If you thought the world of cryptocurrency was just a lot of flashing lights and confetti, think again, old bean! Uniswap, that clever little token, has finally decided to put on its Sunday Best and bounce back from the dreary doldrums of the past few months. And all the while, the whales—those majestic sea monsters of finance—are doing their best impression of silent sentinels, camouflaged and plotting their next big move. 🐋🤫

- Whale accumulation and surging transactions point to Big Money thinking it’s party time again.

- UNI sticks to its neutral territory as Funding Rates swell and more users wade in.

Our darling Uniswap has made a cheeky rebound from the depths of its multi-month slump, bouncing off the wistful $5.60 support with a jaunty 5.40% daily leap—backed by rising volumes and what one might call bullish enthusiasm. As if that weren’t enough, it hints at a possible trend reversal, particularly as traders teeter near those critical support zones, like foxes eyeing the henhouse. The market’s feeling somewhat more chipper, thanks to a cocktail of technical signals and a newfound confidence among the crowd—a decidedly bullish brew.

Can rising network activity reignite UNI’s demand?

On-chain data shows user activity isn’t just hobbling along; it’s putting on the afterburners! New addresses have shot up by 66.12%, while active addresses have increased a modest 19.39% last week. Quite the lively party, considering the stagnant price—just goes to show that folks are still throwing their hats into the ring, perhaps eager to see the magic happen. The increase in zero-balance addresses suggests some shuffle, possibly holders repositioning their chips, but overall, the crowd’s growing—providing some fundamental backbone for UNI’s short-term resilience. Cheers to that!

Are institutional players making a strong comeback?

Oh, this is where the plot thickens! The size of transactions has skyrocketed—by an eye-watering +174.9% in the $10k–$100k range, +168.75% for $100k–$1m, and an astonishing 200% for transfers in the $1m–$10m bracket. Meanwhile, the small fry—transactions under a thousand bucks—are disappearing faster than a snowflake in July, dropping over 20%. Seems the big fish are back, and they’re bringing their sizable wallets with them, leaving the retail chaps to twiddle their thumbs. The market’s turning into a playground for the big suits, folks!

Building pressure for a breakout?

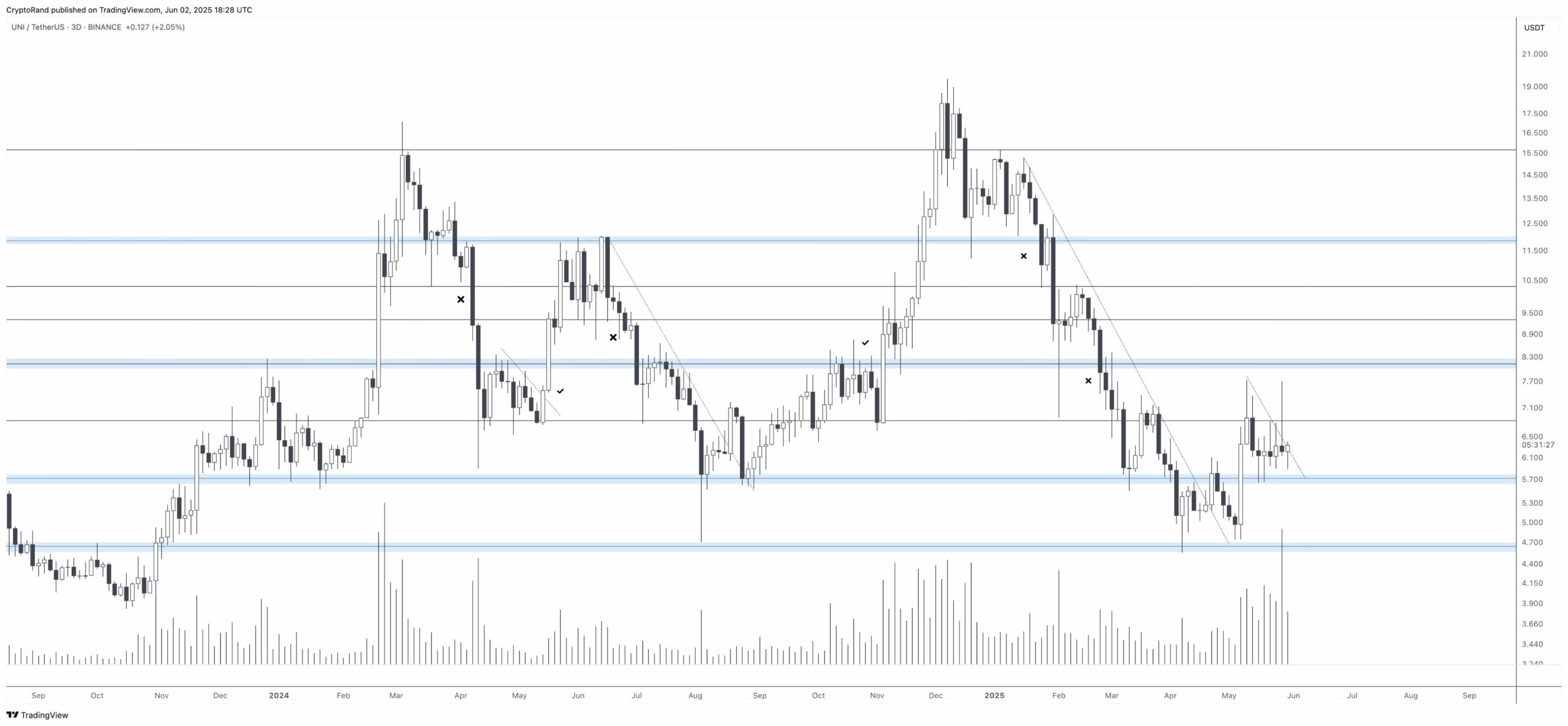

Our dear UNI has been meandering between $5.50 and $7.50 for what feels like an eternity—more precisely, over two months—sort of like that one friend who can’t decide whether to start a diet or not. The MACD indicator is hinting at a possible bullish crossover, like a hinge ready to swing open. The subtle signs suggest that buyers are creeping up while sellers are running out of steam. Usually, this kind of range-bound behaviour is just a prelude to something more dramatic—bursting out like a champagne cork—if the volume and address growth keep climbing, the rescue vessel might be heading to the upside test of $7.50. Exciting stuff, old bean!

Are whales silently accumulating as smaller players exit?

In a classic masterstroke, whale holdings have nudged up by 2.40% over the past thirty days, while our less-gentle investor friends have let their stakes decline by -2.74% and -1.70%. Quite the coup, wouldn’t you say? It’s like the big bloke at the card table quietly stacking chips while the less experienced players leave the game. Such shifts often forecast rising prices—those big fellows know where the fun’s headed, it seems. So, keep an eye on those whales—they might be the puppeteers pulling the strings.

Is the Funding Rate signaling bullish bias?

The Funding Rate—think of it as the mood ring of trading—keeps that positive glow at +0.0056%, suggesting traders are willing to pay a premium to hold long positions. Not a level to break out the champagne yet, but it indicates a market leaning towards bullishness. When volume is also stacking up, and prices stay steady, it’s enough to make one rub their chin thoughtfully. Still, if this rate stays positive without significant price action, it might just be market overenthusiasm—so, proceed with a dash of skepticism, old sport.

Is UNI gearing up for a breakout or another snooze fest?

If all the signs—technical rebound, growing addresses, whale chummy behaviour, and buoyant Funding Rates—are to be believed, then our dear UNI is eyeing the big stage. But, and there’s always a but, it must stumble past the $7.50 mark with a bit of showmanship to truly switch the mood from ‘wait and see’ to ‘let’s dance!’ Until that dramatic moment, it’s more of the same—patience, my dear Watson—but with mounting pressure and a bit of a ‘something’s in the air’ feeling. Keep your monocle polished and your fingers crossed, old bean!

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Bitcoin Billionaire’s Bizarre Stock Scheme: Will It Collapse or Conquer? 🤔

- Ethereum’s Wild Ride: Is It Just Getting Started? 🚀

- Brent Oil Forecast

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- 🚨 Senate Drops Crypto Bill: CFTC to the Rescue? 🚨

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

2025-06-03 20:13