On this fine Wednesday, the Bitcoin mining stocks have taken a nosedive, resembling a rather unfortunate ballet where all the dancers have forgotten their steps.

Bitcoin Mining Stocks: A Dismal Display of Red Ink

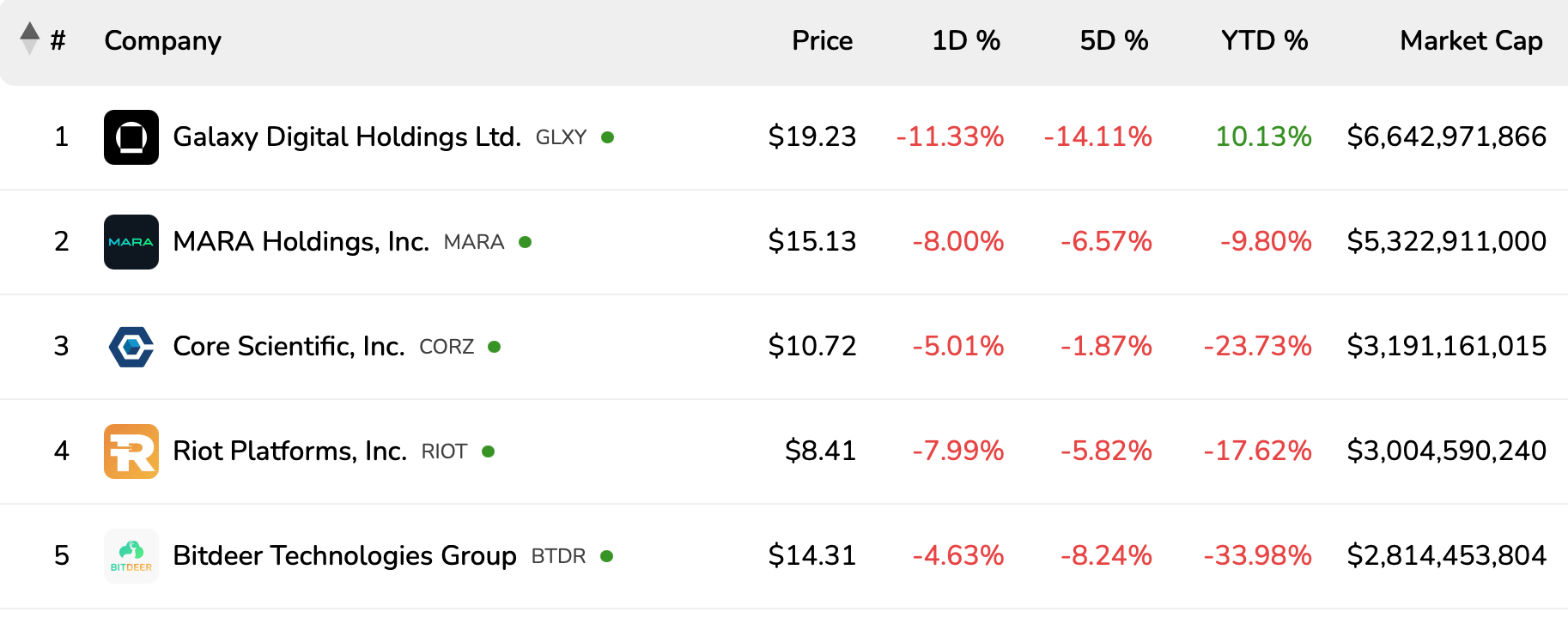

Leading the charge into the abyss is Galaxy Digital Holdings, a titan in market capitalization at a staggering $6.64 billion, which saw its shares plummet by 11.33% this afternoon. Over the last five sessions, it has gracefully descended by 14.11%, despite a year-to-date rise of 10.13%. Meanwhile, the bitcoin miner MARA Holdings, valued at $5.32 billion, has also joined the party, falling 8% today and nearly 10% year to date. Bravo! 👏

Among the top twelve publicly-traded miners, Core Scientific, Riot Platforms, and Bitdeer Technologies have all decided to embrace the red, each posting one-day losses exceeding 4%. Year-to-date, Bitdeer is down nearly 34%, while Riot has slipped 17.62%, and Core Scientific is down 23.73%. A standing ovation for their performance, if only it were for something more uplifting!

In a shocking twist, a few firms have managed to defy gravity. Northern Data AG, the unlikely hero, jumped 9% today and 12.52% over the last week. Yet, despite these fleeting triumphs, it remains the biggest year-to-date laggard, down 35.81% against the U.S. dollar. Quite the paradox, wouldn’t you say?

Cleanspark has held steady with a marginal 0.02% gain year to date, despite a valiant loss of 6.57% during today’s trading session. IREN Limited, in a similar vein, posted a small five-day gain of 1.45%, but alas, its year-to-date performance remains firmly in the negative. A round of applause for their tenacity!

The smallest companies by market capitalization, Terawulf and Cipher Mining, continue to trade under $4 per share, remaining sharply negative year to date, down more than 28% and 34%, respectively. One can only wonder if they have a secret pact with the universe to remain perpetually in the red.

The erratic performance across bitcoin mining stocks suggests a market grappling with cost pressures, akin to a juggler who has lost all but one ball. Short-term rallies from select firms hint at speculative buying, while sustained losses elsewhere reflect broader doubts about profitability and growth. A delightful conundrum!

As volatility persists, investors may be weighing operational efficiency and capital strength more heavily than mere exposure to the bitcoin mining sector’s market action. After all, who needs stability when you can have chaos? 😅

Read More

- Gold Rate Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Is Now the Time to Buy Bitcoin? Shocking Market Signals Unveiled!

- Brent Oil Forecast

- Bitcoin’s Plunge: Are Traders Running for the Hills? 🤑💨

- XRP: The Calm Before the Storm?

- Bitcoin’s Wild Ride: Is It a Rally or Just a Bunch of Greedy Investors? 🤔💰

- Crypto Riches or Fool’s Gold? 🤑

- Silver Rate Forecast

- SEC’s Crypto Custody Circus: Who’s Guarding Your Digital Gold? 🎪💰

2025-05-28 19:27