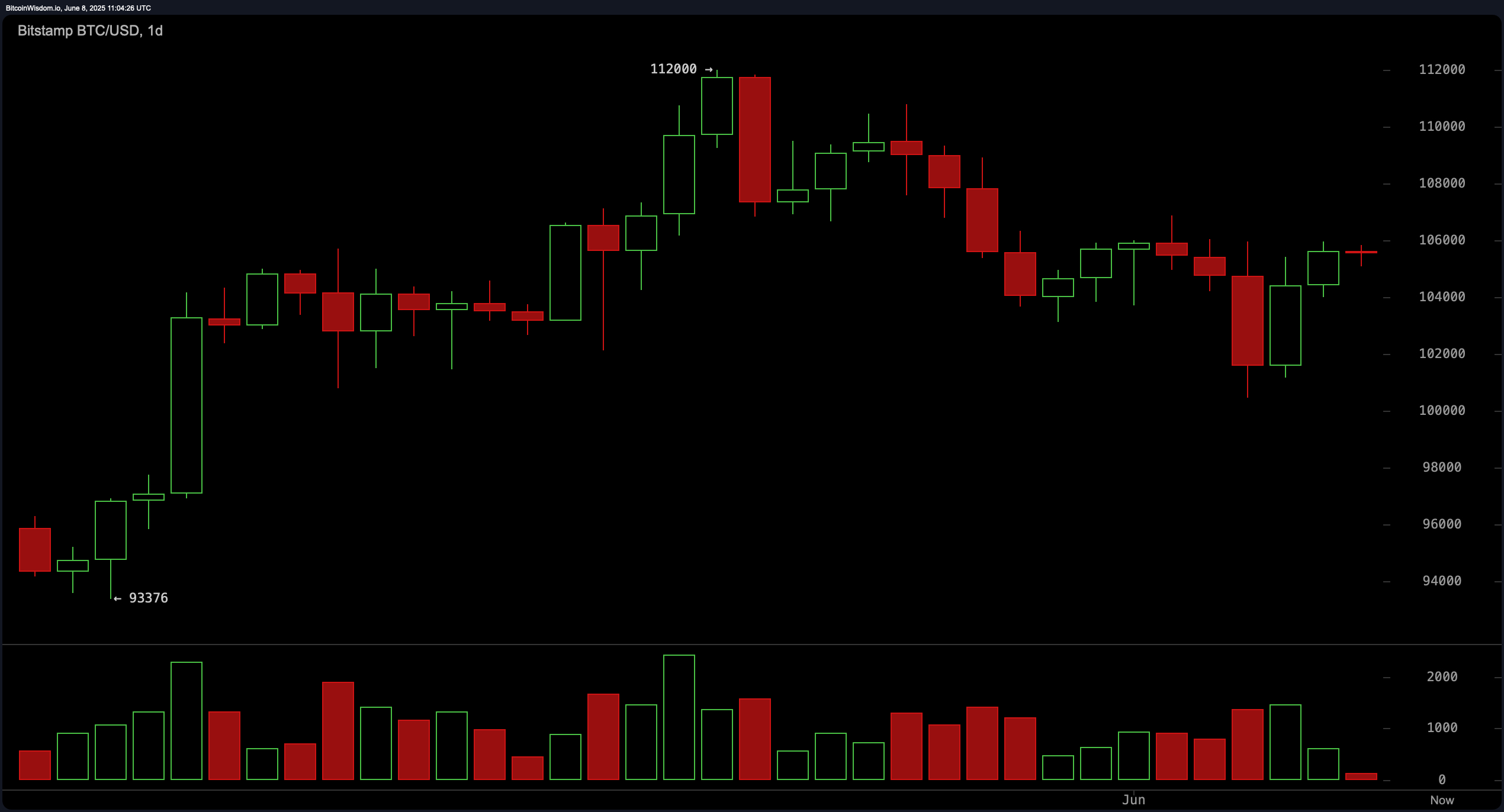

Looking at the daily chart, Bitcoin’s been on a bullish tear since late May, peaking at $112,000—like a star on Hollywood Boulevard. Then it took a breather, retreating to the comfort of the $100,000–$102,000 zone, which it’s tested multiple times—like a stubborn roommate. Currently, it’s chilling near $106,000–$108,000, kind of like a kid eyeing the candy aisle. The smart money? Watching for dips near $104,000–$105,000 with some volume spikes, which might be your cue to buy. Targets? $108,000–$110,000, with careful stops just under $102,000—because nobody likes regrets.

Oscillator readings are about as clear as a muddy puddle—most are neutral. RSI sits at 53, Stochastic at 46, CCI at -39, all saying, “Meh, market’s indecisive.” The ADX at 20 screams “weak trend,” and the MACD? Like that colleague who’s always overcaffeinated—leaning negative. Momentum? Maybe, just maybe, there’s a slight upward spark, but don’t get your hopes too high just yet.

Meanwhile, moving averages tell a different story—potentially bullish. The 10 and 20-period EMAs hover around $105,000, supporting the current price, like a cozy blanket. Longer-term averages? They’re whispering “buy,” so the overall vibe is more “up” than “down.”

Bull Verdict:

Bitcoin’s got a solid foundation above key support zones, with most longer averages pointing upward. Break $106,800 with volume, and it’s game on—target $108,000 and beyond. Dips to $104,500–$105,000? Great spots to load up, just in case there’s more romancing left in this story.

Bear Verdict:

Despite the recent rally, resistance at $106,800 looms like a big bully. Momentum? Fading. Oscillators? Basically shrugging. Volume trends hint at some shaky ground—so if support drops below $104,500, we’re probably heading down to $102,000 or lower, which is — dare I say — a little less fun.

Read More

- Gold Rate Forecast

- Is Now the Time to Buy Bitcoin? Shocking Market Signals Unveiled!

- XRP: The Calm Before the Storm?

- Bitcoin’s Plunge: Are Traders Running for the Hills? 🤑💨

- Brent Oil Forecast

- X Accounts Go Rogue: The Flare Security Scare You Won’t Forget

- SEC’s Crypto Custody Circus: Who’s Guarding Your Digital Gold? 🎪💰

- Suspected Team Wallet Sent $47M of TRUMP to Crypto Exchanges: Dump Incoming?

- You Won’t Believe Why Bitcoin Just Smashed $99K – And What’s Next! 🚀💰

- DOGE’s $1 Dream: Will the Meme Coin Bark or Bite? 🐶💰

2025-06-08 15:27