In the grand theater of finance, where numbers dance like fireflies in the night, the twelve U.S. spot bitcoin exchange-traded funds (ETFs) are managing a staggering 1.2 million BTC. Yet, two titans—Blackrock’s IBIT and Fidelity’s FBTC—hold the lion’s share, a whopping 71% of this digital treasure. Who knew finance could be so dramatic?

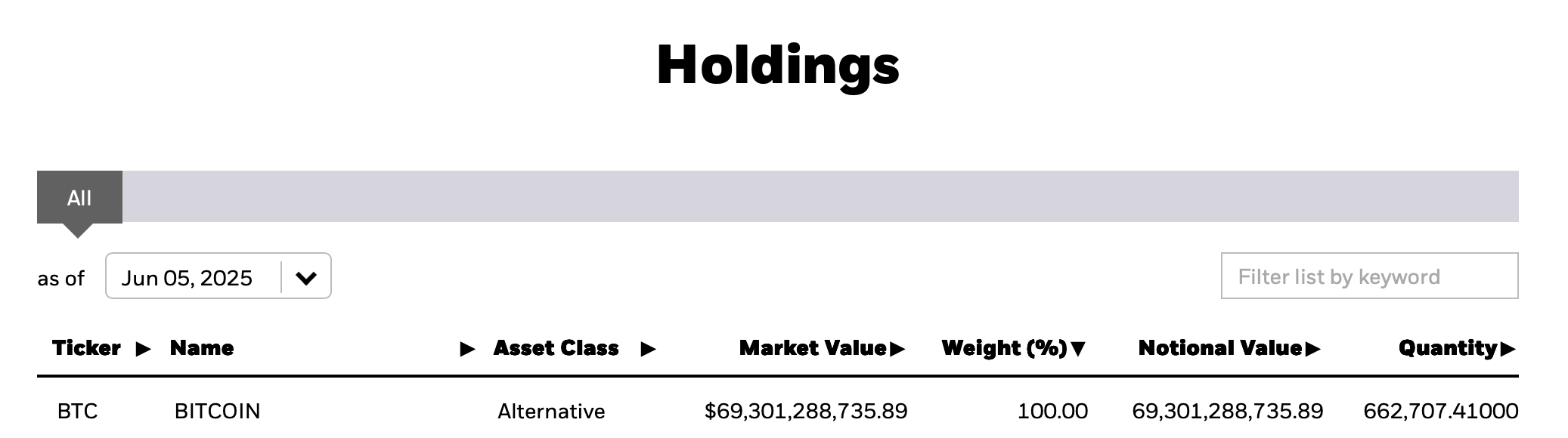

Blackrock’s IBIT made its grand entrance on Wall Street on January 11, 2024—precisely 1 year, 4 months, and 26 days ago. As of June 5, 2025, this financial behemoth controls about 662,707.41 BTC, worth a jaw-dropping $69.2 billion. This single ETF alone accounts for 55.23% of the total 1.2 million BTC managed by the twelve publicly traded bitcoin funds. Talk about a power move!

IBIT’s holdings represent 3.16% of bitcoin’s 21 million fixed supply and 3.34% of the 19,875,085.22 BTC in circulation at the time of writing. No other crypto exchange-traded product (ETP) has managed to accumulate this much so quickly. If IBIT had been hoarding BTC every single day since its debut, it would have raked in about 1,296.88 BTC daily. Not too shabby, right?

//branch.wallet.bitcoin.com/news-contextual-btc”>BTC over the same period, worth just over $20 billion. Slow and steady wins the race, or so they say! 🐢

While FBTC is the second-largest U.S. bitcoin ETF, its growth has been more like a gentle breeze compared to IBIT’s whirlwind. If it keeps this pace, FBTC might reach the 500,000 BTC milestone by around July 18, 2027. And let’s not forget Strategy (formerly Microstrategy), which started its bitcoin (BTC) journey on August 11, 2020. Averaging out, that’s a daily haul of 330.09 BTC. If they keep this up, they won’t hit the million BTC mark until October 27, 2028. Talk about a long game!

The fierce competition among financial giants for bitcoin supremacy hints at a deeper strategic shift brewing beneath the surface. With accumulation timelines stretching into the future, these ETFs are not just chasing assets—they’re laying down the law in a digital monetary landscape. What started as a race for profits may just morph into a battle for monetary influence itself. Buckle up, folks! 🚀

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Silver Rate Forecast

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Brent Oil Forecast

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- Will BNB’s $600 Wall Finally Crumble? Spoiler: The Hodlers Are Plotting 😉

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

2025-06-07 23:57