Well, it was bound to happen, wasn’t it? The crypto market, ever the drama queen, decided to have a meltdown starting bright and early Friday morning in Asia. Bitcoin (BTC), in particular, decided that $105K was just too much to handle and slipped below that magical number. And just like that, the global crypto market cap took a nosedive of nearly 3%, dropping from $3.45 trillion to $3.30 trillion. That’s $150 billion vanished, poof, like a magician’s disappearing act.

Top altcoins weren’t spared either. Ethereum (ETH), XRP, Solana (SOL), Cardano (ADA), and SUI all plummeted 3-6%, leaving investors wondering why they didn’t just stick to gold. And let’s not even get started on the meme coins. Poor Dogecoin (DOGE) and Shiba Inu (SHIB) suffered the most, falling nearly 11%. I guess it’s hard to be the ‘fun coin’ when your price is plummeting faster than a bungee jumper without a cord.

Meanwhile, the Crypto Fear & Greed Index dropped from 74 to 60, signaling that investors are starting to feel more bearish than a lumberjack on a bad day.

So, What’s Causing All This Chaos?

$750 Million in Crypto Liquidations

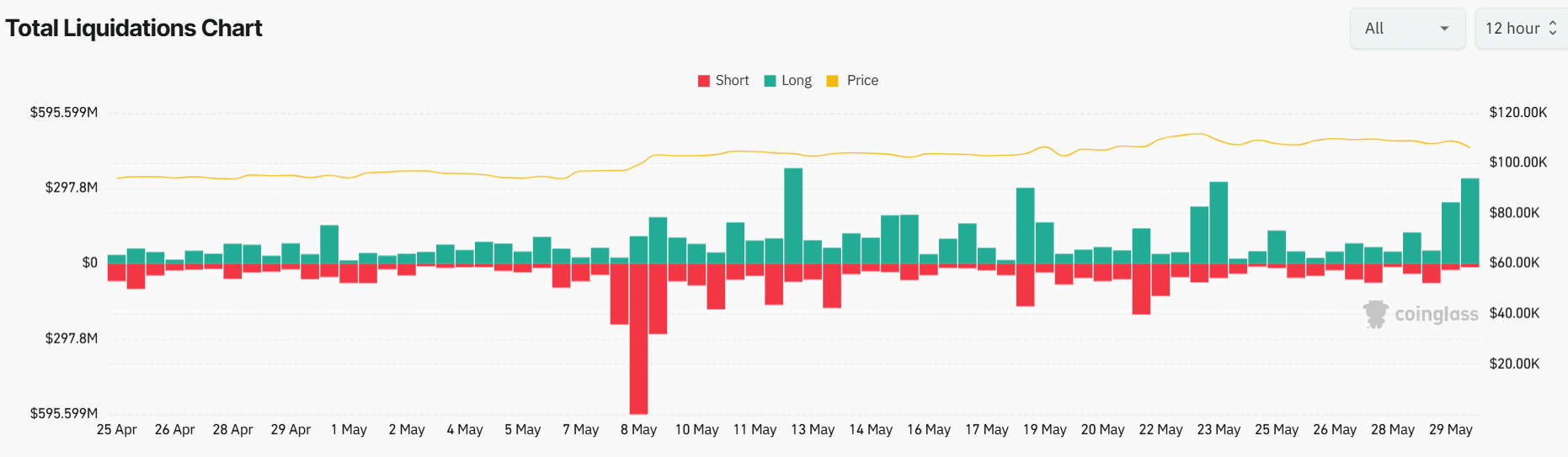

In the past 24 hours, $750 million worth of crypto was liquidated—because apparently, that’s how much it takes to get everyone to panic. $380 million of that was wiped out in just four hours. Over 196K traders were left with empty wallets and sad faces, with the largest single liquidation order being a $12.74 million BTCUSDT transaction on crypto exchange OKX. Because, of course, it was on OKX.

It turns out, $660 million in long positions and $90 million in short positions were liquidated, and the crypto market took a tumble that would make any rollercoaster jealous.

Hyper Trader 0x5078c2fbea2b2 came within $27 of full liquidation on #Binance flush. Closes 1000 BTC – still open long 1687 $BTC 40x liquidation level $104600.

— MartyParty (@martypartymusic) May 30, 2025

Options Expiry: The $11.6 Billion Elephant in the Room

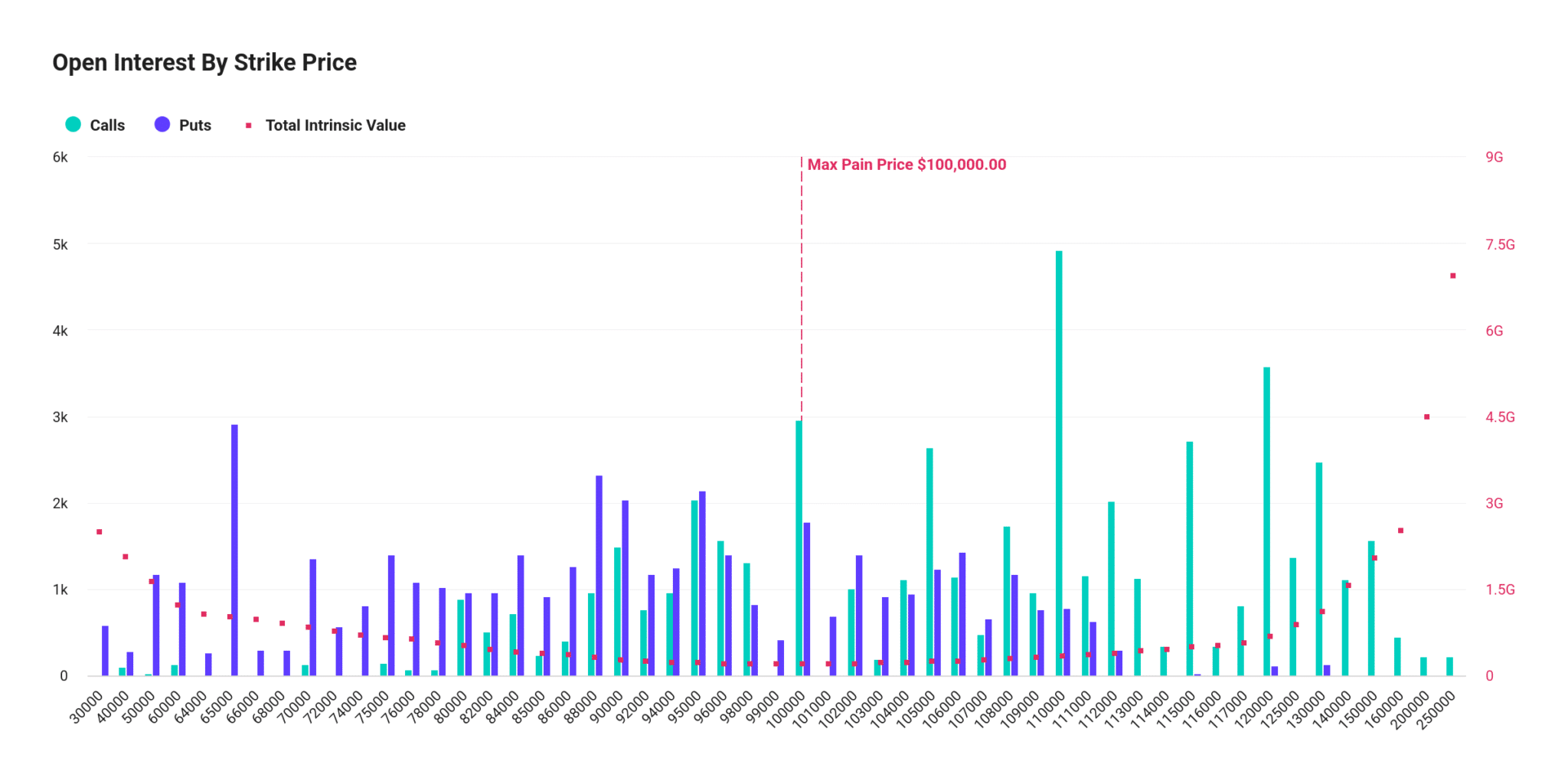

So, here’s the thing—$11.6 billion worth of Bitcoin and Ethereum options were expiring on Deribit today. Traders, clearly fans of rollercoasters, had been betting on a price pullback in anticipation of significant upcoming events. With a huge chunk of options expiring, it was like a big game of musical chairs. Only, this time, when the music stopped, everyone was out of luck.

According to Deribit, 93K BTC options worth nearly $10 billion were set to expire, and guess what? The max pain point is $100,000, meaning more potential dips for Bitcoin lovers. Isn’t that just fantastic?

And let’s not forget Ethereum. 624K ETH options worth $1.62 billion were expiring too. With a max pain point of $2,300, ETH’s price may just be riding a wild wave of ups and downs.

US PCE Inflation Data: More Numbers to Ruin Your Day

Meanwhile, traders had their eyes glued to the release of the US PCE inflation data. The annual PCE is expected to fall slightly to 2.2%, down from last month’s 2.3%. Just when you thought things couldn’t get more fun, the monthly inflation is expected to rise by 0.1%. Because why not? Everyone loves a little extra tension.

At the time of writing, Bitcoin was floating at $106,146, and Ethereum was casually changing hands at $2,638. A slight rebound was happening, but let’s be honest—it’s more like a limp than a recovery.

Spot Bitcoin ETF Outflow: A Case Study in Bad Timing

Oh, and there’s also this little gem: Spot Bitcoin ETFs recorded a net outflow of $346.8 million yesterday, the first outflow in nearly 10 trading days. BlackRock’s IBIT ETF saw some love, with $125.1 million inflow, while other ETFs like Fidelity’s FBTC and Grayscale’s GBTC saw outflows. Because, of course, timing is everything, and the market just loves to make you second-guess every decision you ever made.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- USD RUB PREDICTION

- EUR UAH PREDICTION

- USD TRY PREDICTION

- Brent Oil Forecast

- USD IDR PREDICTION

- SEI’s Suicide Dive to $0.20! 🚀😱 Or the Greatest Trick Since Woland Came to Moscow?

- New ETF: Bitcoin and Gold Tango to Save Your Wallet from Currency Woes!

- SOL PREDICTION. SOL cryptocurrency

2025-05-30 13:17