Ah, the sweet thrill of keeping an eye on US economic indicators—because who doesn’t love the chaos it brings to crypto markets? This week is no different, with key data that could make or break your portfolio.

It’s no secret that US economic data now has a more significant role in Bitcoin’s drama. Traders and investors, brace yourselves for the wild ride ahead.

US Economic Data to Watch (Because You’re a Masochist for Market Drama)

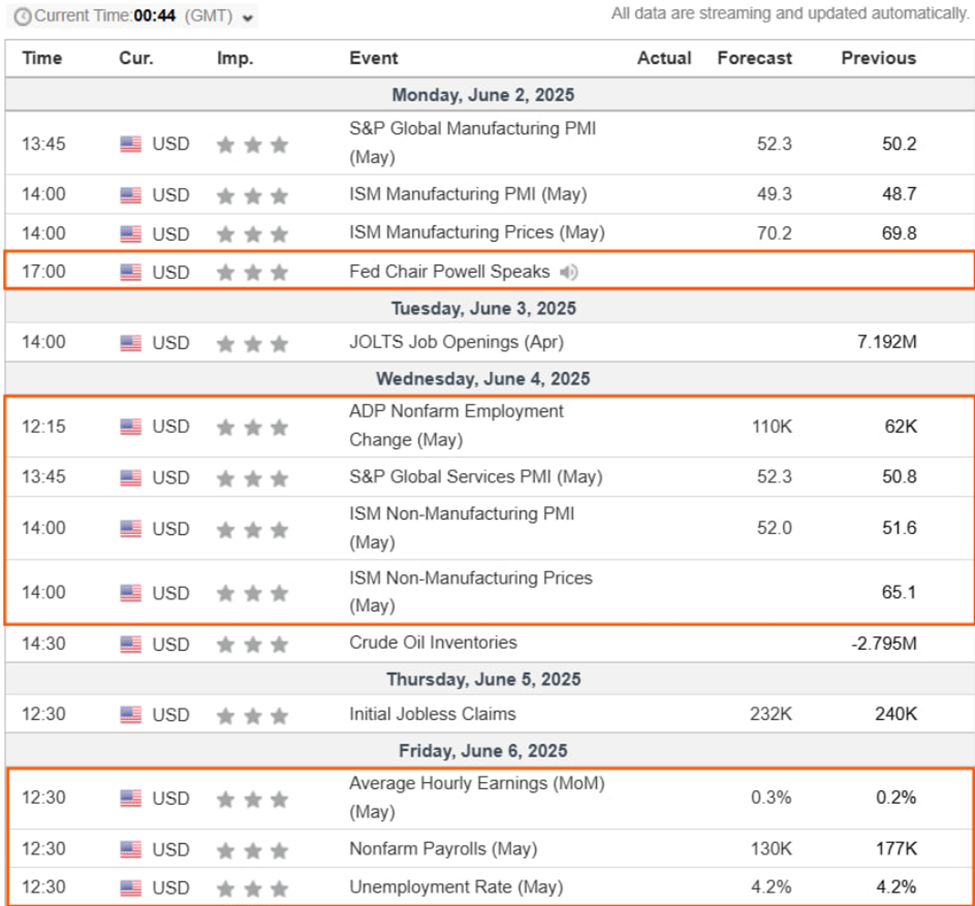

For those with a penchant for volatility, here’s your golden opportunity to trade around these key US economic data points.

US Job Openings (JOLTS) – Is It Really a “Job Opening” If Nobody Wants It?

On June 3, the Job Openings and Labor Turnover Survey (JOLTS) for April 2025 will be released. In March, job openings plummeted to 7.192 million, the lowest since September 2024. And of course, it fell short of the market’s high expectations of 7.48 million.

This decline happened before Trump’s tariffs fully flexed their muscles. According to Bloomberg analysts, this has already put a dent in hiring.

“…employers focusing on containing costs as households become a bit more guarded and businesses reconsidered investment plans against a backdrop of shifting trade policy,” Bloomberg cynically noted.

If job openings continue their downward trend, it may signal that the labor market is losing its shine, and the Fed might finally decide to ease up on monetary policy.

Here’s the kicker: a weaker dollar could make Bitcoin more appealing—because who doesn’t want to jump on that ship? But if job openings stabilize or grow, don’t expect Bitcoin’s price to soar. It’ll likely be more of a yawn than a party.

ADP Employment – Who’s Really Getting Hired? Certainly Not at a Fast Pace…

The ADP Employment report for May 2025 is due on June 4. In April, only 62,000 jobs were added, a far cry from March’s 147,000. But hey, economists forecast 112,000. Fingers crossed, right?

If job growth disappoints again, it might trigger the Fed to go soft on its monetary stance, and you know what that means: Bitcoin could shine as a safe haven against a depreciating dollar.

But if the report comes in stronger than expected, well… expect Bitcoin to face some tough competition from the dollar. It’s all about balancing that sweet, sweet risk.

Initial Jobless Claims – A Clue that People are Starting to Get Fired

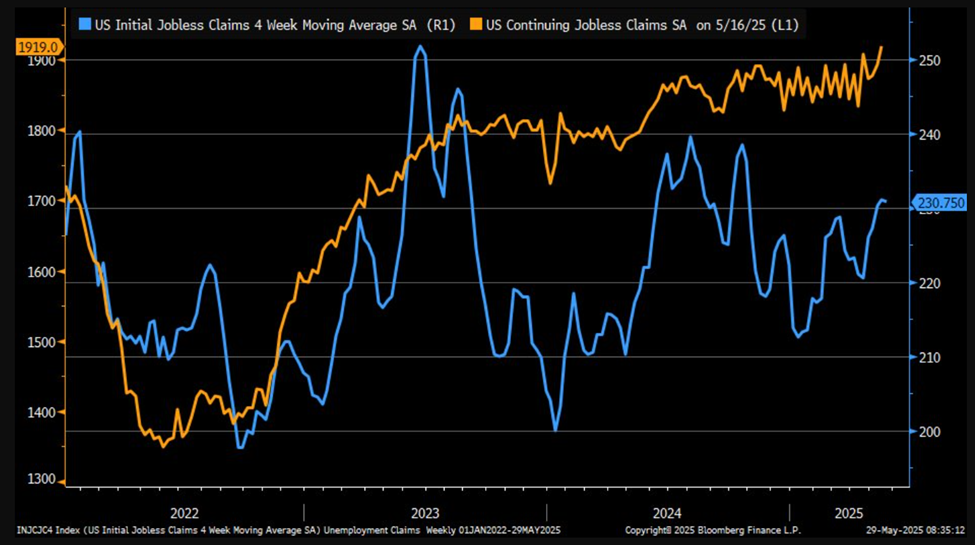

Initial jobless claims for the week ending May 24 jumped to 240,000, up from 226,000 the week before. And guess what? It exceeded the forecast of 229,000. Could the labor market be softening? Definitely looks that way.

We’ll see if claims rise further for the week ending May 31, with a forecast of 232,000. If claims tick up, the Fed may be pushed to ease its grip, leading to a weaker dollar—cue Bitcoin’s rise as the asset to buy.

But, of course, if this is just a temporary hiccup, don’t expect Bitcoin to take off in any meaningful way. Let’s hope it’s not just a passing wave of bad news.

“Initial jobless claims continue to steadily, but slowly, increase,” noted the always-so-optimistic Eric Basmajian.

Non-Farm Payrolls – The “Good News” That May Actually Be Bad News

The US Employment report, aka Non-Farm Payrolls (NFP), for May 2025 will be released on June 6. April’s job addition of 177,000 was more than expected, with the unemployment rate holding steady at 4.2%. Talk about a lukewarm success.

“Economists expect payrolls to rise by 125,000, following March and April’s strong performance. That would still leave the 3-month average solid at 162,000,” Bloomberg analysts added with remarkable optimism.

So, if job growth slows to 130,000 in May, the Fed might see it as a reason to tighten its policies. That could strengthen the dollar and crush Bitcoin’s rally.

But if concerns about the economy persist, and the Fed turns dovish, well then Bitcoin could be the golden ticket to protect against all the monetary shenanigans.

And of course, with the current state of employment, employers are nervously awaiting the White House’s trade policy updates. It’s like waiting for a movie to drop its next trailer—except it’s a lot more stressful.

“Increased volatility is expected—prepare your risk management and wait for confirmations before entering trades,” cautioned MrD Indicators with a lot more certainty than anyone else.

As of now, Bitcoin is trading at $104,858, up by 0.17% in the last 24 hours. Keep your fingers crossed, folks—it’s going to be a bumpy ride!

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- USD TRY PREDICTION

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- SEC & CFTC: 24/7 Markets? Because Who Needs Sleep? 😂

- FLR Token’s Wild Ride: Is It the Next Crypto Superstar? 🚀💰

- SEI’s Suicide Dive to $0.20! 🚀😱 Or the Greatest Trick Since Woland Came to Moscow?

- Brent Oil Forecast

- Ethereum’s Wild Ride: Is It Just Getting Started? 🚀

2025-06-02 10:41