Bitcoin, that shining beacon of decentralization, security, and immutability, has long been the darling of crypto enthusiasts. But wait—hold the applause. Justin Drake, a security expert with a penchant for dramatic metaphors, just dropped a bombshell: Bitcoin’s security model is a ticking “time bomb.” 💥

According to Drake, the heart of Bitcoin’s proof-of-work (PoW) mechanism is facing a critical flaw. If left unchecked, this flaw could unravel the very fabric of the cryptocurrency ecosystem. And no, it’s not a bug in the code—it’s a flaw in the system itself. 😱

Why is Bitcoin Security a “Time Bomb”? 🕰️💣

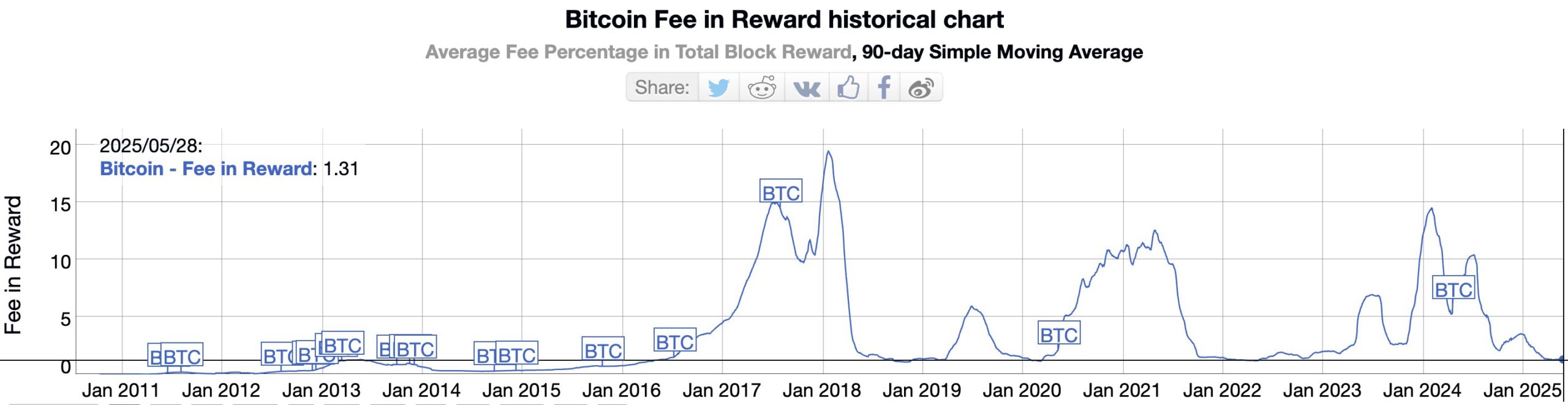

Drake’s main beef is with the plummeting transaction fees. They’ve hit rock bottom—down to a 13-year low, a shocking dip below 10 BTC per day. 🧐

Here’s the deal: transaction fees make up just 1% of miner revenue. The other 99%? That comes from block rewards—the shiny new Bitcoins given to miners for keeping the network running. But here’s the twist—those block rewards get halved every four years. In April 2024, the block reward dropped to 3.125 BTC. The cycle continues until we hit the grand cap of 21 million coins. 🎭

Bitcoin enthusiasts have long been betting that, as block rewards shrink, transaction fees would rise to make up the difference. But surprise—data shows the exact opposite. Transaction fees have fallen faster than the block rewards have been halved. Oops. 😬

In 2016, transaction fees were a modest 1% of the 25 BTC block reward. Fast-forward to April 2025, and despite the block reward plummeting to 3.125 BTC, fees still account for only 1%. This decline is shrinking Bitcoin’s security budget—the very thing that incentivizes miners to protect the network. Without that incentive, the network becomes a sitting duck for attackers. 😅

“Imagine fees were the only source of miner revenue today:

→ revenue drops 100x

→ hashing infra decreases 100x

→ 1% of today’s infra (1 large farm) can 51% attack Bitcoin

That’s the trajectory we’re on. The 21 million cap breaks security, it’s self-destructive. It should be clear now Satoshi made an oopsie.” – Justin Drake

And to make matters worse, efforts to revive transaction utility and boost fees have been… underwhelming. Lightning Network, Liquid, Stacks, and Ordinals all caused brief fee spikes—before the declines hit again. So much for the “magic fix,” right? 🔮

With Bitcoin’s security still largely relying on block rewards—something that’s finite and ever-shrinking—where does that leave us? Staring at a looming crisis. 😬

Not everyone agrees with Drake’s gloomy outlook. Kushal Babel, a researcher at Category Labs, argues that we’re measuring fees all wrong. He suggests we need to look at transaction fees in U.S. dollars, not BTC. Because, you know, inflation doesn’t just affect your morning coffee, it might be messing with Bitcoin too. ☕💸

“It’s incorrect to say fees are at an all-time low by denominating them in BTC. What matters for security is the fees in dollar terms—we need to consider the BTC/USD price. That may tell a different story.” – Kushal Babel

Did Satoshi Make a Mistake? 🤔

Now, let’s get to the juicy bit: Did Satoshi Nakamoto screw up? Drake thinks he might’ve made a big oopsie, but hey, not everyone is sold on that theory. Some Bitcoiners think Bitcoin has veered off course—into “digital gold” territory—leaving the original vision of BTC as a “cash-like” currency behind. 💰

Lukasinho, Strategy Analyst at Auditless, believes Satoshi’s vision wasn’t flawed at all. Rather, it’s the so-called “small blockers” who have lost the plot, turning Bitcoin into a “pet rock” instead of the active, fee-generating currency it was meant to be. 🪨

“Satoshi didn’t make an error nor are the 21 million wrong. The small blockers made the oopsie. Satoshi’s vision was for BTC to become digital cash, used frequently—and generating tx fees. Not for it to become a pet rock sleeping in wallets.” – Lukasinho

And let’s not forget that there’s a lurking threat Satoshi probably didn’t foresee: quantum computing. We’ve heard it before, but the possibility of quantum attacks looms large. Experts are warning that quantum computing could break Bitcoin’s cryptography wide open, which could lead to even bigger security headaches down the road. 🤖

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- USD RUB PREDICTION

- EUR UAH PREDICTION

- USD TRY PREDICTION

- Brent Oil Forecast

- USD IDR PREDICTION

- New ETF: Bitcoin and Gold Tango to Save Your Wallet from Currency Woes!

- Secrets of Ethereum’s Tech Mastermind Uncovered!

- STETH GBP PREDICTION. STETH cryptocurrency

2025-05-30 14:27