Ah, Ethereum, that capricious creature of the crypto sea, has decided to take a breather this week, having encountered a rather formidable resistance level. It appears that the whales, those grand lords of the blockchain, have begun to sell off their treasures, leaving us mere mortals to ponder the fate of our digital coins. 🐋💰

As of this fine Wednesday, May 28, Ethereum (ETH) is languishing at a modest $2,650, just shy of the illustrious barrier of $2,722. But fret not, dear reader, for it remains a staggering 91% above its nadir this year—truly a tale of resilience! 📈

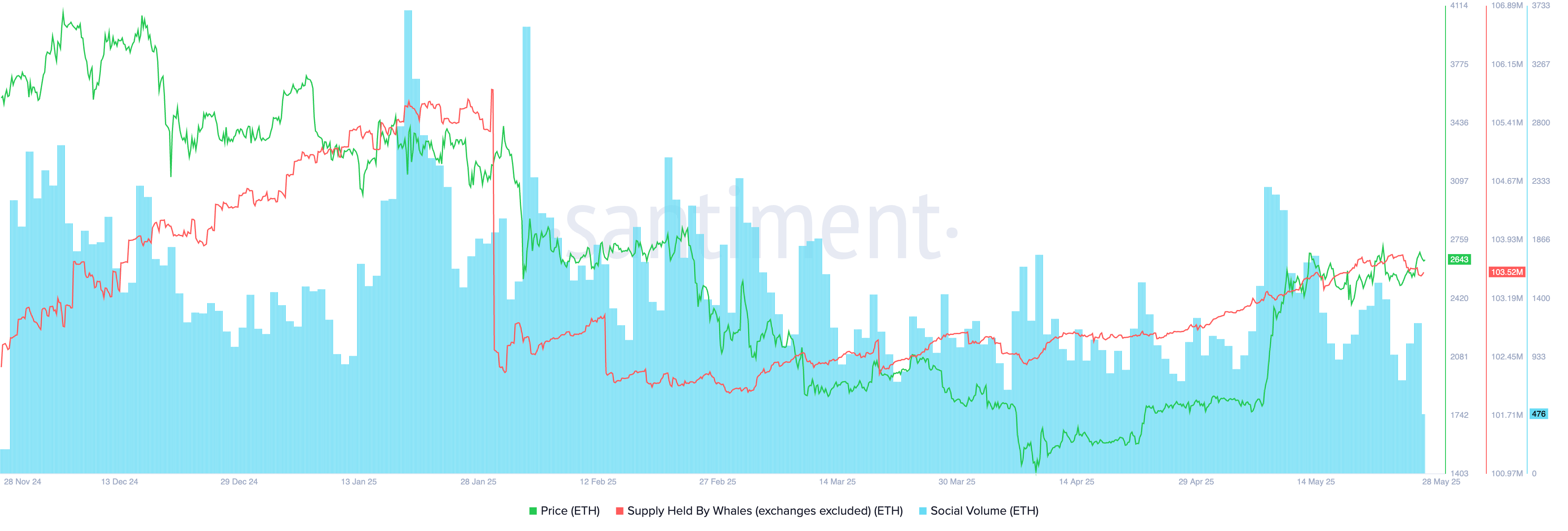

According to the ever-watchful Santiment, our aquatic friends have relinquished 200,000 coins, a staggering $530 million worth of digital gold. They now clutch a mere 103.52 million coins, down from 103.74 million on May 24. One can only imagine the drama unfolding in their underwater palaces! 🏰

Meanwhile, the social chatter surrounding Ethereum has plummeted to a dismal 476, a far cry from this month’s high of 3,060. It seems traders are no longer engaging in spirited discussions on platforms like Telegram and X. Alas, when the gossip dies down, so too does the price—who knew social media could wield such power? 🤷♂️

But wait, there’s more! Ethereum’s network is grappling with challenges from its layer-2 networks. Data from growthepie reveals a mere 415,000 active addresses on Tuesday, dwarfed by Base’s 1.93 million and Celo’s 486,000. It’s a veritable David and Goliath scenario, and one can’t help but root for the underdog! 🥳

In a twist of fate, the rent paid to Ethereum by these networks has taken a nosedive. Base has coughed up $112,000 in the last 30 days, down a staggering 57% from the previous month. Arbitrum One and Optimism have also seen their contributions shrink to $39,000 and $13,000, respectively. It’s a veritable financial famine! 🍽️

On a brighter note, there are whispers that U.S. investors are once again warming up to Ethereum ETFs. These funds have enjoyed positive inflows for three consecutive weeks, amassing an impressive $38 million this week alone. Cumulative inflows now stand at $2.8 billion, bringing total assets to a princely $9.60 billion. Perhaps there is hope yet! 🌟

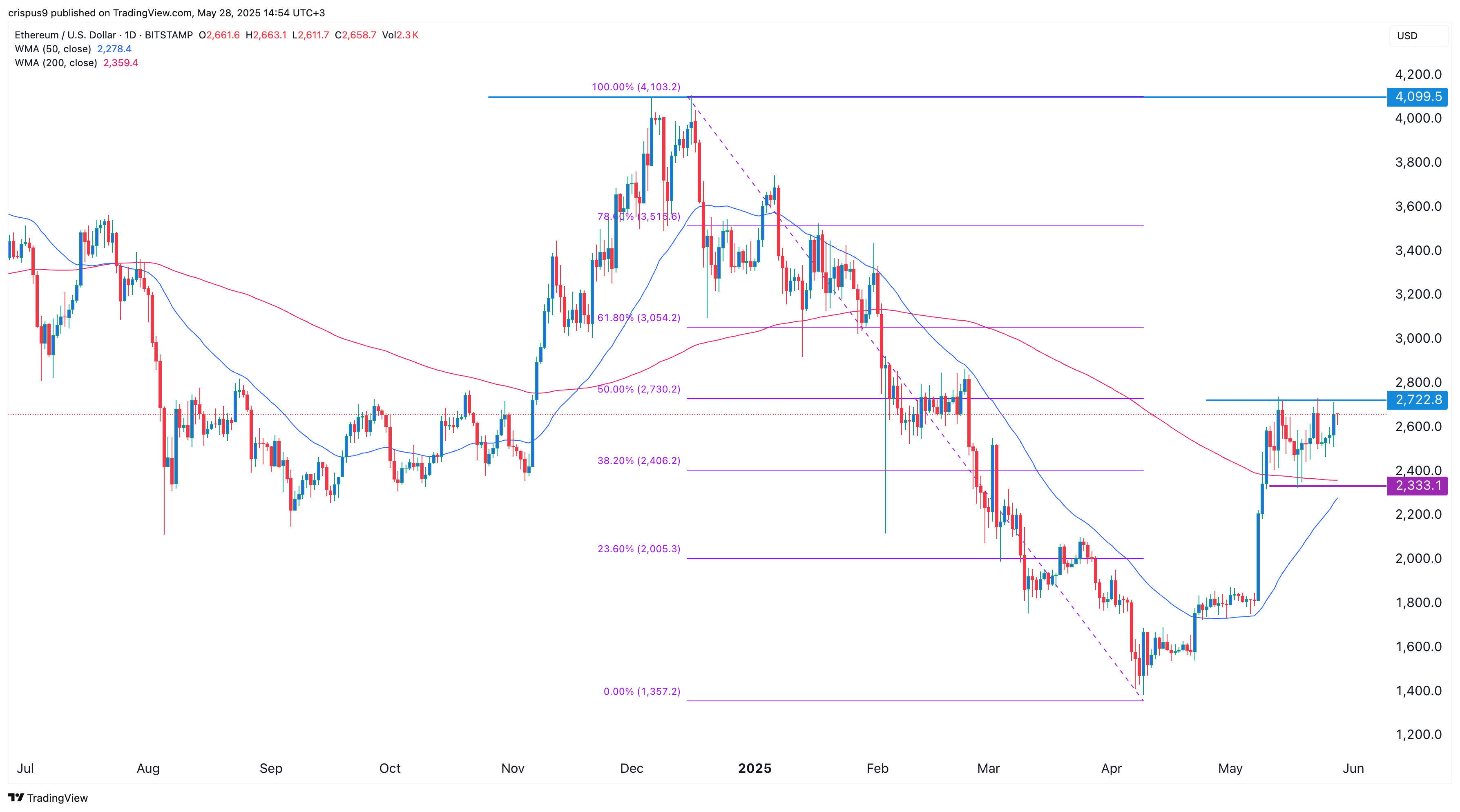

Ethereum Price Technical Analysis

The daily chart reveals that ETH has hit a bit of a wall in recent weeks, finding resistance at the fabled $2,722. It has attempted to breach this level—coinciding with the 50% Fibonacci retracement point—on at least three occasions, but alas, to no avail. Such is the life of a cryptocurrency! 📉

Ethereum has taken on a bullish flag-like appearance, with a vertical move followed by a period of consolidation. It is tantalizingly close to forming a golden cross pattern, as the gap between the 50-day and 200-day moving averages continues to narrow. Will it break free? Only time will tell! ⏳

A successful breach above the 50% retracement would signal further upward movement, with the next major resistance lurking at $3,000. Should it surpass this threshold, the odds of Ethereum gallivanting toward the psychological level of $4,000 would increase dramatically. However, a slip below the support at $2,333 would spell doom for our bullish dreams. 😱

Read More

- Gold Rate Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Crypto Riches or Fool’s Gold? 🤑

- BitMine’s 4M ETH Hoard: Stock Valuation Shenanigans 💰💸

- Brent Oil Forecast

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

2025-05-28 15:52